Most Serious Problems — Offer In Compromise266

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

MSP

#18

OFFER IN COMPROMISE: Policy Changes Made by the IRS to

the Offer in Compromise Program Make It More Difficult for

Taxpayers to Submit Acceptable Offers

RESPONSIBLE OFFICIALS

Mary Beth Murphy, Commissioner, Small Business/Self-Employed Division

Donna Hansberry, Chief, Office of Appeals

TAXPAYER RIGHTS IMPACTED

1

The Right to Quality Service

The Right to Finality

The Right to Privacy

The Right to a Fair and Just Tax System

DEFINITION OF PROBLEM

An offer in compromise (OIC) is an agreement between a taxpayer and the government that settles a

tax liability for payment of less than the full amount owed. Congress grants the IRS the authority to

accept offers pursuant to Internal Revenue Code (IRC) § 7122.

2

To its credit, the IRS has engaged in

an outreach campaign to make the OIC a more visible collection tool. For instance, it has worked to

develop electronic newsletters, IRS Tax Tips, and social media for both taxpayers and tax professionals

to use.

3

With a robust and flexible OIC program, the IRS receives money that it might not have collected

through other means and achieves voluntary tax compliance from the taxpayer (at least for the next five

years, which is long enough to create a long-term change in noncompliant behavior).

4

If the taxpayer

does not follow the terms of the agreement, the OIC defaults and the debt is reinstated.

5

The taxpayer

benefits by reaching finality with his or her tax debt sooner in the collection process and paying what

he or she can afford to pay, while the IRS benefits by creating a segment of noncompliant taxpayers who

become more compliant.

A 2017 study by TAS Research found that individual taxpayers (Individual Master File (IMF)) with

accepted OICs were significantly more likely (58 percent compared to 42 percent) to timely file their

subsequent income tax returns for the next five years when compared to taxpayers whose OICs the IRS

did not accept. For the first five years after the OIC, IMF taxpayers with accepted OICs were also much

1

See Taxpayer Bill of Rights (TBOR), www.TaxpayerAdvocate.irs.gov/taxpayer-rights. The rights contained in the TBOR are

also codified in the Internal Revenue Code (IRC). See IRC § 7803(a)(3).

2

Treas. Reg. § 301.7122-1(b).

3

IRS response to TAS information request (Aug. 20, 2018).

4

IRS, Form 656-B, Offer in Compromise 6 (Jun. 2018).

5

Internal Revenue Manual (IRM) 5.8.9.4, Potential Default Cases, (Jan. 12, 2017).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 267

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

more likely to pay their subsequent income taxes than taxpayers whose OICs the IRS did not accept (72

percent compared to 52 percent).

6

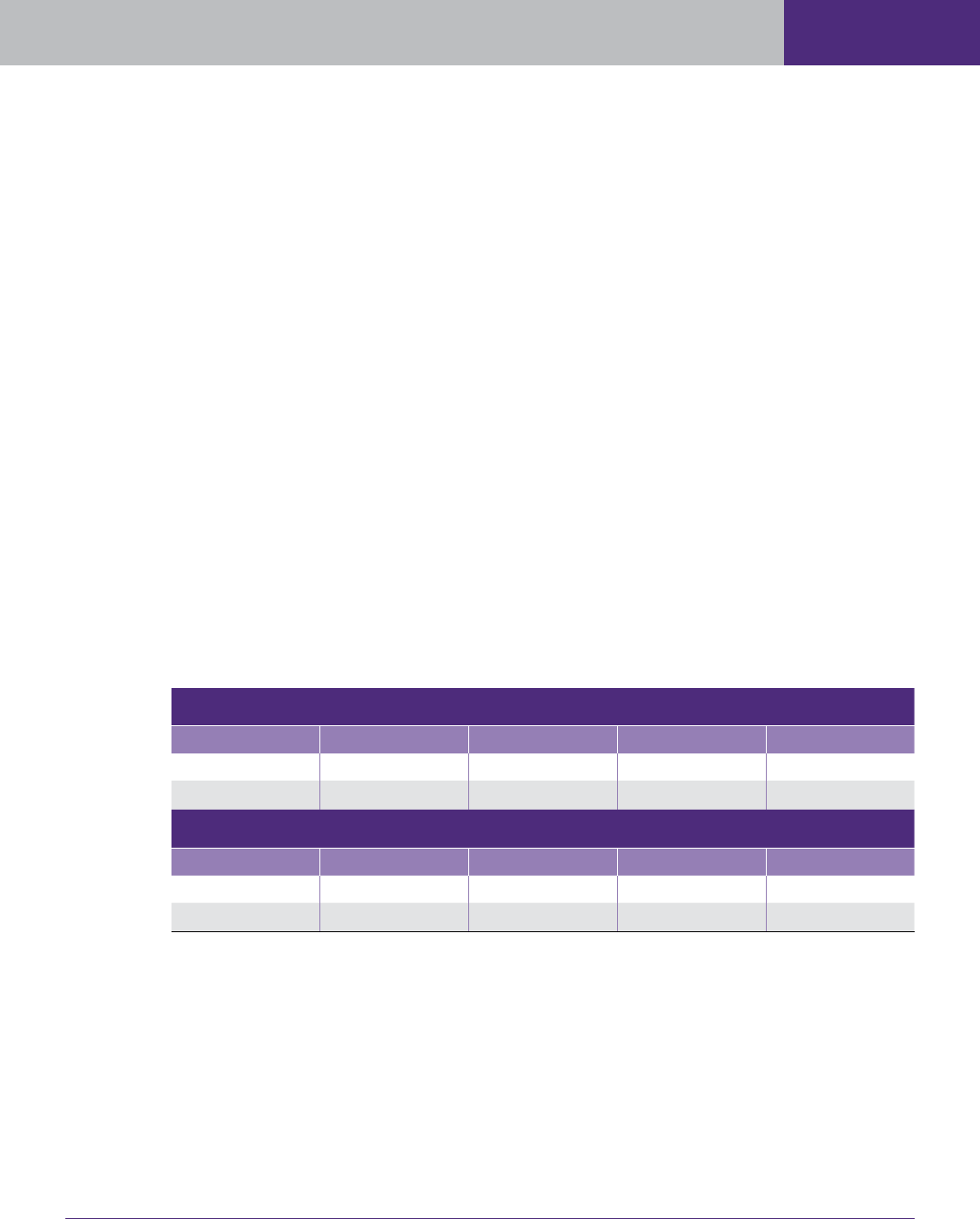

In 2018, TAS Research studied business taxpayers (Business Master File (BMF)) with OICs. It found

that BMF taxpayers with accepted OICs have a better filing rate than IMF taxpayers five years out.

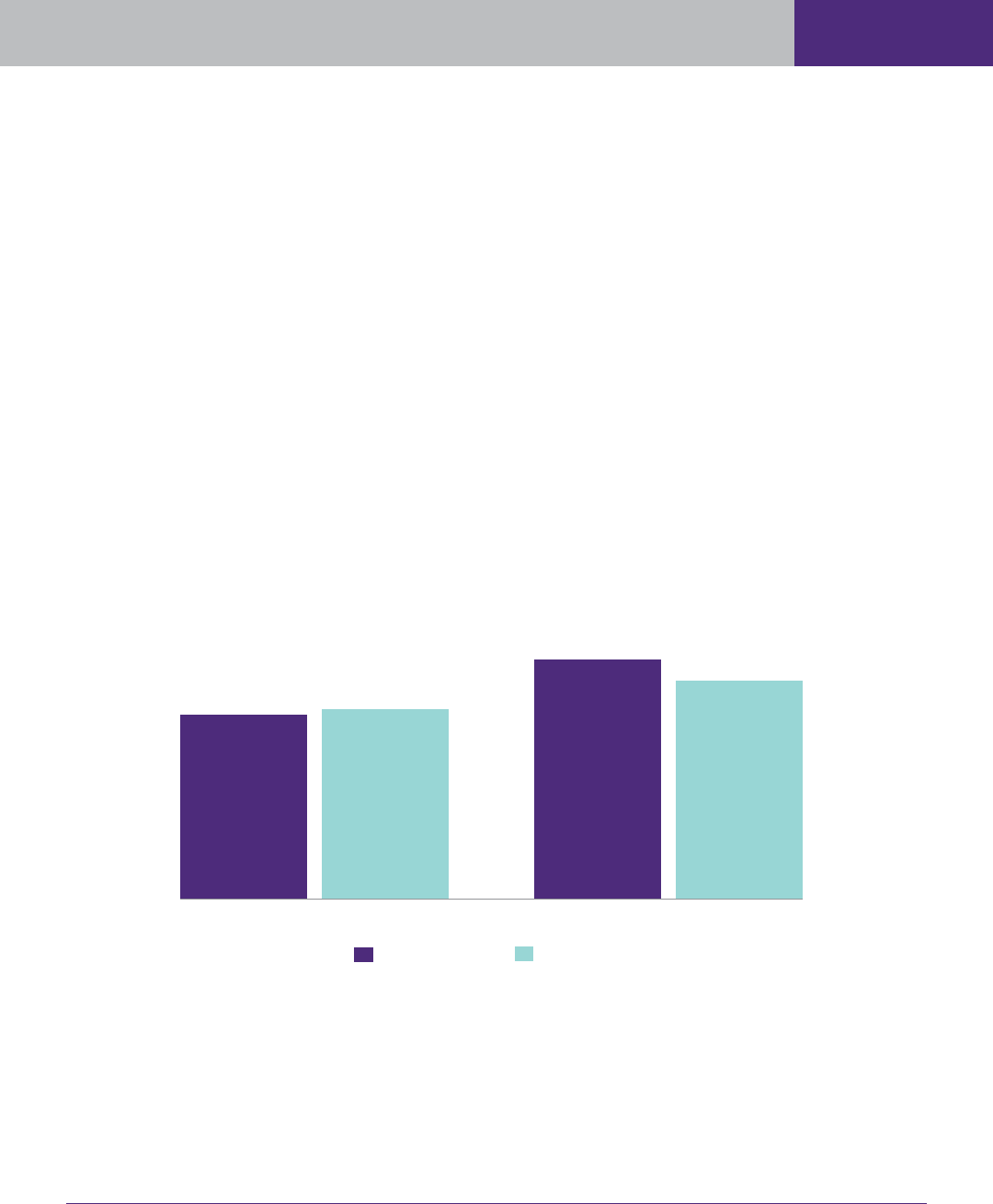

Figure 1.18.1 shows that while 70 percent of IMF taxpayers with an accepted OIC file their returns

five years after an accepted OIC, 91 percent of BMF taxpayers with an accepted OIC do so five years

out.

7

BMF taxpayers also have better future payment compliance. Approximately 72 percent of IMF

taxpayers with accepted OICs had no balance due five years after an accepted OIC compared to 52

percent of IMF taxpayers without an accepted OIC.

8

Approximately 83 percent of BMF taxpayers had

no balance due five years after an accepted OIC compared to 75 percent of BMF taxpayers with no

accepted OIC.

9

FIGURE 1.18.1

IMF and BMF FIling and Payment Compliance for Five Years

After an Offer in Compromise Is Accepted

Filing Compliance

Payment Compliance

70%

IMF With Accepted OIC

BMF With Accepted OIC

72%

91%

83%

6

National Taxpayer Advocate 2017 Annual Report to Congress vol. 2, 43 (Research Study: A Study of the IRS Offer in

Compromise Program).

7

Id.; Research Study: A Study of the IRS Offer in Compromise Program for Business Taxpayers vol. 2, infra. For the purposes

of the Business Master File (BMF) study, TAS Research focused on partnerships, corporations, or sole proprietors.

8

National Taxpayer Advocate 2017 Annual Report to Congress vol. 2, 55; See Research Study: A Study of the IRS Offer in

Compromise Program for Business Taxpayers, infra.

9

Research Study: A Study of the IRS Offer in Compromise Program for Business Taxpayers vol 2, infra.

Most Serious Problems — Offer In Compromise268

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

The IRS is also losing revenue collection opportunities because it uses inflated projections of reasonable

collection potential (RCP). In about 40 percent of the BMF OICs that were not accepted, the OIC

amounts offered are much higher than the amounts ultimately collected through other means.

Notwithstanding the clear benefits of entering into OICs, the National Taxpayer Advocate is concerned

that the IRS is not doing enough to help BMF taxpayers file successful OICs. Additionally, the IRS has

made changes that create barriers to all taxpayers from submitting successful OICs:

The IRS moved away from having revenue officers (ROs) available to work OICs in each state;

OICs submitted by taxpayers who had not filed all necessary tax returns are returned to the

taxpayers as not processable, rather than holding them for a period to allow for return filing;

The IRS will keep the payments sent with OICs it returns for lack of filing compliance;

OICs returned to the taxpayer in error are not subject to the 24-month deemed acceptance period

in IRC § 7122(f); and

The time it takes to process OICs, including any appeals, may lead to multiple years of refund

offsets.

ANALYSIS OF PROBLEM

Background

Treasury Regulations provide three grounds for an OIC:

Doubt as to liability;

10

Doubt as to collectibility;

11

and

Effective tax administration.

12

The law requires two things before the IRS can deem an OIC processable. First, an OIC submission

must include a partial payment (referred to as a Tax Increase Prevention and Reconciliation Act or

“TIPRA” payment).

13

Second, the taxpayer must pay any applicable user fee.

14

Additionally, Treasury

Regulations require taxpayers to make the OIC in writing, sign the OIC under penalty of perjury,

and include all of the information “prescribed or requested by the Secretary.”

15

If an OIC meets the

10

Treas. Reg. 301.7122-1(b)(1). Doubt as to liability exists where there is a genuine dispute as to the existence or amount of

the correct tax liability under the law. Doubt as to liability does not exist where the liability has been established by a final

court decision or judgment concerning the existence or amount of the liability.

11

Treas. Reg. 301.7122-1(b)(2). Doubt as to collectibility exists in any case where the taxpayer’s assets and income are less

than the full amount of the liability.

12

Treas. Reg. 301.7122-1(b)(3). There are two grounds for effective tax administration offers: 1) If the Secretary determines

that, although collection in full could be achieved, collection of the full liability would cause the taxpayer economic hardship

within the meaning of Treas. Reg. § 301.6343-1 and; 2) If there are no grounds for an offer under the other offer in

compromise (OIC) criteria, the IRS may compromise to promote effective tax administration where compelling public policy

or equity considerations identified by the taxpayer provide a sufficient basis for compromising the liability. Compromise will

be justified only where, due to exceptional circumstances, collection of the full liability would undermine public confidence

that the tax laws are being administered in a fair and equitable manner.

13

IRC §§ 7122(c)(1), 7122(d)(3)(C). For lump sum offers, the partial payment must be 20 percent of the OIC amount. For a

periodic payment OIC, the partial payment must consist of the first installment payment. IRC § 7122(c)(1)(A)– (B).

14

IRC § 7122(c)(2)(B). The application fee is currently $186. If an individual taxpayer qualifies for the low income waiver, he

or she will not be required to send any payment with the OIC. IRS, Form 656-B, Offer in Compromise (Jun. 2018).

15

Treas. Reg. § 301.7122-1(d)(1).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 269

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

minimum criteria for consideration, the IRS deems it processable.

16

Prior to April 13, 2016, IRS

procedures dictated that if any of the following criteria were present, the IRS would determine an OIC

as not processable:

The taxpayer is in bankruptcy;

The taxpayer did not submit the application fee with the OIC;

17

The taxpayer failed to submit the initial payment with the OIC;

18

All liabilities have been referred to the Department of Justice;

19

The OIC is filed for an unassessed liability and internal information does not indicate that a

return has been filed;

The OIC is filed solely with respect to liabilities for which the statutory period for collection has

expired; and

The taxpayer marks the total amount of the payment as a deposit.

20

When the IRS determines that an OIC is not processable, it returns the OIC to the taxpayer with a letter

explaining the reason for the IRS’s determination.

21

With a not-processable returned OIC, the IRS may

return the application fee and initial payment to the taxpayer.

22

A rejected OIC differs from a returned

OIC in that the IRS has reviewed the facts of the case prior to rejection, and the taxpayer receives appeal

rights when the OIC is rejected.

23

The IRS will keep payments made on rejected OICs.

24

Every Revenue Officer Should Be Able to Process an OIC

Taxpayers submitting an OIC today can expect that the IRS will work their OIC at one of two

Centralized OIC sites or in one of two OIC field territories. The revenue officers (ROs) in the

field groups are spread across 22 states.

25

ROs who work OICs are referred to as OIC Specialists.

26

Previously, the Special Procedures Function investigated all OICs. As OIC receipts increased, Field ROs

worked OICs for a short period time prior to the establishment of specialized Field OIC groups in fiscal

year (FY) 1996.

27

OICs have gone from being something worked by all ROs to something worked in two territories. This

consolidation of work is not beneficial to the analysis of OICs, which often must take particular facts

and circumstances into account, much of which can be affected by the taxpayer’s geography. The IRS

16

IRM 5.8.2.4.1 (May 25, 2018). Centralized OIC employees make the initial determination of processability. Id.

17

In lieu of the application fee, a taxpayer may check the low income waiver box on Form 656, which would allow him or her to

submit the offer without payment.

18

If the OIC includes part of the initial payment, the OIC may be perfected during the case building process. IRM 5.8.2.4.1

(May 25, 2018).

19

The IRS does not have authority to accept an OIC that is controlled by the Department of Justice. IRM 5.8.1.6.1 (Nov. 8,

2018).

20

This does not include instances where the taxpayer checks the low income waiver box. IRM 5.8.2.3.1(1) (July 28, 2015).

21

IRM 5.8.2.5, Not Processable (May 25, 2018).

22

Id.; IRM 5.8.7.2, Returns (Oct. 07, 2016).

23

IRM 5.8.7.7, Rejection (Oct. 7, 2016).

24

IRS, Form 656, Offer in Compromise 5 (Mar. 2018).

25

Territory 1 has OC Specialists in 10 states and Territory 2 has OC Specialists in 12 states that are not covered in the ten by

Territory 1. IRS, Human Resources Reporting Center, https://persinfo.web.irs.gov/ (last visited Oct. 17, 2018).

26

IRS response to TAS information request (Apr. 26, 2018).

27

IRS response to TAS information request (Aug. 20, 2018). In 2005 the Field OIC groups were consolidated into three Areas.

Id.

Most Serious Problems — Offer In Compromise270

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

should revert back to having a greater geographic presence for OIC Specialists and have at least one

OIC Specialist (if not more) in each state. One benefit of having a Field RO work an OIC is that the

RO is knowledgeable and familiar with the particular community, its economy, and related issues in

which he or she works. However, between FYs 2013 and 2018 there was a ten percent decrease in OIC

Specialists (there were 145 OIC Specialists in FY 2013 and 131 as of FY 2018.)

28

The National Taxpayer

Advocate previously discussed the issue of decreasing numbers and lack of geographic dispersion of OIC

Specialists.

29

The IRS Is Not Doing Enough to Help Business Taxpayers File Successful OICs

The National Taxpayer Advocate is concerned that the IRS is not doing enough to accept OICs from

BMF taxpayers.

30

In 2018, TAS Research built on a previous study of IMF OICs by focusing on BMF

OICs. Overall, the acceptance rate for BMF OICs (24 percent) is lower than the rate for individual

OICs (44 percent).

31

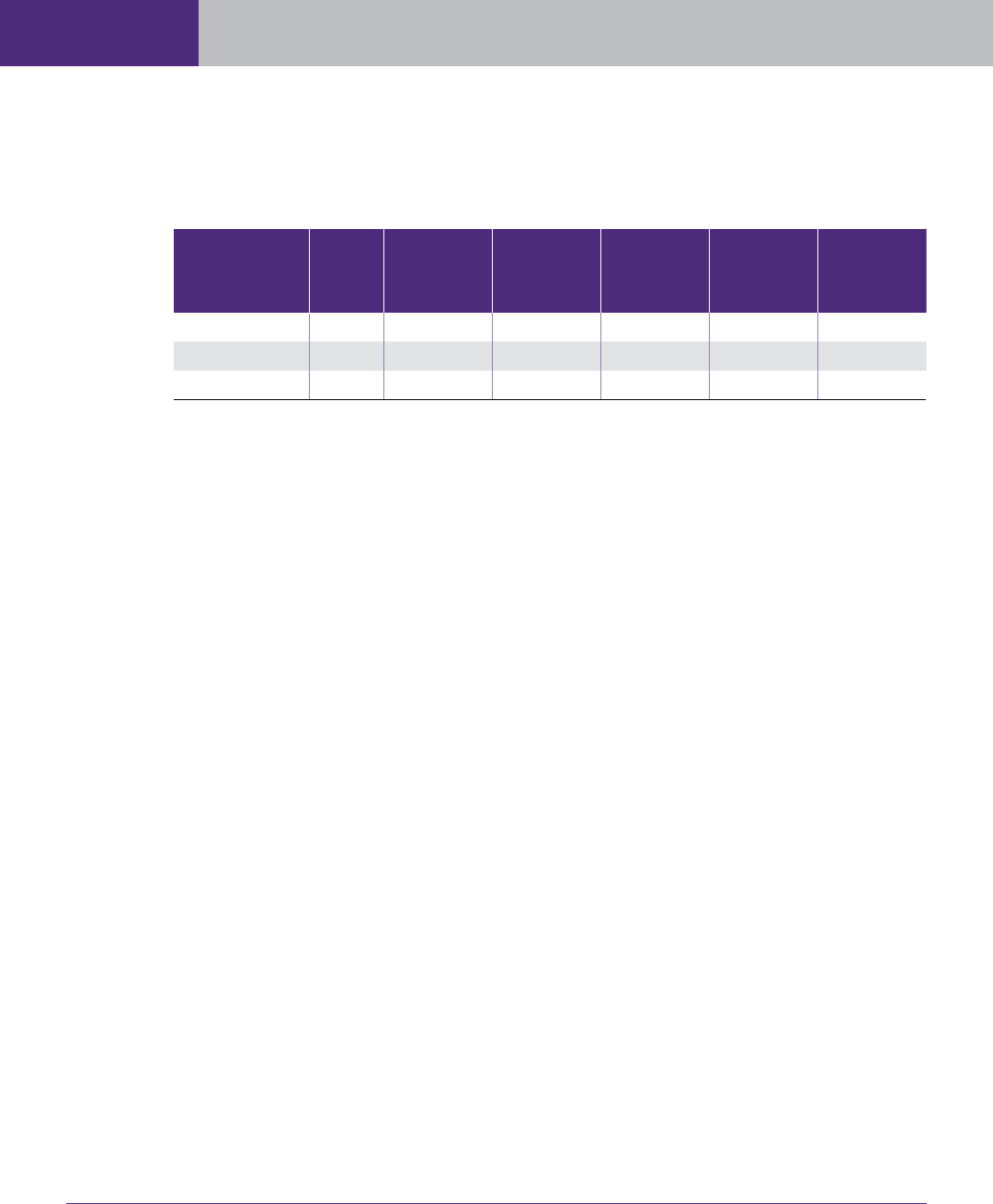

While the IRS may be concerned that IMF and BMF taxpayers use the OIC process to delay collection

action, data from TAS research indicates that BMF taxpayers generally want to submit a successful OIC.

Of the BMF taxpayers who submitted an OIC, approximately 11 percent churned (churning occurs

when a taxpayer submits another OIC within 180 days after the IRS rejects the prior OIC or returns it

as not processable).

32

Of the BMF taxpayers that churned, approximately 33 percent ultimately had an

OIC accepted.

33

Figure 1.18.2 shows the churning rate based on business type.

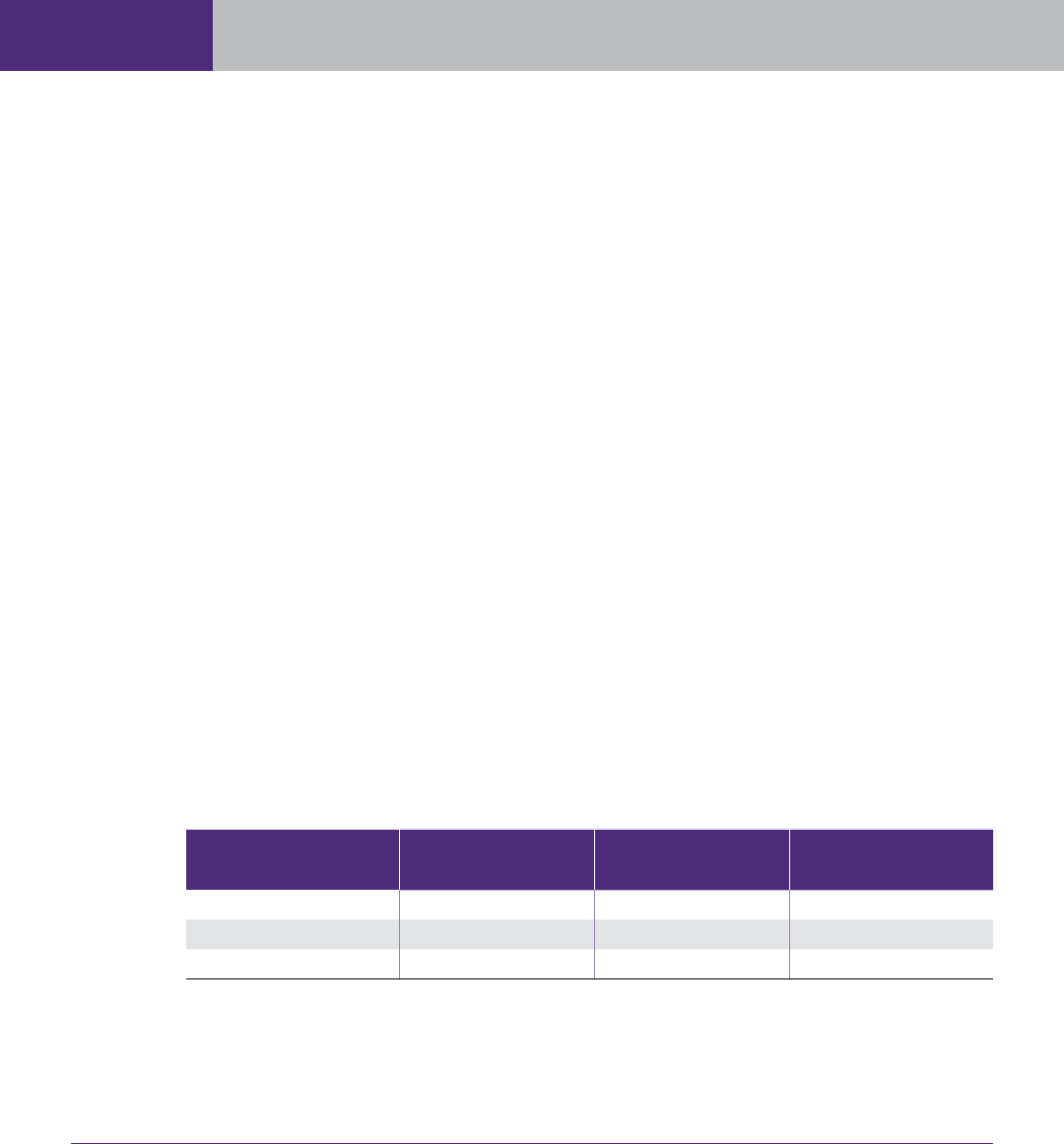

FIGURE 1.18.2, Average Churning and Accepted OICS for BMF Taxpayers by Business

Type Between 2007 and 2017

34

BMF Type Total OICs Percent Churning

Percent Churning With

Accepted OIC

Corporation 20,963 11% 23%

Sole proprietor 12,009 12% 44%

Partnerships 4,283 11% 28%

28

IRS response to TAS information request (May 25, 2018).

29

See National Taxpayer Advocate 2014 Annual Report to Congress 211; National Taxpayer Advocate 2002 Annual Report to

Congress 15.

30

See, e.g., 2014 National Taxpayer Advocate Annual Report to Congress 206-217.

31

Research Study: A Study of the IRS Offer in Compromise Program for Business Taxpayers vol. 2, infra.

32

Id. Additionally, the National Taxpayer Advocate believes the word “churn” has negative connotations for taxpayers trying to

perfect their OICs. Instead, such taxpayers should be viewed as “curing” a defect in the OIC.

33

Id.

34

Id. The entity type of 7,965 businesses is unknown. Corporations filed 20,963 OICs between 2007 and 2017 with 2,386

churned OICs. Of those churned OICs, the IRS ultimately accepted 548 OICs. Sole proprietors filed 12,009 OICs between

2007 and 2017 with 1,482 OICs churning. Of those churned OICs, the IRS ultimately accepted 640 OICs. Partnerships

filed 4,283 OICs between 2007 and 2017 with 501 churned OICs. Of those churned OICs, the IRS ultimately accepted 138

OICs. Because sufficient time has not elapsed to determine if all 2017 OICs churned, churning percentages do not included

OICs submitted in 2017.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 271

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

In the 2017 OIC study, TAS Research looked at rejected OICs by individual taxpayers between 2009

and 2013 and determined that the IRS frequently overestimated RCP.

35

The RCP is calculated by the

IRS after reviewing the taxpayer’s financial information and in many instances will serve as the basis for

an acceptable OIC amount.

36

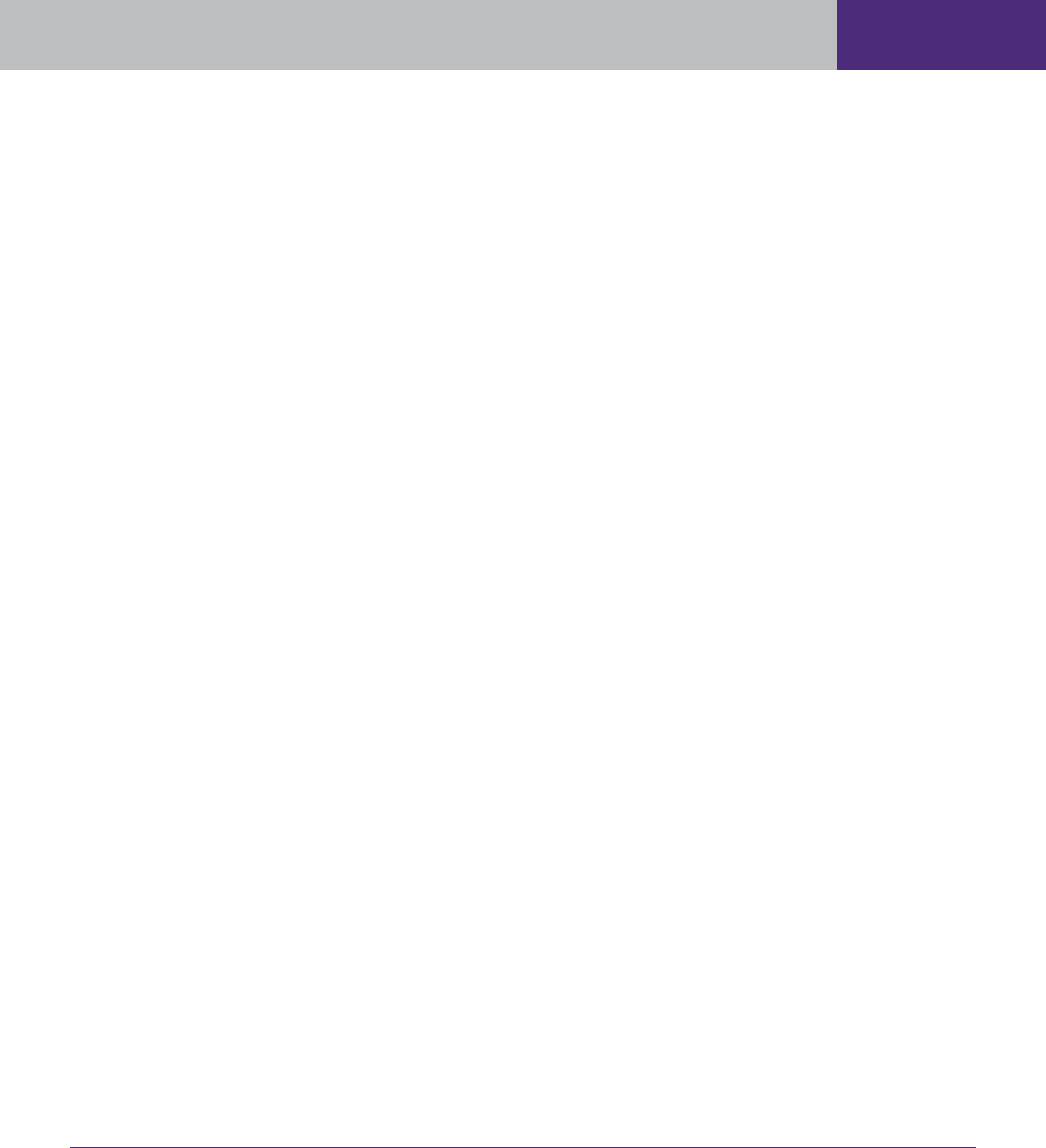

In 2018, TAS Research looked at BMF OICs and again determined that the IRS is losing some revenue

collection opportunities because of inflated RCPs connected to rejected OICs and OICs that were

returned due to an imperfection. Overall, the OIC amount offered for returned or rejected BMF OICs

was often less than what was ultimately collected. However, in about 40 percent of the BMF OICs that

were not accepted, the OIC amounts offered are much higher on average than the amounts ultimately

collected through other means. For instance as seen in Figure 1.18.3, for the 4,347 returned or rejected

corporation OICs, the average amount offered was $34,695, but the IRS ultimately collected an average

of $53,990.

37

However, 1,766 (over 40 percent) of those returned or rejected corporation OICs offered

more than what the IRS ultimately collected. In those 1,766 OICs, the average amount offered was

$49,920 and the average amount ultimately collected was just $16,189.

38

This trend is consistent across

all business types.

FIGURE 1.18.3, Amounts Offered and Collected for All Returned or Rejected Offers From

Corporations Compared to Returned or Rejected Offers From Corporations Where the Offer

Amount Was Greater Than Payment

39

All Returned/Rejected Corp. Offers

Count Mean Median Total

Offered 4,347 $34,695 $48,000 $150,818,185

Collected $53,990 $11,084 $206,024,907

Returned/Rejected Corp. Offers with Offer > Payment

Count Mean Median Total

Offered 1,766 $49,920 $12,000 $88,159,029

Collected $16,189 $1,766 $28,589,014

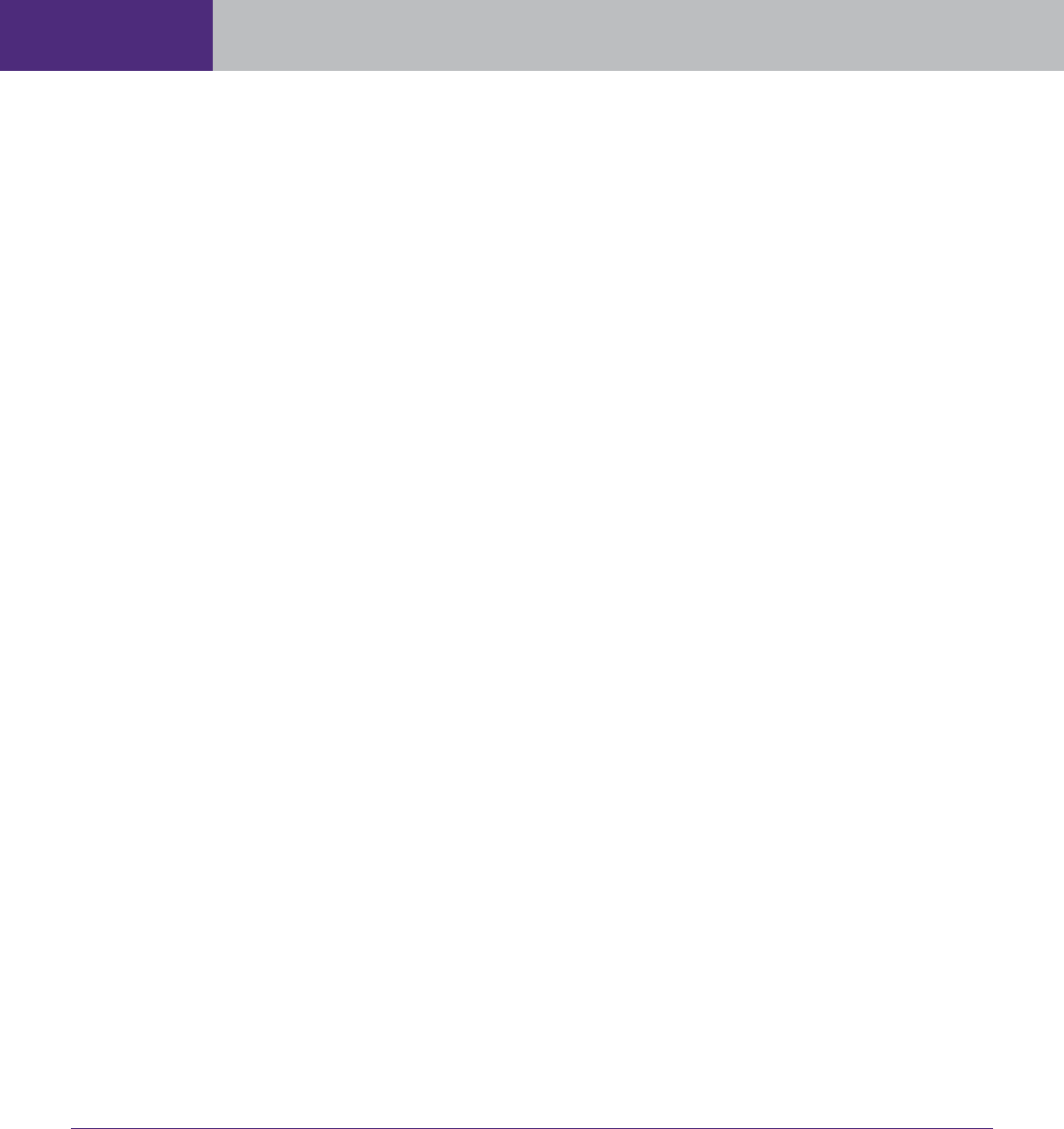

Furthermore, Figure 1.18.4 focuses on businesses that submitted OICs greater than the amount

collected. The table shows that the RCP for each of the entities is overestimated. In fact, depending on

business entity type, the RCP is overestimated about seven to ten times greater than the amount that is

offered and about 20 to 30 times what has been collected.

35

National Taxpayer Advocate 2017 Annual Report to Congress vol. 2, 59.

36

IRM 5.8.1.2.3, Policy (May 5, 2017).

37

Research Study: A Study of the IRS Offer in Compromise Program for Business Taxpayers vol. 2, infra.

38

Id.

39

Id. The value for amount collected is calculated through August 2018.

Most Serious Problems — Offer In Compromise272

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

FIGURE 1.18.4, Business Rejected OICs Which Exceeded Payments by Business Type

40

Business Type Count

Average

Amount

Offered

Average

Amount

Collected

Percentage

of Amount

Offered Average RCP

Percentage

of Amount

Collected

Partnership

107 $28,882 $7,787 27% $210,744 2,706%

Corporation

617 $53,911 $21,066 39% $414,590 1,968%

Sole Proprietor

178 $16,345 $5,794 35% $171,005 2,951%

The IRS should study what occurred in the financial analyses of these cases to determine how it can

improve the RCP calculation. Since the RCP plays such a large role in OIC analysis, having an accurate

RCP will improve the taxpayers’ ability to submit successful OICs.

The IRS Has Made Recent Policy Changes That Discourage All Taxpayers From

Submitting Successful Offers

OICs Submitted by a Taxpayer Who Has Not Filed All Necessary Tax Returns Are Returned to

the Taxpayer As Not Processable

In 2016, the IRS announced that it would return OICs submitted by a taxpayer who had not filed all

necessary tax returns (based on internal research) to the taxpayer as not processable.

41

Prior to this

change, if the IRS determined that a taxpayer was not in filing compliance, the IRS would process the

OIC and contact the taxpayer to discuss any late tax returns and allow the taxpayer time to file them

within a specified period of time.

42

The IRS decided to return OICs as not processable due to lack of filing compliance as part of an OIC

Future State Initiative, explaining “[the new policy] changes the current COIC practice to sign in offers

from non-compliant taxpayers and attempts to bring them current.”

43

With this initiative, the IRS will

return such OICs to the taxpayer with instructions to become compliant and then resubmit his or her

OIC. A TAS review of the data relied on by the IRS indicates that the IRS considered the time saved by

not working these OICs any further; however, it did not consider the time to work a resubmitted OIC or

conduct any analysis to compare the time saved by returning these OICs versus keeping them open and

achieving filing compliance in the future and resolving outstanding tax liabilities.

40

Research Study: A Study of the IRS Offer in Compromise Program for Business Taxpayers vol. 2, infra. The value for amount

collected is calculated through August 2018.

41

Memorandum from Director, Collection Policy to Director, Specialty Collection Offers, Liens & Advisory (Apr. 13, 2016) (on

file with the author).

42

IRM 5.8.3.6(1), Perfecting Field Cases (July 28, 2015); IRM 5.8.3.7(1), Perfecting COIC Cases (Dec. 7, 2015).

43

IRS response to TAS information request (Sept. 20, 2017). For an in-depth discussion of the IRS’s Future State, see

National Taxpayer Advocate 2015 Annual Report to Congress 3-13.

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 273

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

During FY 2017 and the first three quarters of FY 2018, the IRS returned 2,767 IMF OICs because

of unfiled returns. Of those returned OICs, 947 taxpayers (approximately 34 percent) resubmitted an

OIC.

44

The IRS returned 561 OICs to BMF taxpayers because of unfiled returns in FY 2017. Of those

returned OICs, 266 taxpayers (approximately 47 percent) resubmitted OICs.

45

The IRS Will Keep the Payments Sent With OICs That Are Returned for Lack of Filing

Compliance

In February 2017, the IRS announced a change in practice in which the IRS will keep the payments sent

with OICs that are returned for lack of filing compliance.

46

The payments are applied to the liability;

however, the taxpayer cannot have these funds applied to subsequent OICs. In many instances, the OIC

funds may be borrowed or are from sources not generally available to the taxpayer. By not processing

these OICs (see above) and keeping the payments, the IRS creates a major obstacle to submitting a

successful OIC.

Prior to 2006, sums submitted with an OIC were considered deposits and were not applied to the

liability until the IRS accepted the OIC, unless the taxpayer provided written authorization for

application of the payments.

47

Subsequently, the Tax Increase Prevention and Reconciliation Act of

2005 (TIPRA) required taxpayers to submit a partial payment with the OIC package (hence, the

“TIPRA payment”).

48

In lieu of updated regulations, the IRS issued Notice 2006-68 in July 2006.

Under Notice 2006-68, the IRS treats the TIPRA payment as a payment of tax rather than a refundable

deposit, as the regulations do. Of all the IMF OICs that the IRS returned for lack of filing compliance

during FY 2018, 554 taxpayers made a TIPRA payment with their original OIC. Of those 554

taxpayers, IRS kept the TIPRA payment in approximately 18 percent of the cases and did not reopen the

original OIC, causing the taxpayer to come up with another TIPRA payment for any subsequent OIC.

49

Likewise, 190 BMF taxpayers made a TIPRA payment with their original OIC. Of those taxpayers, 64

percent had their TIPRA payment retained without the OIC being reopened by the IRS. Since the IRS

has taken the legal position in Notice 2006-68 that the IRS must keep TIPRA payments because they

are viewed as payments and not deposits, the IRS should provide taxpayers with an opportunity to cure

any defect prior to considering the OIC not processable. The IRS impedes compliance by keeping OIC

payments without first offering an opportunity to cure OICs it would otherwise deem not processable.

44

For the purposes of this analysis, TAS Research considered the OIC to be a resubmission if it was more than four weeks

after the date indicated by the Small Business/Self-Employed (SB/SE) division as the return date. IRS response to TAS

information request (Aug. 20, 2018); Individual Master File for the Taxpayer Identification Numbers (TINs) provided by SB/SE

where an OIC was returned in FY 2017 as unprocessable because of unfiled returns.

45

IRS response to TAS information request (Aug. 20, 2018); Individual Master File for the TINs provided by SB/SE where an

OIC was returned in FY 2017 as unprocessable because of unfiled returns.

46

Memorandum from Director, Collection Policy to Director, Specialty Collection, Liens & Advisory (Feb. 23, 2017) (on file with

the author).

47

Treas. Reg. § 301.7122-1(h).

48

Tax Increase Prevention and Reconciliation Act of 2005 (TIPRA), Pub. L. No. 109-22, §509, 120 Stat. 362 (2006).

49

IRS response to TAS information request (Aug. 31, 2018). The IRS may reconsider a returned OIC if doing so would be in

the best interest of the IRS and the taxpayer. Generally, in these instances the IRS will not require another application fee

or TIPRA payment. IRM 5.8.7.3, Return Reconsideration (Oct. 7, 2016).

Most Serious Problems — Offer In Compromise274

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

OICs Returned in Error Are Not Subject to the 24-Month Deemed Acceptance Period in

IRC § 7122(f)

Under IRC § 7122(f), which Congress added as part of TIPRA, if an OIC has not been rejected within

24 months of submission, the IRS must deem it accepted.

50

This legislation occurred as a result of

problems first identified with OIC processing during Congressional hearings for the IRS Restructuring

and Reform Act of 1998 (RRA 98).

51

The president of the National Society of Accountants (NSA)

reported NSA members experienced “inordinate delays” with the processing of OICs.

52

One woman

described her experience getting an OIC in connection with an innocent spouse claim. She reported in

part:

I have offered to pay the original assessed amount of $9,000, but that was flatly rejected.

This process of offer in compromise has taken nearly two years to negotiate. At almost every

turn, I have hit a wall in terms of requesting information or filing information. It appears

to me that the right hand doesn’t know what the left hand is doing. I have noticed that in

requesting certain information, letters are signed by one person, but questions should be

directed to another. This slows the process. An agent in Idaho returned my original offer

in compromise because it was submitted on a photocopied form rather than a carbon-copy

original. This slows the process.

53

In an email dated April 27, 2018, IRS Counsel stated that OICs returned in error are not subject to the

24-month deemed acceptance period in IRC § 7122(f).

54

Since an OIC will not be deemed acceptable

once it is rejected, the 24-month period under IRC § 7122(f) is extinguished once the OIC is rejected.

IRC § 7122(f) does not distinguish between a rejection with merit and a rejection made in error by the

IRS.

55

As a result, the IRS will no longer apply the protections of IRC § 7122(f) to OICs returned to

taxpayers after an erroneous rejection by the IRS.

Congress created the protections found in IRC § 7122(f) after listening to taxpayers and practitioners

describe the situations in which they found themselves. By exempting the time associated with an OIC

returned erroneously to the taxpayer, the IRS is going against the Congressional intent in IRC § 7122(f)

as well as violating the taxpayer’s right to a fair and just tax system. This change will also lead to

confusion for taxpayers, particularly for those who do not understand the difference between a returned

and a rejected OIC. And in totality, all of the changes described above will make it more difficult for

taxpayers to get the IRS to accept an OIC.

50

Pub. L. No. 109-222, §509(b)(2), 120 Stat. 363.

51

Taxpayer Rights Proposals And Recommendations of the National Commission on Restructuring the Internal Revenue Service

on Taxpayer Protections and Rights: Hearing Before the H. Subcomm. on Oversight, 105th Cong. 17 (1997) (statement of Rep.

William J. Coyne).

52

IRS Restructuring: Hearing Before the S. Comm. on Finance, 105th Cong. 240 (1997) (statement of Douglas C. Burnette,

president, National Society of Accountants).

53

Internal Revenue Service’s Methods: Hearing Before the S. Comm. on Appropriations, 105th Cong. 17 (1998) (statement of

Amy Powers).

54

In some instances this will harm taxpayers twice. The IRS believes the 24-month period under IRC § 7122(f) stops to run

when an OIC is closed, even if the IRS erroneously returns or withdraws an OIC to a taxpayer and later reopens it. However,

the IRS tolls the collection statute expiration date timeframe in such reopened offers, which allows the IRS a longer time to

collect the taxpayer’s debt if the OIC is not accepted. Treas. Reg. § 301.7122-1(i). So the taxpayer is inconvenienced with

an erroneously returned OIC that no longer is protected by a two-year timeframe for processing but is also subjected to a

longer collection period.

55

See also IRS, Notice 2006-68, Downpayments for Offers in Compromise (July 31, 2006).

Taxpayer Advocate Service — 2018 Annual Report to Congress — Volume One 275

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

The Time It Takes for Appeals to Process OIC Appeals May Lead to Multiple Years of Refund

Offsets

As a term of acceptance for the OIC, the taxpayer agrees that the IRS will keep any refund, including

interest, that might be due for tax periods extending through the calendar year in which the IRS

accepts the offer.

56

This policy may make sense when the OIC can be processed (including any Appeals

action) within a year. However, practitioners report this practice harms their clients because processing

OICs takes so long that the IRS takes multiple refunds.

57

It can be especially difficult for low income

taxpayers who rely on their tax refunds to meet their basic living expenses. Figure 1.18.5 shows the cycle

time for OICs worked in Appeals from receipt of the case until closure.

FIGURE 1.18.5, Appeals Offer in Compromise Case Closed Cycle Time FY 2016-FY 2018

58

FY 2016 FY 2017 FY 2018

174.8 days

(5.8 months)

193.6 days

(6.5 months)

194.7 days

(6.5 months)

While Appeals is not the only cause of delayed processing, the average amount of time that Appeals

keeps a case has gone from 5.8 months in FY 2016 to 6.5 months in FY 2018. This means if a taxpayer

appeals a rejected OIC to Appeals after August of a given year, there is a likelihood that the OIC will be

worked into the next calendar year, and the taxpayer will lose an additional refund. The IRS accepted

24,958 IMF OICs in FY 2017 and in 1.5 percent (378 OICs) of those, the taxpayer lost two refunds.

59

The lost refunds total $ 945,953.

60

For BMF OICs, the IRS accepted 1,599 OICs in FY 2017. Of that

amount, less than one percent (seven OICs) lost two refunds. The lost refunds total $20,383.54.

61

This

impacts the taxpayer’s right to a fair and just tax system.

The role of Appeals is not to develop the case. Appeals employees are instructed to “ask the taxpayer

for clarifying information if the taxpayer (particularly a pro se taxpayer) is unsure of what to provide to

clarify a position that is being advanced by the taxpayer. You will primarily rely on the case development

that is in the case file at the time of appeal.”

62

Additionally, Appeals employees are instructed to

consider only the items in dispute at the time of the OIC rejection or issues raised by the taxpayer.

63

Since OIC analysis is now centralized, Appeals should review its employees’ training and technical

experience to ensure it has a sufficient number of employees to work these OIC cases timely.

56

IRS, Form 656, Offer in Compromise 5 (Mar. 2018).

57

Tax analysTs, Offer in Compromise Participation Can Mean Lost Refunds for Some (June 12, 2018).

58

IRS response to TAS information request (Aug. 6, 2018).

59

Analysis of OIC submission dates and offset refunds from IMF.

60

Id.

61

Analysis of OIC submission dates and offset refunds from BMF.

62

IRM 8.23.1.3(2), Conference and Settlement Practices (Apr. 18, 2016).

63

IRM 8.23.1.3(3), Conference and Settlement Practices (Apr. 18, 2016).

Most Serious Problems — Offer In Compromise276

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

CONCLUSION

As demonstrated by TAS Research, the OIC is a valuable collection tool for both the IRS and taxpayers.

It is a cost-effective way to encourage long-term tax compliance. It provides finality to taxpayers who

are struggling with a tax liability. It saves money for the IRS by collecting as much as possible early in

the process, without expensive enforcement action.

However, the IRS has made several changes to the OIC program which threaten to leave the OIC out

of reach for some taxpayers. Instead of returning OICs for lack of filing compliance, the IRS should

retain the OIC for a period of time during which the taxpayer can “cure” the defect of missing tax

returns. By adopting this approach, the IRS would only retain a TIPRA payment in situations where

an OIC defect cannot be cured. The IRS should rethink its analysis of when the 24-month processing

limitation applies in cases where it rejects an OIC, especially in cases where the rejection was an IRS

error. Refusing to apply this protection to taxpayers compounds the IRS errors to the detriment of

taxpayers. Last, the IRS should review its policy of offsetting multiple years of refunds where there

are long processing times for OIC appeals. The recent IRS changes to the OIC program could harm

taxpayers and may impact the OIC’s viability as a collection tool in the future.

RECOMMENDATIONS

The National Taxpayer Advocate recommends that the IRS:

1. Have at least one OIC Specialist in each state to ensure a more even geographic presence for OIC

analysis.

2. Change its policy for deeming OICs not processable if the taxpayer is not current with his or

her filing requirement and reinstate the requirement to retain the OIC and contact taxpayers to

obtain missing returns within a specified period of time.

3. Reconsider its determination that OICs returned or withdrawn in error are not subject to the

24-month deemed acceptance period in IRC § 7122(f).

4. Limit the number of refunds that can be offset while an OIC is pending to one refund only.

5. Conduct a study to analyze the OIC amount offered and collected amounts to understand why

the IRS is rejecting OICs that have an offered amount greater than the dollars collected. For

instance, the IRS should look at how it is applying the Allowable Living Expense standards and

where the taxpayer is obtaining the payment for the OIC.