Volume 2

TAS Research and Related Studies

A Study of the IRS Offer in Compromise

Program for Business Taxpayers

A Study of the IRS Offer in Compromise Program

for Business Taxpayers

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers132

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

EXECUTIVE SUMMARY

1

An offer in compromise (OIC) is an agreement between a taxpayer and the government that settles a tax

liability for payment of less than the full amount owed. The IRS has authority to accept offers pursuant

to Internal Revenue Code (IRC) § 7122. TAS Research conducted this analysis to study how business

taxpayers (Business Master File (BMF)) use the OIC program and the impact of the OIC program on

future compliance of business taxpayers. For the purposes of this study, “BMF taxpayer” is defined as a

taxpayer who filed a Form 941, Employer’s Quarterly Federal Tax Return, and then either a Form 1065,

U.S. Return of Partnership Income, Form 1120, U.S. Corporation Income Tax Return, Form 1120S, U.S.

Income Tax Return for S Corporation, or a Schedule C, Profit or Loss From Business (Sole Proprietorship).

To study the impact of the OIC program, TAS Research examined taxpayers’ filing and payment

compliance subsequent to an accepted OIC. BMF taxpayers with accepted OICs are about half as

likely to become noncompliant in filing or paying their future BMF tax obligations for five years after

the IRS accepts the OIC than BMF taxpayers whose OICs were not accepted. When considering

only those BMF taxpayers who continued to operate, the difference in subsequent filing and payment

compliance rates were more pronounced. For instance, filing noncompliance beyond five years after the

consideration of an OIC is nearly three times higher for BMF taxpayers whose OIC was not accepted

than for a BMF taxpayers with an accepted OIC. In other words, approximately 91 percent of BMF

taxpayers with an accepted OIC were in filing compliance beyond five years after the OIC consideration

compared to 82 percent of BMF taxpayers without an accepted OIC.

TAS Research also analyzed the number of taxpayers who submit multiple OICs within 180 days,

referred to as “churning.” Between 2007 and 2016, between approximately four percent and nine

percent of taxpayers submitting an OIC had an incident of “churning” with an accepted OIC in

approximately 30 percent to 45 percent of the cases. This indicates that business taxpayers are trying to

submit successful OICs even if it sometimes takes multiple attempts.

TAS Research looked at how the amount offered on returned or rejected OICs compares to what the

IRS has actually been able to collect. TAS Research found that nearly 40 percent of rejected or returned

OICs had an amount offered that was greater than the amount collected. In fact, the average amount

offered for this population of OICs was more than two times the average amount ultimately collected,

and the median amount offered was more than five times the median amount collected.

For rejected OICs in particular, TAS Research looked at what the IRS determined to be the Reasonable

Collection Potential (RCP), which is the calculation of all of the taxpayer’s assets, income, and liabilities.

Depending on the business entity type, TAS Research found that the RCP is about seven to ten times

greater than the amount offered and 20 to 30 times what has been collected subsequently. By rejecting

these OICs, the IRS not only loses an opportunity to collect revenue, but it misses out on the improved

compliance effect that comes with accepted OICs.

1

The principal authors of this study are Kate Leifeld, Stacie Swanson, and Jeff Wilson.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 133

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

INTRODUCTION

Taxpayers who cannot pay their tax debt in full have options. For instance, a taxpayer may qualify for a

monthly payment plan, referred to as an installment agreement.

2

Some taxpayers can also qualify for a

status called currently not collectible (CNC) if payment of the debt would create an economic hardship.

3

As will be discussed below, CNC based on hardship is not an option for all business types.

An OIC allows the taxpayer to offer an amount less than the total amount owed in full satisfaction

of the debt. This study focuses on OICs from BMF taxpayers with tax debts. OICs are particularly

important to BMF taxpayers because they are unable to obtain relief from IRS levies on the basis of

economic hardship. Generally, under IRC § 6343(a)(1)(D), the IRS must release a levy if it determines

that the levy is creating an economic hardship; however, under regulations, the IRS only extends this

relief to individual taxpayers.

4

Treasury Regulations provide three grounds for an OIC:

Doubt as to liability;

5

Doubt as to collectability;

6

and

Effective tax administration (ETA).

7

As part of the compromise, the taxpayer agrees to remain fully compliant with all filing and paying

requirements for five years after acceptance of the OIC.

8

If a taxpayer fails to stay in compliance, the

entire liability, minus the amount paid with the OIC, plus penalties and interest may be reinstated.

9

Thus, OICs represent an opportunity for the IRS to transform a taxpayer’s noncompliant behavior into

compliant behavior, without assuming any additional risk.

Notwithstanding the merits of the OIC program, historically the IRS has a lower OIC acceptance rate

for BMF taxpayers than individual taxpayers (Individual Master File (IMF)). This study attempts to

determine whether by returning or rejecting OICs from businesses, the IRS is missing opportunities to

collect revenue and to enable businesses to obtain a fresh start.

The study confirmed that on average BMF OICs have a lower acceptance rate compared to IMF OICs.

In fact, the average acceptance rate for IMF OICs is approximately 44 percent while BMF OICs have

2

Internal Revenue Code (IRC) § 6159.

3

Internal Revenue Manual (IRM) 5.16.1.2, Currently Not Collectible Procedures (Sept. 18, 2018).

4

Treas. Reg. 301.6343-1(b)(4). See also IRM 5.11.2.3.1.4, Economic Hardship (Apr. 15, 2014). For further discussion of

this issue, see National Taxpayer Advocate 2011 Annual Report to Congress 537-543.

5

Treas. Reg. 301.7122-1(b)(1). Doubt as to liability exists where there is a genuine dispute as to the existence or amount of

the correct tax liability under the law. Doubt as to liability does not exist where the liability has been established by a final

court decision or judgment concerning the existence or amount of the liability.

6

Treas. Reg. 301.7122-1(b)(2). Doubt as to collectability exists in any case where the taxpayer’s assets and income are less

than the full amount of the liability.

7

Treas. Reg. 301.7122-1(b)(3). There are two grounds for Effective Tax Administration (ETA) offers: 1) If the Secretary

determines that, although collection in full could be achieved, collection of the full liability would cause the taxpayer

economic hardship within the meaning of Treas. Reg. § 301.6343-1 and; 2) If there are no grounds for an offer under the

other offer in compromise (OIC) criteria, the IRS may compromise to promote effective tax administration where compelling

public policy or equity considerations identified by the taxpayer provide a sufficient basis for compromising the liability.

Compromise will be justified only where, due to exceptional circumstances, collection of the full liability would undermine

public confidence that the tax laws are being administered in a fair and equitable manner.

8

IRS, Form 656-B, Offer in Compromise (Rev. June 2018).

9

IRM 5.8.9.4, Actions on Post-Accepted Offers, Potential Default Cases (Jan. 12, 2017).

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers134

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

an acceptance rate of about 24 percent. However, the study also found that the noncompliance rate of

BMF taxpayers with an accepted OIC is generally less than the noncompliance rate for businesses unable

to obtain an accepted OIC. For instance, when we consider payment compliance for the five years

following the OIC consideration, BMF taxpayers with an accepted OIC have a payment compliance

rate of 83 percent compared to 75 percent for BMF taxpayers without an accepted OIC. And in

approximately 40 percent of rejected OIC cases, TAS Research determined that the offered amount was

nearly three times more than the amount actually collected.

BACKGROUND

OIC is one of several collection alternatives

When a taxpayer is unable to fully pay their debt, the IRS may use collection alternatives. One such

option is through a series of monthly payments (referred to as installment agreements).

10

With respect

to individual taxpayers, if paying the tax debt creates an economic hardship for the taxpayer, the IRS

may stop collection activity and consider the taxpayer to be CNC.

11

However, the option of CNC-

economic hardship is not available to corporations and only to limited liability corporations (LLCs) and

partnerships in certain situations.

12

Even though a tax delinquency may be paid over time or reported

CNC, penalties and interest continue to accrue during the ten year (or more) period in which the IRS

must collect the liability.

13

The third option is an OIC. An OIC is an agreement between a taxpayer and the government that

settles a tax liability for payment of less than the full amount owed.

14

The objectives of the OIC

program are to:

Affect collection of what can reasonably be collected at the earliest possible time and at the least

cost to the government;

Achieve a resolution that is in the best interest of both the business and the government;

Provide the business a fresh start toward future voluntary compliance with all filing and payment

requirements; and

Secure collection of revenue that may not be collected through any other means.

15

10

IRC § 6159; IRM 5.14.1.1.1, Background (July 16, 2018)

11

IRM 5.16.1.2, Currently Not Collectible Procedures (Sept. 18, 2018).

12

Id.

13

The IRS generally has ten years to collect a tax debt once it is assessed, which is referred to as the collection statute

expiration date (CSED). IRC § 6502. Some events may extend or suspend the CSED. In particular, the CSED is suspended

during the period an OIC is pending, for 30 days immediately following the rejection of the OIC, and for any period when a

timely filed appeal from the rejection is being considered by Appeals. Treas. Reg. § 301.7122-1(i). In some cases, the IRS

may choose to reduce to judgment the liability on which a notice of federal tax lien has been filed. This means the IRS

would bring suit in federal district court. Once the judgment is in place, the IRS is not limited to the 10-year CSED period.

28 U.S.C. § 3201.

14

IRC § 7122.

15

IRM 1.2.14.1.17, Policy Statement 5-100 (Jan. 30, 1992); IRM 5.8.1.2.4, Overview, Objectives (Sept. 23, 2008).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 135

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Legal Requirements for Acceptable OICs

According to the Internal Revenue Code, for the OIC to be processable, the taxpayer must:

Include a partial payment (referred to as a “TIPRA payment”) with the OIC; and

16

Pay any applicable user fee.

17

In April 2016, the IRS announced that OICs submitted by a taxpayer who had not filed all necessary tax

returns (based on internal research) would be returned to the taxpayer as not processable.

18

In February

2017, the IRS further announced the IRS will keep the payments sent with OICs that are not processed

and returned for lack of filing compliance.

19

Otherwise, the IRS may return the user fee and initial payment to the taxpayer when an OIC is returned

as not processable.

20

The IRS will keep payments made on rejected OICs.

21

The Reasonable Collection Potential Calculation Plays a Vital Role in the OIC

Acceptance Process

The IRS will accept an OIC when it is unlikely that a tax liability can be collected in full and the

amount offered reflects reasonable collection potential.

22

Additionally, unless special circumstances

exist, OICs will not be accepted if the IRS believes the liability can be paid in full as a lump sum, by

installment payments extending through the remaining statutory period for collection, or through

other means of collection.

23

The IRS first conducts an analysis to see if the taxpayer can afford to

pay the liability through the liquidation of existing assets or an installment agreement. Once the IRS

confirms that the taxpayer will not able to pay the debt through these methods, the IRS then determines

the taxpayer’s RCP, which will consider all of the taxpayer’s income, assets, expenses, and liabilities.

24

Unless special circumstances exist, the RCP will serve as the basis for an acceptable OIC amount.

25

16

IRC §§ 7122(c)(1), 7122(d)(3)(C). For lump sum offers, the partial payment must be 20 percent of the OIC amount. For a

periodic payment OIC, the partial payment must consist of the first installment payment. IRC §§ 7122(c)(1)(A)–(B).

17

IRC § 7122(c)(2). If an individual taxpayer qualifies for the low-income waiver, he or she will not be required to send

any payment with the OIC. IRS, Form 656-B, Offer in Compromise (June 2018). Additionally, Treasury regulations require

taxpayers to make the OIC in writing, sign the OIC under penalty of perjury, and include all of the information “prescribed or

requested by the Secretary.” Treas. Reg. § 301.7122-1(d)(1). If an OIC meets the minimum criteria for consideration, the

IRS deems it processable. IRM 5.8.2.3 (May 14, 2013).

18

IRS, Memorandum for Director, Specialty Collection Offers, Liens & Advisory, Offer in Compromise Filing Compliance and Case

Perfection, SBSE-05-0416-0015 (Apr. 13, 2016).

19

IRS, Memorandum for Director, Specialty, Offers, Liens & Advisory, Offer in Compromise Filing Compliance and Case Perfection,

SBSE-05-0217-0020 (Feb. 23, 2017). See also Policy Changes Made by the IRS to the Offer in Compromise Program Makes It

More Difficult for Taxpayers to Submit Acceptable Offers, supra.

20

IRM 5.8.2.5, Not Processable (May 25, 2018); IRM 5.8.7.2, Returns (Oct. 07, 2016).

21

IRS, Form 656, Offer in Compromise (June 2018). A rejected OIC differs from a returned OIC in that the IRS has reviewed

the facts of the case prior to rejection, and the taxpayer receives appeal rights when the OIC is rejected. IRM 5.8.7.7,

Rejection (Oct. 7, 2016).

22

IRM 1.2.14.1.17, Policy statement 5-100 (Jan. 30, 1992).

23

IRM 5.8.1.2.3, Policy (May 5, 2017).

24

IRM 5.8.5.2, Ability to Pay (Mar. 23, 2018).

25

IRM 5.8.1.2.3, Policy (May 5, 2017).

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers136

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

BMF OIC Acceptance Rates Show a Slight Increase

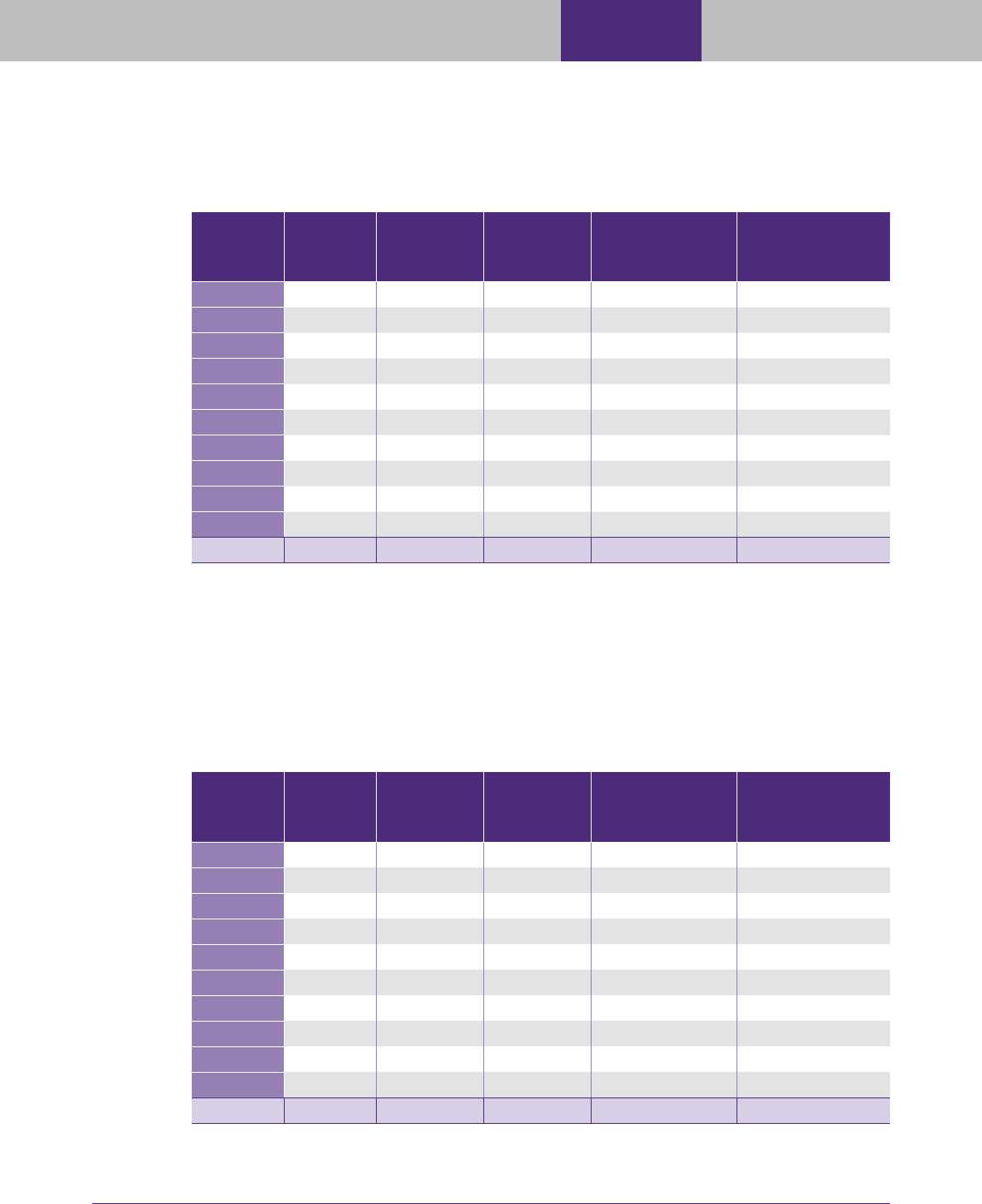

The following figure shows the OIC receipts, dispositions, and acceptances for IMF and BMF taxpayers

since FY 2010. The IRS began accepting a larger percentage of OICs in FY 2011 and reached its

highest acceptance rate in 2013 with 43.7 percent. The current rate of OIC acceptances remains about

38 percent.

26

FIGURE 5.1, Individual and Business OIC Receipts, Dispositions and Acceptances since

2010

27

FY

Receipts Acceptances Dispositions Acceptance Rate

2010

56,539 13,886 52,104 26.7%

2011

59,411 19,562 57,836 33.8%

2012

63,801 23,628 62,597 37.7%

2013

74,217 30,840 70,622 43.7%

2014

67,935 26,924 64,322 41.9%

2015

66,600 27,417 64,479 42.5%

2016

62,937 26,663 65,858 40.5%

2017

62,243 25,326 66,549 38.1%

TAS analysis of IRS OIC data show that from 2007 to 2017, approximately 450,000 IMF taxpayers

submitted OICs and about 44 percent of them were ultimately accepted.

28

FIGURE 5.2, OIC Receipts, Dispositions and Acceptances for Individual Taxpayers

29

FY

Receipts Acceptances Dispositions Acceptance Rate

2010

48,378 15,606 45,537 34.3%

2011

51,022 20,523 50,034 41.0%

2012

57,805 25,752 54,909 46.9%

2013

63,069 29,022 59,079 49.1%

2014

59,017 29,522 58,936 50.1%

2015

57,619 25,619 53,931 47.5%

2016

52,188 26,150 56,280 46.5%

2017

50,042 24,906 54,817 45.4%

26

National Taxpayer Advocate 2017 Annual Report to Congress vol. 2 49. The acceptance rate is the numbers of accepted

OICs in a fiscal year divided by the total number of OIC investigations closed by the IRS during that same fiscal year. These

figures include both Individual Master File (IMF) and Business Master File (BMF) taxpayers. Fiscal year (FY) 2018 numbers

were not included in this study because not enough time had elapsed to provide analysis.

27

National Taxpayer Advocate 2017 Annual Report to Congress vol. 2 49.

28

IRS, CDW. Individual Master File (IMF) Oct. 2017.

29

Id. The table only shows data from FY 2010 through FY 2017.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 137

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

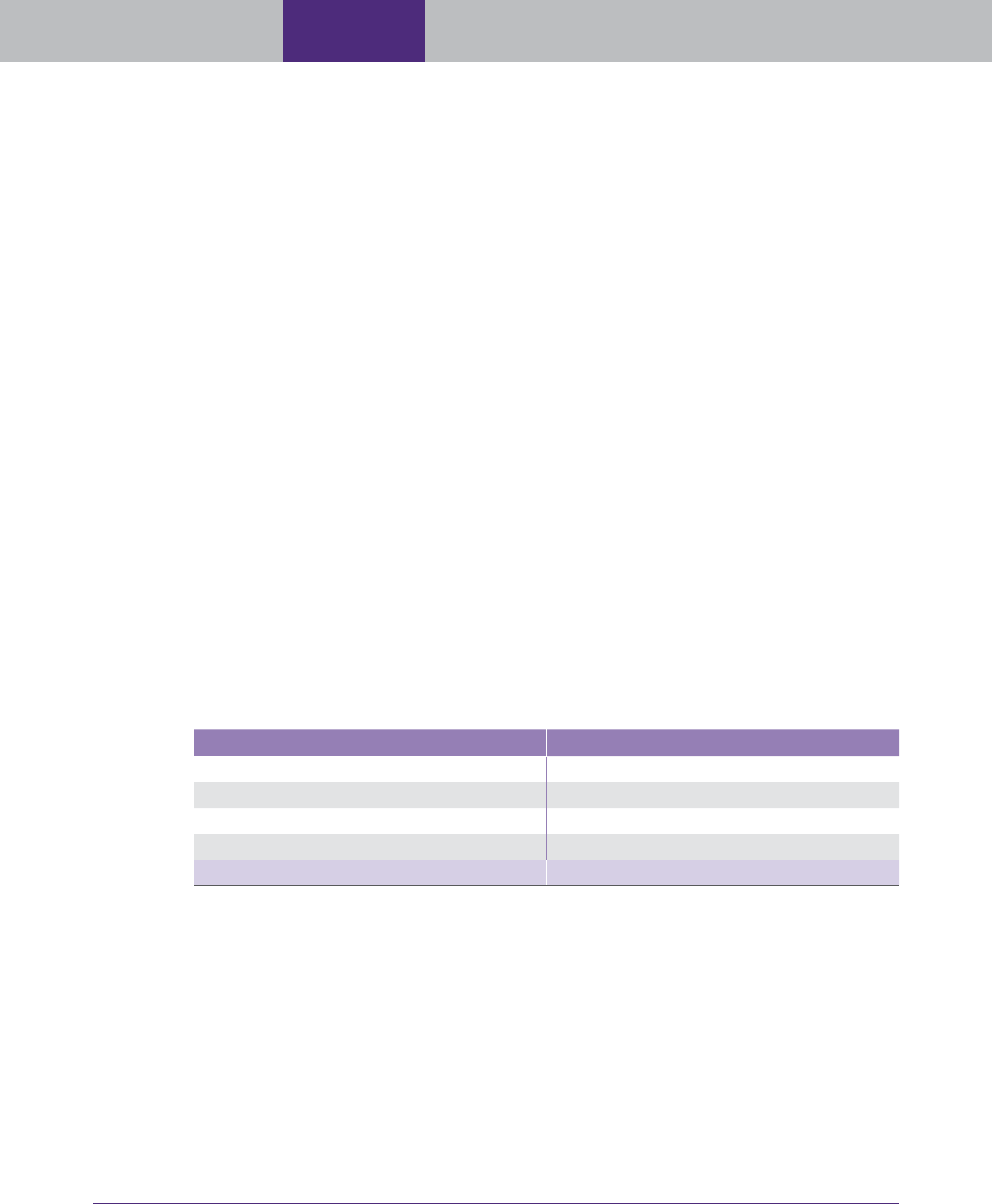

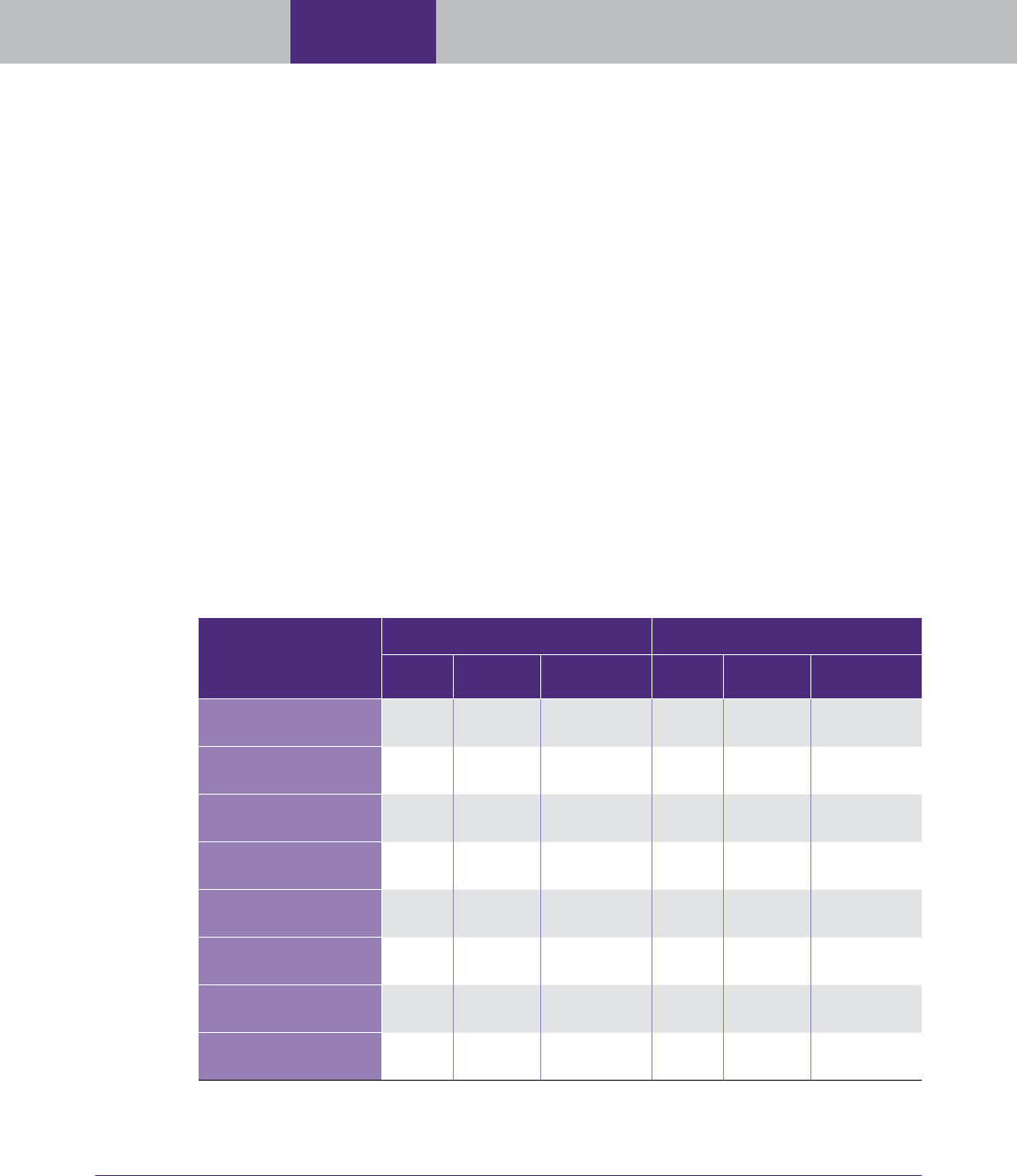

Furthermore, the National Taxpayer Advocate’s study on IMF OICs last year established that accepting

an OIC may improve an IMF taxpayer’s future compliance. Figure 5.3 compares filing compliance and

the incidence of taxpayer delinquent investigations (TDIs) between IMF taxpayers with accepted OICs

and all taxpayers with unaccepted OICs.

30

FIGURE 5.3

31

Filing Compliance for Taxpayers for the First Five Years

After the Offer in Compromise Disposition

Taxpayers With

Accepted Offers

Since 2007

Percent Filing

Income Tax Returns

After the OIC

Percent With No

Late Filed Returns

After the OIC

Percent With

No TDI

Taxpayers With

Unaccepted Offers

Since 2007

70%

66%

42%

58%

90%

97%

30

A taxpayer delinquent investigation (TDI) is part of the Return Delinquency (RD) Program, which works responses to notices

that are issued to taxpayers that have been identified as liable to file and have not filed a tax return by the Return Due Date

(RDD). IRM 5.19.22.2, What Is The BMF Return Delinquency Program? (Jan. 2, 2015).

31

IRS, CDW. Business Master File (BMF) Oct. 2017.

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers138

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

Figure 5.4 shows the payment compliance for IMF taxpayers by looking at the incidence of balances due

and taxpayer delinquent accounts (TDAs).

32

FIGURE 5.4

33

Payment Compliance for Taxpayers for the Five Years

Required by the Offer in Compromise

All Accepted Offers

Percent With No Balance Due Percent With No TDA

All Non-Accepted Offers

72%

52%

71%

89%

However, while the IRS has accepted more OICs in recent years, its acceptance rate for OICs submitted

by BMF taxpayers is still over 20 percentage points less than its acceptance rate for OICs submitted

by IMF taxpayers. From FYs 2010 to 2017, the acceptance rate for IMF OICs was approximately

44 percent, but the acceptance rate for BMF OICs was about 24 percent.

34

FIGURE 5.5, OIC Receipts, Dispositions and Acceptances for Business Entities

FY

Receipts Acceptances Dispositions Acceptance Rate

2010 5,972 864 5,979 14.5%

2011 6,262 1,158 6,928 16.7%

2012 6,576 1,543 7,547 20.4%

2013 6,811 1,471 6,887 21.4%

2014 6,573 1,477 7,048 21.0%

2015 6,237 1,630 6,813 23.9%

2016 5,348 1,594 6,697 23.8%

2017 4,721 1,512 5,710 26.5%

32

A taxpayer delinquent account (TDA) occurs when a taxpayer has a balance due. IRM 5.19.22.2.1, BMF Return Delinquency

Overview (July 7, 2016). In particular, it occurs after the final collection notice is issued. IRS, Document 6209, Section 8A,

Master File Codes (2018).

33

We derived the presence of unfiled returns and balances due by examining the collection status of the module from the IMF.

34

IRS, CDW IMF Oct. 2017; IRS, CDW BMF and BMF Dec. 2017.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 139

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Although the IRS has begun accepting more BMF OICs in the last three years, increasing from

21 percent in 2014 to 26.5 percent in FY 2017, the BMF acceptance rate is still less than the IMF

acceptance rate, which was 45.4 percent in FY 2017.

The recent increase in acceptance of BMF OICs may be partly explained by a change in IRM guidance.

For example, IRM 5.8.11.4.3, which relates to determining the appropriate OIC amount for ETA OICs,

offered this guidance for BMF OICs in 2013:

When compromising based on IRM 5.8.11.2.2.1 paragraphs 4, 5, and 8, in business cases

in particular, the Service must be cautious to avoid providing financial advantages through

the forgiveness of tax debt. This may create the appearance that the delinquent business has

been able to profit from its failure to pay, giving it a competitive advantage over other, fully

compliant businesses. For this reason, the Service will generally insist that a compromise

with an operating business provide for payment of the full amount of tax, exclusive of

interest and penalties.

35

The current IRM section does not include this language. Instead, it says:

the offer amount should be for an amount deemed reasonable based on the specific facts

of the case, generally the Service will insist that a compromise with an operating business

provide for payment of the full amount of the remaining tax balance, exclusive of interest

and penalties. If the taxpayer is an operating business impacted by the fraudulent act of a

PSP [payroll service provider], the full amount of the remaining tax balance, exclusive of

interest and penalties, may not be required based on the taxpayer’s situation.

36

Considering the recent, slight improvements in the BMF OIC acceptance rate, TAS Research studied

the impact of the OIC program on subsequent compliance of BMF taxpayers. When the IRS rejects

an OIC, the IRS must continue to devote additional resources to collect these liabilities, while missing

a significant opportunity to change taxpayer behavior toward ongoing voluntary filing and payment

compliance. This study will look at how the IRS uses the OIC program and ways in which it can be

improved for the benefit of taxpayers and the IRS alike.

OBJECTIVES

Quantify the number of BMF taxpayers who have submitted multiple OICs within 180 days

(churning);

Determine the collection and filing status of the BMF returns with an OIC;

Determine how much revenue collection potential is lost by not accepting OICs (i.e., what

revenue is collected versus what is offered for those returned or rejected OICs while also

considering the RCP as determined by the IRS).

Compare the OIC acceptance rates at the two centralized OIC processing sites, Memphis and

Brookhaven, to identify any variations.

35

IRM 5.8.11.4.3(2)(c) (Sept. 23, 2008).

36

IRM 5.8.11.4.3(2)(c) (Aug. 5, 2015).

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers140

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

METHODOLOGY

This study includes all three types of OICs submitted by different types of BMF taxpayers. To begin

the OIC process, a taxpayer submits Form 656, Offer in Compromise, with the required financial

documentation and user fee. TAS Research analyzed the accounts of BMF taxpayers who submitted an

OIC from 2007 to 2017 to the IRS.

37

To determine the entity type in the population of OIC BMF returns, TAS research obtained the Master

File Transcript (MFT) Code of the return and treated them as follows:

MFT Code = 6: Partnership;

MFT Code = 2: Corporation;

Sole Proprietorship if the taxpayer identification number (TIN) of the business matched the

employer identification number (EIN) of the Schedule C; and

Other: any remaining after the above identifications were treated as missing and analyses of the

Form 941s were done separately.

To complete these objectives, TAS Research had to obtain the MFT Code of the return and assign the

appropriate entity types as they matched. To begin, TAS Research selected those with MFT Code 6

to select the partnerships, and those with MFT Code 2 to select the corporations. Those that were

remaining were matched to the EIN of Schedule C, Profit or Loss From Business (Sole Proprietorship),

from Form 1040 returns to determine which ones were sole proprietors. The results are as follows:

FIGURE 5.6, Type and Number of Each Business Entity Studied

Type of Business Entity Number of Taxpayers

Partnerships

a

4,283

Corporations 20,963

Schedule C Sole Proprietors 12,009

Unknown

b

7,965

Total 45,220

a Some entities filed both partnership and corporate income tax returns at various times but were considered as corporations for

our analysis. An additional 1,789 taxpayers had an identified entity type such as a not-for-profit organization, or trust, or estate.

b Many of these unidentified taxpayers were identified as sole proprietorships based on the employer identification number (EIN)

reported on schedule C; however, in many instances more than one taxpayer reported the same EIN on his or her Schedule C. If

this situation occurred, these taxpayers were considered as unidentified.

37

“BMF taxpayer” is defined as a taxpayer who filed a Form 941, Employer’s Quarterly Federal Tax Return, and then either a

Form 1065, U.S. Return of Partnership Income, Form 1120, U.S. Corporation Income Tax Return, Form 1120S, U.S. Income

Tax Return for S Corporation, or a Schedule C, Profit or Loss From Business (Sole Proprietorship).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 141

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

To determine if the taxpayer submitted churning OICs, TAS Research selected all OICs closed as either

rejected,

38

withdrawn/terminated,

39

or returned as not processable.

40

The IRS defines “churning” as

a new OIC submitted within 180 days after one of the previously indicated OIC disposition types.

41

TAS Research also identified taxpayers that had an OIC accepted by the IRS to distinguish them from

taxpayers whose OIC was returned or rejected.

42

To determine the payment and filing status of the subsequent BMF returns with an OIC, TAS Research

obtained the status codes of the modules for returns due for both five years and up to ten years after the

year in which the offer was submitted.

43

TAS Research detected if any payment delinquency was present

and if a payment delinquency reached TDA status.

44

TAS Research also completed an analysis of filing

and payment compliance for only those entities who remained in business after the IRS either accepted

or did not accept the OIC.

TAS Research requested and obtained from the IRS a list of BMF taxpayers whose OICs were returned

or rejected by the IRS from 2009 through 2013, the amount of these OICs, and, in the case of rejected

OICs, the amount of RCP determined by the IRS.

45

The IRS defines RCP as the amount that can be

collected from all available means, including administrative and judicial collection remedies. RCP is

generally the sum of taxpayers’ assets, future income for the life of the statutory period for collection,

amounts collectible from third parties (e.g., assets involved in a fraudulent conveyance from the taxpayer),

and taxpayer assets which are beyond the reach of the government (e.g., taxpayer assets in foreign

countries).

46

TAS Research compared the amount subsequently collected from these taxpayers to the

amount that was submitted on the rejected OIC, while also considering the RCP calculated by the IRS.

47

Research used the Transaction Code (TC) 780 to determine if there was an accepted OIC for the

taxpayer. An accepted OIC can be identified by a TC 780 posting to the delinquent taxpayer accounts.

To determine which campus processed the offer, Research determined the state where the taxpayer

submitted the OIC and then used the following data to determine the campus from the following

Collection website:

http://mysbse.web.irs.gov/collection/toolsprocesses/CaseRes/oic/recordsrequest/16188.aspx

38

Transaction Code 481.

39

Transaction Code 482.

40

Transaction Code 483.

41

IRS, IRS Offers in Compromise, An Analysis of Various Aspects of the OIC Program 2 (Sept. 2004).

42

Transaction code 780.

43

Data is from the BMF on the IRS CDW. TAS analyzed the BMF tax returns due for the entity in the years following the year in

which the IRS accepted the OIC.

44

Any tax return with a status greater than 12 indicates that the return has been in balance due status. In addition, a status

of 22, 24, or 26 indicates a TDA. A TDA occurs when a taxpayer has a balance due. 5.19.22.2.1, BMF Return Delinquency

Overview (July 7, 2016). In particular, it occurs after the final collection notice is issued. IRS, Document 6209, Section 8A,

Master File Codes (2018).

45

This study includes an examination of all rejected or returned OICs, and whether the OIC was submitted based on doubt as

to collectability, doubt as to liability, or effective tax administration. However, the IRS generally only computes reasonable

collection potential (RCP) for rejected OICs.

46

IRM 5.8.4.3.1, Components of Collectability (Apr. 30, 2015).

47

The amount offered was obtained from an extract provided by the IRS from its Automated OIC System. Subsequent

payments are captured by the IRS as Transaction Code 670. For rejected OICs, the TC 670 date was used only if it was

after the date of the first TC 480 (when a processable OIC is submitted). We also examined the presence of any taxpayer

refunds offset against the liability after rejection.

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers142

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

Memphis – Business is in the following states:

Alabama, Arkansas, Florida, Georgia, Hawaii, Idaho, Kentucky, Louisiana, Mississippi,

North Carolina, New Mexico, Nevada, Oklahoma, Oregon, Tennessee, Texas, Washington,

Wisconsin

Brookhaven – Business is in the following states:

Alaska, Arizona, California, Colorado, Connecticut, Delaware, District of Columbia,

Illinois, Indiana, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Minnesota,

Missouri, Montana, Nebraska, New Hampshire, New Jersey, New York, North Dakota,

Ohio, Pennsylvania, Rhode Island, South Carolina, South Dakota, Utah, Vermont, Virginia,

West Virginia, Wyoming, Puerto Rico or has a foreign address

FINDINGS

Since 2007, quantify the number of business taxpayers who have submitted multiple

OICs within 180 days (also known as churning)

TAS Research used the Compliance Data Warehouse to select the population of BMF taxpayers that

submitted an OIC between 2007 and 2017.

48

This analysis resulted in the detection 47,004 unique

BMF taxpayers who submitted an OIC for approximately 390,000 modules.

49

Churned OICs are ones in which the taxpayer makes multiple OIC submissions within a 180-day

period. There are many reasons why an OIC may need to be perfected. For instance, the IRS may

return a taxpayer’s OIC as not processable when the taxpayer does not submit the required user fee

or Tax Increase and Prevention Reconciliation Act (TIPRA) payment, or when the taxpayer is not in

filing compliance.

50

The change in processability for OICs submitted by taxpayers who are not in filing

compliance is a relatively new change in procedure.

51

Prior to this change, if the IRS determined that

a taxpayer was not in filing compliance, the IRS would process the OIC and contact the taxpayer to

discuss any late tax returns and allow the taxpayer time to file them within a specified period of time.

52

Also, generally the IRS will reject the OIC if it determines that the amount offered is not sufficient

based on its calculation of the RCP.

53

To determine if the taxpayers submitted churned OICs, TAS Research calculated the date from when

an OIC was rejected/returned/terminated to when a second OIC was submitted. If the amount of time

was less than six months, the subsequent OIC was counted as a churned OIC. Overall, approximately

48

IRS, CDW, BMF Dec. 2017. Transaction Code 480 dated after 2007.

49

Modules refer to a tax form (indicated by a MFT Code) and a period associated with that tax form. For example, a taxpayer

may submit an offer for each quarter of their 2010 Form 941, Employer’s Quarterly Federal Tax Return Liabilities. As

discussed in this section, many taxpayers will submit multiple OICs for the same liabilities.

50

IRM 5.8.2.4.1, Determining Processability (May 25, 2018), contains a complete list of reasons causing the IRS to deem an

OIC as not processable.

51

Memorandum from Director, Collection Policy to Director, Specialty Collection, Liens & Advisory (Apr. 13, 2016) (on file with

TAS). For more information on this topic, see National Taxpayer Advocate 2017 Annual Report to Congress, vol. 2 42-60;

National Taxpayer Advocate 2014 Annual Report to Congress 218-224; National Taxpayer Advocate 2009 Annual Report to

Congress 196-212; The National Taxpayer Advocate’s 2014 Annual Report To Congress: Hearing Before the H. Subcomm. On

Govt. Operations of the H. Comm.On Oversight And Government Reform, 114th Cong. 23 (Apr. 15, 2015) (statement of Nina

E. Olson, National Taxpayer Advocate).

52

IRM 5.8.3.6(1), Perfecting Field Cases (July 28, 2015); IRM 5.8.3.7(1), Perfecting COIC Cases (Dec. 7, 2015).

53

IRM Exhibit 5.8.1-1, Common Abbreviations Used in the IRM (May 5, 2017). See also Policy Changes Made by the IRS to the

Offer in Compromise Program Makes It More Difficult for Taxpayers to Submit Acceptable Offers, supra.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 143

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

6.6 percent of taxpayers submitted churned OICs on BMF tax liabilities. The churning rate for BMF

taxpayers is slightly lower than the churning rate of about ten percent of IMF taxpayers.

54

This analysis

suggests that most BMF taxpayers do not submit OICs merely to delay collection.

FIGURE 5.7, Churning Counts and Acceptance Rates for All Churned BMF OICs

Year of first

TC 480 Count

Number of

Taxpayers Who

Churned

Percent of

Taxpayers

Who Churned

Count of Taxpayers

Who Churned With

Accepted OIC

Percent of Taxpayers

Who Churned With

Accepted OIC

2007 5,313 381 7.2% 130 34.1%

2008 4,474 305 6.8% 92 30.2%

2009 3,698 221 6.0% 70 31.7%

2010 4,741 304 6.4% 123 40.5%

2011 4,665 392 8.4% 171 43.6%

2012 4,693 312 6.6% 124 39.7%

2013 4,828 331 6.9% 145 43.8%

2014 4,513 351 7.8% 121 34.5%

2015 4,032 217 5.4% 79 36.4%

2016 3,221 114 3.5% 28 24.6%

Total

a

44,178 2,928 6.6% 1,083 37.0%

a Businesses submitted 2,826 OIC in 2017; however, when TAS Research extracted the data for this study in early 2018, sufficient

time had not elapsed to determine the churning rate. We have been unable to determine why both the number of OICs submitted

and the acceptance rate of churned OICs decreased beginning in 2016; however, this decrease could be occurring because of the

IRS’s decision to no longer consider OICs from taxpayers with return delinquencies as processable.

Furthermore, about 37 percent of taxpayers who had a churned OIC ultimately had an accepted OIC.

While the IRS certainly has reason to reject or return some OICs, the data indicate that many taxpayers

with rejected or returned OICs are trying to resolve their tax delinquencies with a perfected OIC. In

addition, this data indicates it may take some taxpayers multiple attempts to perfect their OICs.

When the IRS returns or rejects an OIC and the taxpayer subsequently submits a new OIC, the IRS

expends additional resources by reworking the OIC. Moreover, taxpayers may become deterred or

prevented from submitting another OIC, which could negatively impact future voluntary filing and

payment compliance, as discussed below. For instance, a taxpayer may borrow money from a friend or

family member to finance the filing fee and initial payment, a source of income the IRS normally would

not have access to, only to have the OIC returned and the initial payment kept by the IRS. A taxpayer

in this situation may be unable to submit a second, perfected OIC.

Figures 5.8 through 5.11 explore the number of taxpayers who had churned OICs and if these taxpayers

ultimately received an accepted OIC, according to their business entity type (partnership, corporation,

or sole proprietorship).

54

National Taxpayer Advocate 2017 Annual Report to Congress vol. 2 52.

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers144

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

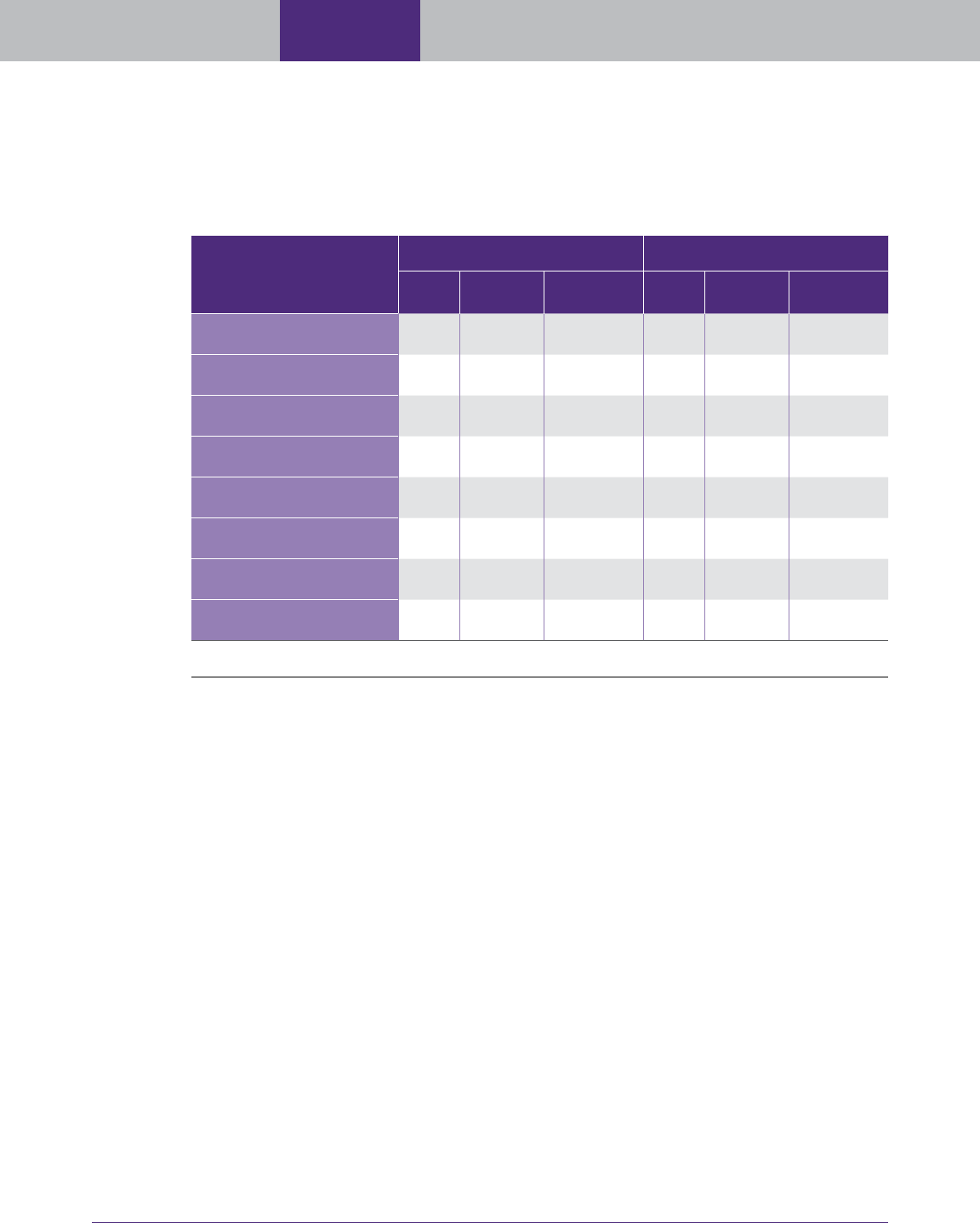

FIGURE 5.8, Churn and Acceptance Rates by Entity Type Between 2007 and 2016

55

%

Partnership

Churn

% Partnership

Churn with

Acceptance Rate

% Corp

Churn

% Corp Churn

with Acceptance

Rate

% Sole

Prop. Churn

% Sole Prop

Churn with

Acceptance Rate

2007 13.07% 26.53% 10.40% 22.93% 12.38% 36.32%

2008 10.96% 24.39% 11.06% 16.75% 13.13% 31.21%

2009 10.90% 14.29% 9.89% 19.14% 12.03% 43.48%

2010 12.64% 30.36% 10.44% 27.78% 14.00% 46.24%

2011 12.16% 33.96% 12.17% 30.65% 14.35% 47.37%

2012 11.53% 23.08% 13.07% 23.34% 11.44% 57.60%

2013 11.85% 38.60% 12.27% 27.15% 11.46% 62.40%

2014 13.03% 29.31% 15.26% 24.15% 11.43% 46.67%

2015 9.21% 28.57% 9.74% 20.00% 10.07% 38.38%

2016 7.36% 18.18% 6.71% 9.52% 6.61% 14.29%

Total 11.44% 27.95% 11.30% 23.36% 11.98% 43.54%

FIGURE 5.9, Churning Counts and Acceptance Rates for All Churned Partnership OICs

56

Year of first

TC 480 Count

Number of

Taxpayers

Who Churned

Percent of

Taxpayers

Who Churned

Count of Taxpayers

Who Churned with

Accepted OIC

Percent of Taxpayers

Who Churned with

Accepted OIC

2007

375 49 13.07% 13 26.53%

2008

374 41 10.96% 10 24.39%

2009

321 35 10.90% 5 14.29%

2010

443 56 12.64% 17 30.36%

2011

436 53 12.16% 18 33.96%

2012

451 52 11.53% 12 23.08%

2013

481 57 11.85% 22 38.60%

2014

445 58 13.03% 17 29.31%

2015

380 35 9.21% 10 28.57%

2016

299 22 7.36% 4 18.18%

Total 4,005 458 11.44% 128 27.95%

The IRS accepted about 28 percent of OICs from partnerships with churned OICs during the years

2007 through 2016. The percent of partnerships with churning OICs is approximately 11 percent,

which is similar to the overall rate for all the BMF OICs. Figure 5.10 depicts the prevalence of churning

and subsequent acceptance in OICs submitted by corporations.

55

IRS, CDW BMF Dec. 2017.

56

Id.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 145

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

FIGURE 5.10, Churning Counts and Acceptance Rates for All Churned Corporation OICs

57

Year of first

TC 480 Count

Number of

Taxpayers

Who Churned

Percent of

Taxpayers

Who Churned

Count of Taxpayers

Who Churned with

Accepted OIC

Percent of Taxpayers

Who Churned with

Accepted OIC

2007

1,972 205 10.40% 47 22.93%

2008

1,727 191 11.06% 32 16.75%

2009

1,638 162 9.89% 31 19.14%

2010

2,068 216 10.44% 60 27.78%

2011

2,038 248 12.17% 76 30.65%

2012

2,196 287 13.07% 67 23.34%

2013

2,372 291 12.27% 79 27.15%

2014

2,116 323 15.26% 78 24.15%

2015

1,899 185 9.74% 37 20.00%

2016

1,564 105 6.71% 10 9.52%

Total 19,590 2,213 11.30% 517 23.36%

The percent of corporations with churning OICs is approximately 11 percent, which is similar to the

overall percent for all the business entities. However, only 23 percent of these churned OICs were

ultimately accepted, which is the lowest rate for the most common three business entities. Figure 5.11

examines the churning of OICs submitted by sole proprietorships.

FIGURE 5.11, Churning Counts and Acceptance Rates for All Churned Sole Proprietorship

OICs

58

Year of first

TC 480 Count

Number of

Taxpayers

Who Churned

Percent of

Taxpayers

Who Churned

Count of Taxpayers

Who Churned with

Accepted OIC

Percent of Taxpayers

Who Churned with

Accepted OIC

2007 1,713 212 12.38% 77 36.32%

2008 1,318 173 13.13% 54 31.21%

2009 956 115 12.03% 50 43.48%

2010 1,236 173 14.00% 80 46.24%

2011 1,192 171 14.35% 81 47.37%

2012 1,093 125 11.44% 72 57.60%

2013 1,091 125 11.46% 78 62.40%

2014 1,050 120 11.43% 56 46.67%

2015 983 99 10.07% 38 38.38%

2016 741 49 6.61% 7 14.29%

Total 11,373 1,362 11.98% 593 43.54%

57

IRS, CDW BMF Dec. 2017.

58

Id.

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers146

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

Again, the percent churning is approximately 12 percent which is about what the overall percent is for

all the BMF entities. However, the acceptance rate of sole proprietors with churned OICs is almost

44 percent, which is much higher than the acceptance rate for other business entity types with churned

OICs.

Determine the collection and filing status of the BMF returns with an accepted OIC

Figure 5.12 provides a comparison of the subsequent compliance for those taxpayers whose OICs the

IRS did or did not accept. These include all returns filed by the business, not just delinquent income tax

returns. TAS Research explored four different measures of subsequent compliance:

The presence of a TDA;

59

The presence of a TDI;

60

The presence of a balance due (not arising to the level of a TDA); and

The presence of an unfiled return (not arising to the level of a TDI).

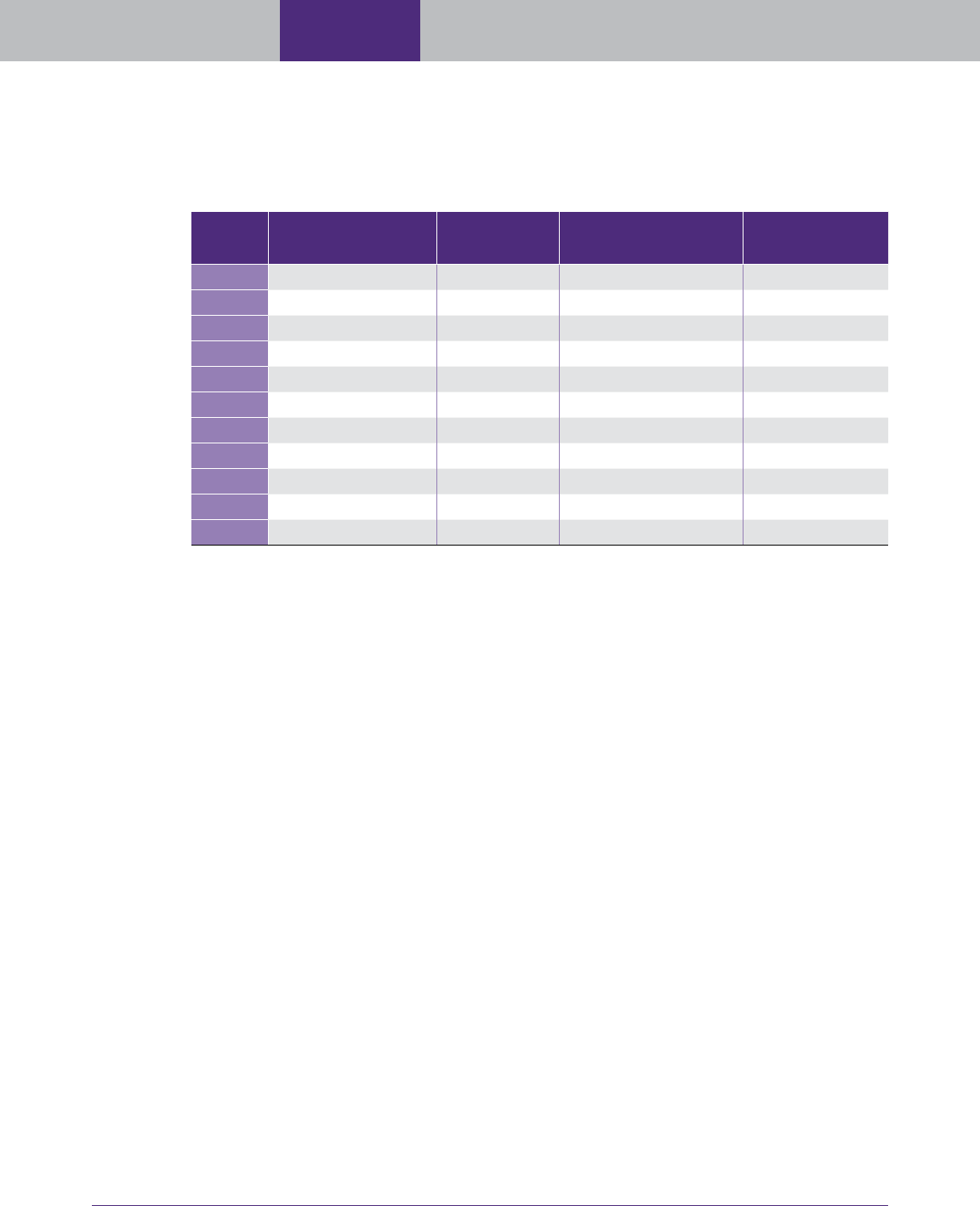

FIGURE 5.12, Filing and Payment Compliance Five and Ten Years or More After OIC Was

Submitted

61

Measure/Result

OIC Not Accepted OIC Accepted

Count

Non-

compliant

Percent

Non-Compliant Count

Non-

compliant

Percent

Non-Compliant

TDA During Five Years

After OIC Acceptance

33,961 5,184 15.3% 13,043 893 6.8%

TDI During Five Years After

OIC Acceptance

33,961 2,883 8.5% 13,043 417 3.2%

TDA During All Years After

OIC Acceptance

33,961 2,645 7.8% 13,043 359 2.8%

TDI During All Years After

OIC Acceptance

33,961 2,212 6.5% 13,043 274 2.1%

Balance Due During Five

Years After OIC Acceptance

33,961 8,480 25.0% 13,043 2,203 16.9%

Balance Due During All

Years After OIC Acceptance

33,961 4,034 11.9% 13,043 769 5.9%

Unfiled Return During Five

Years After OIC Acceptance

33,961 6,073 17.9% 13,043 1,146 8.8%

Unfiled Return During All

Years After OIC Acceptance

33,961 3,751 11.0% 13,043 579 4.4%

59

A TDA occurs when a taxpayer has a balance due. IRM 5.19.22.2.1, BMF Return Delinquency Overview (July 7, 2016). In

particular, it occurs after the final collection notice is issued. IRS, Document 6209, Section 8A, Master File Codes (2018).

60

A TDI is part of the Return Delinquency (RD) Program, which works responses to notices that are issued to taxpayers that

have been identified as liable to file and have not filed a tax return by the RD. IRM 5.19.22.2, What Is The BMF Return

Delinquency Program? (Jan. 2, 2015).

61

IRS, CDW, BMF Sept. 2018.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 147

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

TAS Research examined the four measures for two different time periods: the first five years after the

year in which the IRS accepted the OIC, and for all years after the year in which the IRS accepted the

OIC.

62

The results indicate that BMF taxpayers with accepted OICs are significantly more compliant

when considering the measures above. The noncompliance rate of taxpayers with an accepted OIC is

generally less than half of the noncompliance rate for businesses unable to obtain an accepted OIC. For

example, only 6.8 percent of businesses with an accepted OIC have a TDA within the five years after the OIC

acceptance, compared to 15.3 percent of businesses whose OIC the IRS did not accept. Similarly, only 3.2

percent of businesses where the IRS accepted an OIC had a TDI within five years after the acceptance

of their OIC, compared to 8.5 percent of taxpayers whose OIC the IRS did not accept. The differences

in TDA and TDI compliance rates beyond five years after the OIC acceptance or rejection show an even

wider disparity, with those businesses with accepted OICs having a significantly better level of both filing and

payment compliance.

When Businesses That Stay in Operation Are Considered, Results Are Even Stronger

Businesses often submit OICs after they have decided to end their operation. Therefore, TAS Research

examined which businesses continued their operations by determining which businesses continued

to file subsequent returns (or have a requirement to file) after the IRS accepted or rejected their OIC.

Figure 5.13 duplicates Figure 5.12, but only for those taxpayers continuing to have tax due returns (even

if the tax due was timely filed and paid). The data shows that in all but one category (having a TDI

more than five years out), BMF taxpayers with an accepted OIC were much more likely to be compliant

than BMF taxpayers without an accepted OIC. Even so, the group having a TDI more than five years

out still had better compliance when an OIC was accepted (an approximately 94 percent compliance rate

for BMF taxpayers with an accepted OIC compared to 86 percent compliance rate for BMF taxpayers

without an accepted OIC).

When it comes to payment compliance, BMF taxpayers with an accepted OIC had an approximately

44 percent compliance rate during the five years after OIC acceptance. This compares to a nearly 32

percent compliance rate for BMF taxpayers without an accepted OIC. Perhaps one way to improve

the compliance rate for BMF taxpayers with an accepted OIC even more is to send reminders in the

beginning of the year to adjust withholdings and make estimated payments.

62

The terms of an OIC allow the IRS to default an accepted OIC when the taxpayer accrues additional liabilities or fails to file

within five years after the IRS accepts the OIC.

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers148

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

FIGURE 5.13, Filing and Payment Compliance Five and Ten Years or More After OIC Was

Submitted for Only In-Business Taxpayers

63

Measure/Result

OIC Not Accepted

a

OIC Accepted

Count

Non-

compliant

Percent Non-

Compliant Count

Non-

compliant

Percent Non-

Compliant

TDA During Five Years After OIC

Acceptance

12,475 5,184 41.56% 3,950 893 22.61%

TDI During Five Years After OIC

Acceptance

12,475 2,352 18.85% 3,950 379 9.59%

TDA During All Years After OIC

Acceptance

12,475 2,645 21.20% 3,950 359 9.09%

TDI During All Years After OIC

Acceptance

12,475 1,761 14.12% 3,950 245 6.20%

Balance Due During Five Years

After OIC Acceptance

12,475 8,480 67.98% 3,950 2,203 55.77%

Balance Due During All Years

After OIC Acceptance

12,475 4,034 32.34% 3,950 769 19.47%

Unfiled Return During Five Years

After OIC Acceptance

12,475 5,177 41.50% 3,950 1,044 26.43%

Unfiled Return During All Years

After OIC Acceptance

12,475 3,088 24.75% 3,950 518 13.11%

a To determine the year of business, research used either the last year of an accepted OIC or the last year of a rejected OIC.

Research excluded any offer that is still open or that was accepted or rejected in 2017.

Determine How Much Revenue Collection Potential Is Lost By Not Accepting OICs

Figures 5.14 through 5.17 show that in a majority of the cases, the IRS’s analysis works as it should

with rejected and returned OICs because the amount offered is often less than what was ultimately

collected by about twice as much. However, when further analysis is done, TAS Research also determined

that almost 40 percent of rejected OICs were for more than was ultimately collected. Specifically, in

these instances, the amount offered was nearly three times the amount actually collected, as shown

in Figure 5.14. Figures 5.15 through 5.17 compare the amount offered and the amount collected for

partnerships, corporations, and sole-proprietorships, respectively. By rejecting these OICs, the IRS not

only loses an opportunity to collect revenue, but it misses out on the improved compliance effect that

comes with accepted OICs.

63

IRS, CDW, BMF 2007–2017 Sept. 2018.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 149

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

FIGURE 5.14, Amounts Offered and Collected for All Returned or Rejected BMF OICs

Compared to Returned or Rejected OICs Where the OIC Amount Was Greater Than

Payment

64

ALL Returned/Rejected OICs

Count Mean Median Total

Offered 7,295 $29,447 $6,000 $214,817,800

Collected

6,317 $44,849 $9,020 $283,311,550

All Returned/Rejected OICs with Offer > Payment

Count Mean Median Total

Offered 2,828 $45,044 $10,000 $127,384,853

Collected

2,828 $12,846 $1,554 $36,328,386

FIGURE 5.15, Amounts Offered and Collected for All Returned or Rejected Partnership

OICs Compared to Returned or Rejected Partnership OICs Where the OIC Amount Was

Greater Than Payment

65

ALL Returned/Rejected Partnership OICs

Count Mean Median Total

Offered

878 $35,625 $5,000 $31,279,406

Collected

709 $34,655 $7,120 $24,570,594

All Returned/Rejected OICs with Offer > Payment

Count Mean Median Total

Offered

326 $71,639 $10,000 $23,354,468

Collected

326 $7,398 $1,278 $2,411,678

64

IRS Automated OIC System Aug. 2017; IRS CDW BMF Sept. 2018. Some additional amounts may have been collected from

Trust Fund Recovery Penalty assessments against individuals of corporations determined responsible for collecting trust

fund taxes.

65

IRS Automated OIC System Aug. 2017; IRS CDW BMF Sept. 2018.

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers150

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

FIGURE 5.16, Amounts Offered and Collected for All Returned or Rejected Corporation

OICs Compared to Returned or Rejected Corporation OICs Where the OIC Amount Was

Greater Than Payment

66

ALL Returned/Rejected Corporation OICs

Count Mean Median Total

Offered

4,347 $34,695 $48,000 $150,818,185

Collected

3,816 $53,990 $11,084 $206,024,907

Returned/Rejected Corporation OICs with Offer > Payment

Count Mean Median Total

Offered

1,766 $49,920 $12,000 $88,159,029

Collected

1,766 $16,189 $1,766 $28,589,014

FIGURE 5.17, Amounts Offered and Collected for All Returned or Rejected Sole Proprietor

OICs Compared to Returned or Rejected Sole Proprietor OICs Where the OIC Amount Was

Greater Than Payment

67

ALL Returned/Rejected Sole Proprietor OICs

Count Mean Median Total

Offered

1,061 $13,043 $4,000 $13,838,242

Collected

921 $21,010 $6,000 $19,350,635

Returned/Rejected Sole Proprietor OICs with OIC > Payment

Count Mean Median Total

Offered

394 $19,154 $7,284 $7,546,841

Collected

394 $5,834 $1,103 $2,298,464

Regardless of entity type, Figures 5.14 through 5.17 show that, overall, the IRS collected more than was

offered. However, for nearly 39 percent of the cases, the OIC amount was much more than what the

IRS ultimately collected. On average, among these cases, the amount offered was more than three times

what was collected in the subsequent years. For partnerships, the amount offered was nearly ten times

the amount actually collected. When considering the nearly four in ten OICs where the amount offered

was greater than the amount collected, the median amount offered was more than six times the median

amount collected.

66

IRS Automated OIC System Aug. 2017; IRS CDW BMF Sept. 2018.

67

Id.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 151

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

When the IRS rejects an OIC, as opposed to returning it as not processable, the IRS computes a specific

dollar amount it believes is the RCP. TAS Research also looked at the RCP for the BMF OICs that were

rejected. Figures 5.18 through 5.25 show the amount offered compared to the amounts subsequently

collected and the RCP for rejected OICs. The data is then broken down by business entity type.

FIGURE 5.18, All Offered, Collected, and RCP Amounts with Rejected OICs

68

All Rejected OICs with RCP

Count Mean Median Total

Offered

2,775 $28,754 $7,152 $79,793,191

Collected

2,487 $49,030 $11,436 $121,936,743

RCP

2,775 $403,127 $113,066 $1,118,678,499

The above table shows that the percent that was offered was approximately seven percent of the RCP, in

addition, what was ultimately collected was about 10 percent of the RCP. Again, the table below shows

the percentage of the offered amount and collected amount to the RCP is insignificant (12 percent and

five percent respectively). Of the 2,775 rejected partnership OICs, 1,038 (or approximately 37 percent)

had an OIC greater than the subsequent payments.

FIGURE 5.19, All Offered, Collected, and RCP Amounts With Rejected OICs – When the

OIC Amount Is Greater Than Subsequent Payments Collected

69

All Rejected OICs

Count Mean Median Total

Offered

1,038 $40,576 $10,563 $42,117,880

Collected

1,038 $15,495 $1,959 $16,083,995

RCP

1,038 $331,507 $128,796 $344,104,001

Overall, Figures 5.18 through 5.25 show that the RCP for the entities in this population is significantly

overestimated. In fact, depending on business entity type, the RCP is about seven to ten times greater than

the amount offered and 20 to 30 times what has been collected subsequently. In addition to the impact on

revenue collection, inflating the RCP may discourage OIC submissions, with the concurrent impact on

subsequent compliance.

68

IRS Automated OIC System Aug. 2017; IRS CDW BMF Sept. 2018.

69

Id.

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers152

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

FIGURE 5.20, Offered, Collected, and RCP Amounts for Partnerships With Rejected OICs

70

Rejected Partnership OICs

Count Mean Median Total

Offered

292 $20,459 $5,921 $5,974,098

Collected

248 $34,573 $9,231 $8,574,124

RCP

292 $215,159 $97,551 $62,826,537

FIGURE 5.21, Offered, Collected, and RCP Amounts for Partnerships With Rejected OICs

When the OIC Is Greater Than Subsequent Payments Collected

71

Rejected Partnership OICs

Count Mean Median Total

Offered

107 $28,882 $10,000 $3,090,341

Collected

107 $7,787 $1,550 $833,183

RCP

107 $210,744 $109,774 $22,549,598

FIGURE 5.22, Offered, Collected, and RCP Amounts for Corporations With Rejected OICs

72

Rejected Corporation OICs

Count Mean Median Total

Offered

1,588 $37,305 $10,000 $59,239,821

Collected

1,437 $62,258 $15,192 $89,465,223

RCP

1,588 $496,646 $141,478 $788,673,719

70

IRS Automated OIC System Aug. 2017; IRS CDW BMF Sept. 2018.

71

Id.

72

Id.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 153

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

FIGURE 5.23, Offered, Collected, and RCP Amounts for Corporations With Rejected OICs

When the OIC Is Greater Than Subsequent Payments Collected

73

Rejected Corporation OICs

Count Mean Median Total

Offered

617 $53,911 $14,091 $33,263,376

Collected

617 $21,066 $2,571 $12,997,627

RCP

617 $414,590 $154,839 $255,802,007

FIGURE 5.24, Offered, Collected, and RCP Amounts for Sole Proprietorships With Rejected

OICs

74

Rejected Sole Proprietor OICs

Count Mean Median Total

Offered

483 $12,901 $4,050 $6,230,942

Collected

441 $22,401 $7,362 $9,878,670

RCP

483 $185,772 $83,450 $89,727,724

FIGURE 5.25, Offered, Collected, and RCP Amounts for Sole Proprietorships With Rejected

OICs When the OIC Is Greater Than Subsequent Payments Collected

75

Rejected Sole Proprietor OICs

Count Mean Median Total

Offered

178 $16,345 $6,450 $2,909,466

Collected

178 $5,794 $1,000 $1,031,330

RCP

178 $171,005 $87,789 $30,438,947

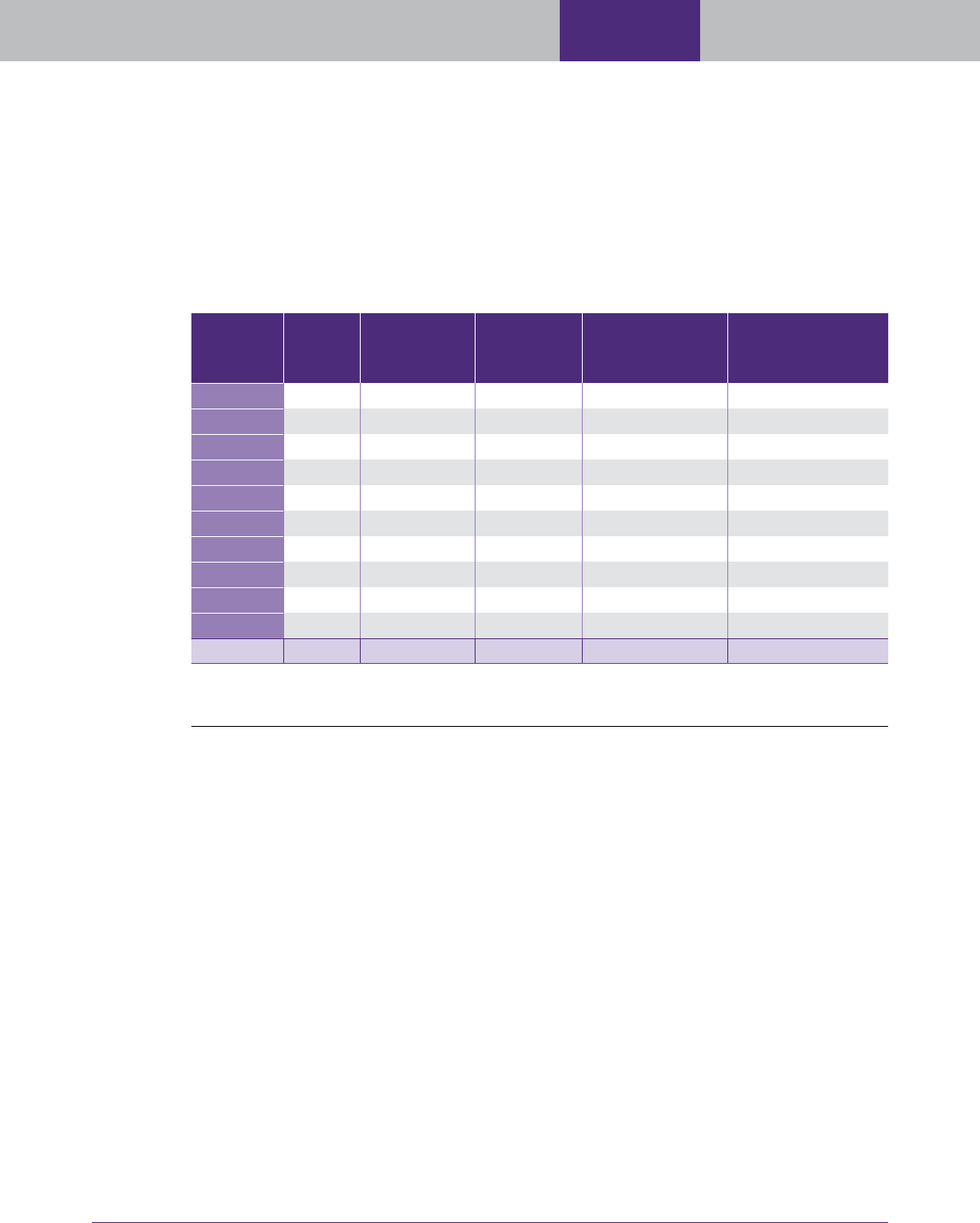

Determine the campus that processed the OICs and accepted the OICs

Several Low Income Taxpayer Clinics and other stakeholders have expressed concerns to the National

Taxpayer Advocate that OICs are not worked consistently between the two campuses, Memphis and

Brookhaven, which process the initial offer.

76

73

IRS Automated OIC System Aug. 2017; IRS CDW BMF Sept. 2018.

74

Id.

75

Id.

76

Low Income Taxpayer Clinics (LITCs) assist low income individuals who have a tax dispute with the IRS, and provide

education and outreach to individuals who speak English as a second language (ESL). TAS, Low Income Taxpayer Clinics,

https://taxpayeradvocate.irs.gov/about/litc. See IRC § 7526.

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers154

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

FIGURE 5.26, OIC Acceptance Rates by Campus Processing OIC

77

Year

Business OICs

Processed by Memphis

Percentage of

OICs Accepted

Business OICs Processed

by Brookhaven

Percentage of OICs

Accepted

2007

2,007 23.9% 3,301 25.2%

2008

1,659 18.7% 2,812 20.0%

2009

1,446 23.4% 2,249 25.3%

2010

1,812 26.3% 2,928 25.8%

2011

1,774 29.2% 2,889 32.4%

2012

1,885 30.9% 2,803 34.4%

2013

1,853 30.2% 2,972 33.1%

2014

1,716 32.2% 2,796 35.5%

2015

1,409 32.4% 2,619 35.5%

2016

1,184 27.5% 2,035 31.9%

2017

989 8.4% 1,835 9.5%

Although, overall, for the past 11 years, the difference in the acceptance rates of business offers is only

about two percent. The difference between the business OIC acceptance rates widened from 2011 to

2016, with Brookhaven’s business OIC acceptance rate being 4.4 percentage points higher than OICs

processed at the Memphis site in 2016. The difference between the OIC acceptance rates has come

down to a much smaller difference in 2017. Currently, we do not see a significant difference in OIC

processing between the two sites.

CONCLUSIONS

OICs benefit both the IRS and the taxpayer. The IRS collects as much as it can, based on the taxpayer’s

reasonable collection potential, conditioned on the taxpayer remaining in compliance. The taxpayer

is able to move on with a “fresh start.” This is particularly important to BMF taxpayers who do not

have access to the full array of collection alternatives available to IMF taxpayers. TAS research shows

that accepting an OIC positively impacts future filing and payment compliance for BMF taxpayers.

However, in over a third of rejected OICs, our research shows that the IRS overinflated the RCP, leading

to a rejected OIC.

When read in conjunction with the National Taxpayer Advocate’s IMF OIC study from last year, TAS

Research has shown that the OIC program is an important tool for revenue collection, taxpayer health

and welfare, and continued compliance.

Overall, since 2007, the percentage of BMF taxpayers who have submitted an OIC, and

subsequently churn, is approximately seven percent. The IRS accepted the OICs of over a third

of those taxpayers with churned OICs, suggesting that taxpayers are often trying to submit

successful OICs and the IRS could save resources by working with these taxpayers to perfect

OICs rather than returning them.

77

IRS, CDW BMF Dec. 2017. Decisions may not have been made on 2017 OICs when the data for this report was pulled in

2018.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume Two 155

ALEsPAYE

Understatement

Penalty

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

BMF taxpayers with accepted OICs have a higher rate of remaining in filing and payment

compliance for the five years after the IRS accepts the OIC than compared to BMF taxpayers

whose OICs were not accepted. Taxpayers with accepted OICs have even better compliance

beyond five years when compared to businesses who had their OICs returned or rejected. When

considering only those taxpayers who continued to operate, the difference in subsequent filing

and payment compliance rates were more pronounced in favor of those businesses having an

accepted OIC. For instance, filing compliance for all years after OIC acceptance is about 12

percentage points higher for a BMF taxpayer continuing to operate with an accepted OIC than

for a BMF taxpayer with a rejected OIC.

The IRS often overestimates the business taxpayer’s RCP. In fact, the RCP is overestimated by

about eight times what was offered and about 20 times what was ultimately collected.

RECOMMENDATIONS

Congress intended for the IRS to take a flexible approach in using the OIC as a collection tool. For

businesses, it may be the only viable collection alternative. While the IRS accepts many OICs, the

percentage of accepted BMF OICs is less than that of IMF OICs. The IRS also returns or rejects many

OICs that could be perfected by working with the taxpayer. And in a substantial number of cases, the

IRS rejected an OIC and then failed to collect as much as the taxpayer offered to satisfy the liability.

Yet, taxpayers with accepted OICs have better subsequent filing and payment compliance. With these

facts in mind, the National Taxpayer Advocate makes the following recommendations:

The IRS should devote more resources to working with taxpayers to perfect OICs it would

otherwise reject or return. Securing acceptable OICs could save the IRS money by preventing

resources from being spent collecting the uncompromised delinquency and by obtaining the

increased filing and payment compliance that generally accompanies accepted OICs. It also

reduces the effort to reopen a case in the case of churned OICs.

The IRS should study a sample of returned and rejected OICs to determine factors which indicate

that the IRS is likely to collect an amount less than what has been offered to compromise the

liability. Given the large differential between RCP and the amount offered for some rejected

OICs, taxpayers may become discouraged, unable, or unwilling to amend their OICs. As part of

this study, the IRS should also determine what factors lead to an inflated RCP so that, in future

situations with similar circumstances, the IRS could determine a more realistic amount of RCP,

which may result in more accepted OICs.

The IRS should consider further improving its IRM guidance. For instance, to encourage

consideration of specific facts and circumstances for each business, the IRS should eliminate the

general assumption that an operating business should provide payment for the full amount of

remaining tax and focus on the actual facts and circumstances in which the business operates.

TAS RESEARCH AND RELATED STUDIES — A Study of the IRS Offer in Compromise Program for Business Taxpayers156

OIC Study

Liens and

Letters

Improving

Notices

IRS

Audits

Understatement

Penalty

ALEs PAYE

This page intentionally left blank.