Volume 2

TAS Research and Related Studies

A Study Of The IRS Offer In

Compromise Program

A Study Of The IRS Offer In Compromise Programes

TAS RESEARCH AND RELATED STUDIES — OIC Program 42

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

A Study Of The IRS Offer In Compromise Program

1

EXECUTIVE SUMMARY ............................................................... 43

INTRODUCTION ..................................................................... 44

BACKGROUND ...................................................................... 48

OBJECTIVES ........................................................................ 49

METHODOLOGY ..................................................................... 50

FINDINGS .......................................................................... 51

Quantify the number of taxpayers who have “churned” since 2007. .......................... 51

Examine the subsequent filing and payment compliance for the five years required by the

terms of the accepted OIC. ......................................................... 53

Examine the subsequent filing and payment for the years beyond the five required by the

terms of the accepted OIC ......................................................... 55

Compare the amount the IRS could have collected on a rejected OIC to the amount actually

collected subsequently ............................................................. 56

Determine if the IRS realizes its estimation of the reasonable collection potential when it

rejects an offer. .................................................................. 59

CONCLUSIONS ...................................................................... 59

RECOMMENDATIONS ................................................................ 60

1

The principal authors of this study are Kate Leifeld, Stacie Swanson, and Jeff Wilson.

Taxpayer Advocate Service — 2017 Annual Report to Congress — Volume Two 43

EITC

Letters

Collection

Agencies

OIC

Program

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

EXECUTIVE SUMMARY

Internal Revenue Code (IRC) § 7122 authorizes the IRS to accept less than the full amount of tax,

penalties, or interest due. As a condition of acceptance for an offer in compromise (OIC), the taxpayer

must agree to remain compliant with his or her filing and paying requirements for the five years

following the acceptance of the OIC. Therefore, although the IRS agrees to settle a tax debt for less

than the full amount due, the IRS secures future filing and payment compliance for the next five years.

As a result, the IRS benefits by obtaining an extensive period of compliance, hopefully developing

better taxpayer habits, which extend into the foreseeable future, while also collecting an amount that it

is unlikely to collect otherwise. On the other hand, the taxpayer is no longer saddled with a debt that

cannot be satisfied.

In 2004, the Office of Program Evaluation and Risk Analysis (OPERA) completed a study of the IRS

OIC program. The study found:

Low rates of taxpayers submitting multiple offers in a relatively short period of time;

High rates of subsequent compliance among taxpayers with accepted offers; and

An often overly optimistic IRS view of the collection potential from taxpayers with rejected

offers.

This current study of the IRS OIC program was designed to be similar to the 2004 OPERA study. The

specific objectives of this study were to:

Quantify the number of taxpayers who have submitted multiple OICs in a short amount of time

(churning);

Examine the subsequent filing and payment compliance for the five years after the IRS accepts a

taxpayer’s OIC;

Determine if subsequent compliance continues beyond the five years required as part of the

accepted OIC agreement;

Compare the amount the IRS could have collected per the terms of a rejected or returned OIC to

the amount actually collected subsequent to the offer; and

Determine if the IRS realizes its estimation of the reasonable collection potential when it rejects

an offer.

This study shows that fewer than ten percent of taxpayers “churn,” defined as submitting multiple OICs

within a six-month period. Furthermore, nearly half of the taxpayers who churn ultimately receive an

accepted OIC, suggesting that taxpayers are not trying to game the system, but are legitimately seeking

an acceptable offer. This also raises the question of whether the IRS could save resources by engaging

more with taxpayers on their original offers rather than creating additional burden for both the IRS and

taxpayers by rejecting or returning offers.

Taxpayers with accepted OICs were significantly more likely (16 percent) to timely file their subsequent

income tax returns for the next five years when compared to taxpayers whose OICs were not accepted.

For the first five years after the offer, taxpayers with accepted offers are also much more likely to pay

their subsequent income taxes than taxpayers whose OICs were not accepted (72 percent compared to 52

percent).

TAS RESEARCH AND RELATED STUDIES — OIC Program 44

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

Taxpayers with accepted OICs continued to be more compliant with filing and payment requirements

even after the five years the taxpayer is required to remain compliant under the terms of the accepted

OIC. Most notably, taxpayers are 11 percent less likely to file a late return and 20 percent less likely to

file an unpaid balance due return.

The IRS secures at least as much (often more) than the offered amount in 60 percent of the OICs it

returns or rejects. However, on average, in the remaining 40 percent, the IRS has only collected a third

of the amount offered through subsequent payments. Overall, even after we factor in refunds offset to

satisfy the delinquent liabilities, the IRS still collects significantly less than the amount offered on rejected or

returned OICs.

In fact, when examining rejected OICs, the IRS determined reasonable collection potential was over

15 times the amount offered, and over 40 times the amount actually collected. While the rejection

of the OIC is sometimes appropriate, in many instances, the IRS often has an exaggerated view of the

taxpayer’s reasonable collection potential, with the dollars collected being less than the amount offered,

and significantly less than the amount the IRS determined as the taxpayer’s reasonable collection

potential.

In view of the findings in this study, the National Taxpayer Advocate has made the following

recommendations:

The IRS should consider devoting more resources to obtaining acceptable OICs from taxpayers

who seek to compromise their liabilities. Securing acceptable OICs could save IRS money

by preventing resources from being spent collecting the uncompromised delinquency and by

obtaining the increased filing and payment compliance that generally accompanies accepted

OICs. Such an approach could also decrease the resources wasted as a result of taxpayers

submitting multiple OICs within a short period of time.

The IRS should study a sample of returned and rejected OICs to determine factors which indicate

that the IRS is likely to actually collect an amount less than what has been offered to compromise

the liability. Given the huge differential between Reasonable Collection Potential (RCP) and the

amount offered for rejected OICs, taxpayers may become discouraged, distrustful, and unwilling

to amend their OICs upward. As part of this study, the IRS should also determine what factors

lead to an inflated RCP, so that in future situations with similar circumstances, the IRS could

determine a more realistic amount of RCP, which may result in more accepted OICs.

INTRODUCTION

The IRS collects taxes from taxpayers with balances due from various tax obligations. In general,

taxpayers are required to pay their tax obligations in full. While the IRS seeks an immediate, complete

satisfaction of an outstanding liability, some taxpayers are not able to immediately pay their tax debts.

In such cases, the IRS offers payment arrangements for taxpayers to satisfy their debts through a series

of monthly payments (referred to as installment agreements).

2

If the taxpayer is financially unable to

pay their tax debts, the IRS may report the liability as currently uncollectible.

3

In such cases, the IRS

monitors the income of the taxpayer and will reactivate the account when a previous IRS financial

analysis indicates assets may become available to satisfy the tax obligation, or a recently filed tax return

2

Internal Revenue Code (IRC) §6159; Internal Revenue Manual (IRM) 5.14.1.1, Securing Installment Agreements, Overview

(Jan. 1, 2016).

3

IRM 5.16.1.1, Currently Not Collectible Overview (Aug. 25, 2014).

Taxpayer Advocate Service — 2017 Annual Report to Congress — Volume Two 45

EITC

Letters

Collection

Agencies

OIC

Program

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

indicates that the taxpayer’s income has increased to a level where it appears that taxpayers can afford to

begin making payments. Even though a tax delinquency may be paid over time or reported currently

not collectible, penalties and interest continue to accrue during the ten-year (or more) period in which

the IRS has to collect the liability.

4

Additionally, IRC § 7122 authorizes the IRS to accept less than the full amount of tax, penalties, or

interest due. This collection tool is known as an OIC.

5

This statute instructs the IRS to establish

procedures to determine when an OIC is sufficient.

6

Furthermore, Congress directed the IRS to “develop

and publish schedules of national and local allowances designed to provide that taxpayers entering into a

compromise have an adequate means to provide for basic living expenses”.

7

Low-dollar OICs will not be

rejected out of hand.

8

In turn, as part of the compromise, the taxpayer agrees to remain fully compliant

with his or her filing and paying requirements for five years after acceptance of the OIC.

9

Treasury Regulations provide three grounds for an OIC:

Doubt as to liability;

10

Doubt as to collectability;

11

and

Effective tax administration (ETA).

12

The law requires two things before an OIC can be deemed processable. First, an OIC submission must

include a partial payment (referred to as a “TIPRA payment”).

13

Second, the taxpayer must pay any

applicable user fee.

14

Additionally, Treasury Regulations require that the OIC be made in writing, be

4

The IRS generally has ten years to collect a tax debt once it is assessed, which is referred to as the collection statute

expiration date (CSED). IRC § 6502. Some events may extend or suspend the CSED. In particular, the CSED is suspended

during the period an offer in compromise (OIC) is pending, for 30 days immediately following the rejection of the OIC, and

for any period when a timely filed appeal from the rejection is being considered by Appeals. Treas. Reg. § 301.7122-1(i). In

some cases, the IRS may choose to reduce the liability to judgment. This means the IRS would bring suit in federal district

court. Once the judgment is in place, the IRS is not limited to the 10-year CSED period. 28 U.S.C. § 3201.

5

See also, IRM 5.8.1.2.1, Offer in Compromise, Definition (Sept. 23, 2008).

6

IRC § 7122(d)(1).

7

IRC § 7122(d)(2).

8

IRC § 7122(d)(3).

9

IRS, Form 656-B, Offer In Compromise 5 (Mar. 2017).

10

Treas. Reg. 301.7122-1(b)(1). Doubt as to liability exists where there is a genuine dispute as to the existence or amount of

the correct tax liability under the law. Doubt as to liability does not exist where the liability has been established by a final

court decision or judgment concerning the existence or amount of the liability.

11

Treas. Reg. 301.7122-1(b)(2). Doubt as to collectibility exists in any case where the taxpayer’s assets and income are less

than the full amount of the liability.

12

Treas. Reg. 301.7122-1(b)(3). There are two grounds for Effective Tax Administration (ETA) offers: 1) If the Secretary

determines that, although collection in full could be achieved, collection of the full liability would cause the taxpayer

economic hardship within the meaning of Treas. Reg. § 301.6343-1 and; 2) If there are no grounds for an offer under the

other OIC criteria, the IRS may compromise to promote effective tax administration where compelling public policy or equity

considerations identified by the taxpayer provide a sufficient basis for compromising the liability. Compromise will be

justified only where, due to exceptional circumstances, collection of the full liability would undermine public confidence that

the tax laws are being administered in a fair and equitable manner.

13

IRC §§ 7122(c)(1), 7122(d)(3)(C). For lump sum offers, the partial payment must be 20 percent of the OIC amount. For a

periodic payment OIC, the partial payment must consist of the first installment payment. IRC §§ 7122(c)(1)(A)– (B).

14

IRC § 7122(c)(2)(B). If an individual taxpayer qualifies for the low income waiver, he or she will not be required to send any

payment with the OIC. IRS, Form 656-B, Offer in Compromise (Mar. 2017).

TAS RESEARCH AND RELATED STUDIES — OIC Program 46

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

signed by the taxpayer under penalty of perjury, and contain all of the information “prescribed or requested

by the Secretary”.

15

If an OIC meets the minimum criteria for consideration, it is deemed processable.

16

An OIC may be returned as unprocessable for a variety of reasons, including the taxpayer did not

provide the application fee or applicable initial payment, the taxpayer is in bankruptcy, etc.

17

In April

2016, the IRS announced that OICs submitted by a taxpayer who had not filed all necessary tax returns

(based on internal research) would be returned to the taxpayer as not processable.

18

In February 2017,

the IRS announced another change in practice, whereby the IRS will keep the payments sent with OICs

that are not processed and returned for lack of filing compliance.

19

An OIC may be rejected for many reasons such as the facts do not support acceptance, acceptance is

not in the government’s best interest, or other public policy reasons.

20

A rejected OIC differs from

a returned OIC in that the IRS has reviewed the facts of the case prior to rejection and the taxpayer

receives appeal rights when the OIC is rejected.

21

When an OIC is rejected, the IRS keeps any required

TIPRA payments made by the taxpayer.

22

The objectives of the OIC program are to:

Affect collection of what can reasonably be collected at the earliest possible time and at the least

cost to the government;

Achieve a resolution that is in the best interest of both the individual taxpayer and the government;

Provide the taxpayer a fresh start toward future voluntary compliance with all filing and payment

requirements; and

Secure collection of revenue that may not be collected through any other means.

23

Taxpayers that have an accepted offer are required to stay in compliance for five years following the

acceptance of their offer, meaning they have to file and pay timely.

24

If they fail to comply, the entire

liability, minus the amount paid with the offer, plus penalties and interest may be reinstated.

25

Thus,

as discussed below, OICs represent an opportunity for the IRS to transform a taxpayer’s noncompliant

behavior into compliant behavior, with the public fisc completely protected against failure.

15

Treas. Reg. § 301.7122-1(d)(1).

16

IRM 5.8.2.3, Centralized Offer in Compromise Initial Processing and Processability, Processability (May 14, 2013). Centralized

OIC (COIC) employees make the initial determination of processability. IRM 5.8.2.3, Centralized Offer in Compromise Initial

Processing and Processability, Processability (May 14, 2013).

17

IRM 5.8.2.3.1, Centralized Offer in Compromise Initial Processing and Processability, Determining Processability (July 28, 2015).

18

IRS, Memorandum for Director, Specialty Collection Offers, Liens & Advisory, Offer in Compromise Filing Compliance and Case

Perfection, SBSE-05-0416-0015 (Apr. 13, 2016).

19

IRS, Memorandum for Director, Collection Policy, Offer in Compromise Filing Compliance and Case Perfection (Feb. 23, 2017).

20

IRM 5.8.7.7, Return, Terminate, Withdraw, and Reject Processing, Rejection (Oct. 7, 2016).

21

Id. This study includes an examination of all rejected or returned offers in compromise submitted from individual taxpayers,

whether the OIC was based on doubt as to collectability, doubt as to liability, or effective tax administration.

22

IRM 5.8.2.7.1 Processable Offers - Payment Processing (May 14, 2013).

23

IRM 1.2.14.1.17, Policy Statement 5-100 (Jan. 30, 1992); IRM 5.8.1.2.4, Overview, Objectives (Sept. 23, 2008).

24

IRS, Form 656-B, Offer In Compromise 5 (Mar. 2017).

25

IRM 5.8.9.4, Actions on Post-Accepted Offers, Potential Default Cases (Jan. 12, 2017).

Taxpayer Advocate Service — 2017 Annual Report to Congress — Volume Two 47

EITC

Letters

Collection

Agencies

OIC

Program

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

Congress has long viewed the OIC as a viable and reasonable collection alternative.

26

The Senate

intended that the IRS would adopt a “liberal acceptance policy for [offers] to provide an incentive for

taxpayers to continue to file tax returns and continue to pay their taxes”.

27

This view was also adopted in

the conference report for the IRS Restructuring and Reform Act of 1998 (RRA 98):

The conferees believe that the IRS should be flexible in finding ways to work with taxpayers

who are sincerely trying to meet their obligations and remain in the tax system. Accordingly,

the conferees believe that the IRS should make it easier for taxpayers to enter into offer in

compromise agreements, and should do more to educate the taxpaying public about the

availability of such agreements.

28

However, the IRS accepts fewer than half of the OICs submitted by taxpayers each year. While good

reasons exist for the IRS to reject or return many offers, both the IRS and the taxpayer benefit from an

accepted OIC. The IRS not only resolves the current delinquencies, but also generally ensures future

filing and payment compliance for at least the next five years, and often longer. Therefore, the IRS does

not continue to expend its resources on the current liabilities or future delinquencies. The taxpayer

obtains a clean start, free from the existing tax debt and has incentive to avoid future debts for the next

five years, which often translates into the development of good filing and payment compliance habits

well into the future.

This study includes all types of OICs submitted by individual taxpayers, including doubt as to

collectability offers, doubt as to liability offers, and effective tax administration offers. The report

will begin by exploring the frequency with which taxpayers submit multiple offers within a six-month

period. The IRS may be concerned that taxpayers could engage in a practice of submitting multiple

unacceptable offers for the primary purpose of delaying collection actions, which the IRS might use to

collect on the delinquency.

29

This report will also examine the taxpayers’ filing and payment compliance

subsequent to an accepted OIC, and how the amount actually collected on liabilities where the OIC was

returned or rejected compares to what the IRS has actually been able to collect, and for rejected OICs,

what the IRS determined to be the RCP.

30

26

IRS Restructuring and Reform Act of 1998 (RRA 98), Pub. L. No. 105-206 (1998); H.R. Conf. Rep. 599, 105th Cong.,

2d Sess. 288-89 (1998).

27

S. Rep. no. 105-174 at 90 (1998).

28

RRA 98, Pub. L. No. 105-206 (1998); H.R. REP. NO. 105-599, at 288-89 (1998) (Conf. Rep.).

29

IRS Offers in Compromise, An Analysis of Various Aspects of the OIC Program 2004. Per IRM 5.11.1.4.11, Offers in

Compromise (Aug. 1, 2014), notices of levy cannot be served while an OIC is pending, within 30 days after an OIC is

rejected, or while a rejected OIC is being appealed. IRM 5.8.4.20, Offer Submitted Solely to Delay Collection (May 10, 2013),

describes IRS procedures when the IRS believes an OIC is submitted solely to delay collection.

30

This study includes an examination of all rejected or returned OICs submitted by individual taxpayers, whether the OIC was

submitted based on doubt as to collectability, doubt as to liability, or effective tax administration.

TAS RESEARCH AND RELATED STUDIES — OIC Program 48

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

BACKGROUND

Per Policy statement in 5-100 in IRM 1.2.14.1.17, the Service will accept an OIC when it is unlikely

that the tax liability can be collected in full and the amount offered reasonably reflects collection

potential. Unless special circumstances exist, OICs will not be accepted if the IRS believes the liability

can be paid in full as a lump sum, or by installment payments extending through the remaining

statutory period for collection, or through other means of collection.

31

The IRS first conducts an

analysis to see if the taxpayer can afford to pay the liability through the liquidation of existing assets

or an installment agreement. Once the IRS confirms that the taxpayer will not be able to pay the debt

through an installment agreement, the IRS then determines the RCP for the taxpayer.

32

Unless special

circumstances exist, the RCP will serve as the basis for an acceptable OIC amount.

33

The taxpayer has

the option to pay the offered amount in a “lump sum,” which means the OIC will be paid in five or

fewer payments within five or fewer months, or through periodic payments, of six or more installments

which are limited to a maximum of two years.

34

In FY 2001, shortly after initiating new OIC procedures in response to the RRA98, the IRS accepted

over 34 percent of its disposed OICs. However, in the subsequent FYs from 2002 to 2007, the IRS

accepted less than 25 percent of taxpayer OICs.

35

In 2004, the OPERA completed a study on the IRS OIC program that included the following

significant findings regarding subsequent compliance and the amount collected:

36

Approximately 60 percent of the Individual Master File (IMF) taxpayers included in their

analysis remained in full compliance with their filing and paying requirements. When adjusted

to exclude taxpayers who received the first collection notice, but no subsequent notices,

approximately 80 percent of these taxpayers essentially remained in compliance.

In 44 percent of rejected OICs and 59 percent of returned OICs, the IRS collected less than 50

percent of the amount offered. Of rejected or withdrawn OICs from individuals, 37 percent

remained in active collection status, while 56 percent of the modules on returned OICs remained

in active collection status. For tax modules included in rejected or withdrawn OICs submitted by

individuals, 20 percent were in Currently Not Collectible (CNC) status, including those where

the collection statute expiration date (CSED) has expired.

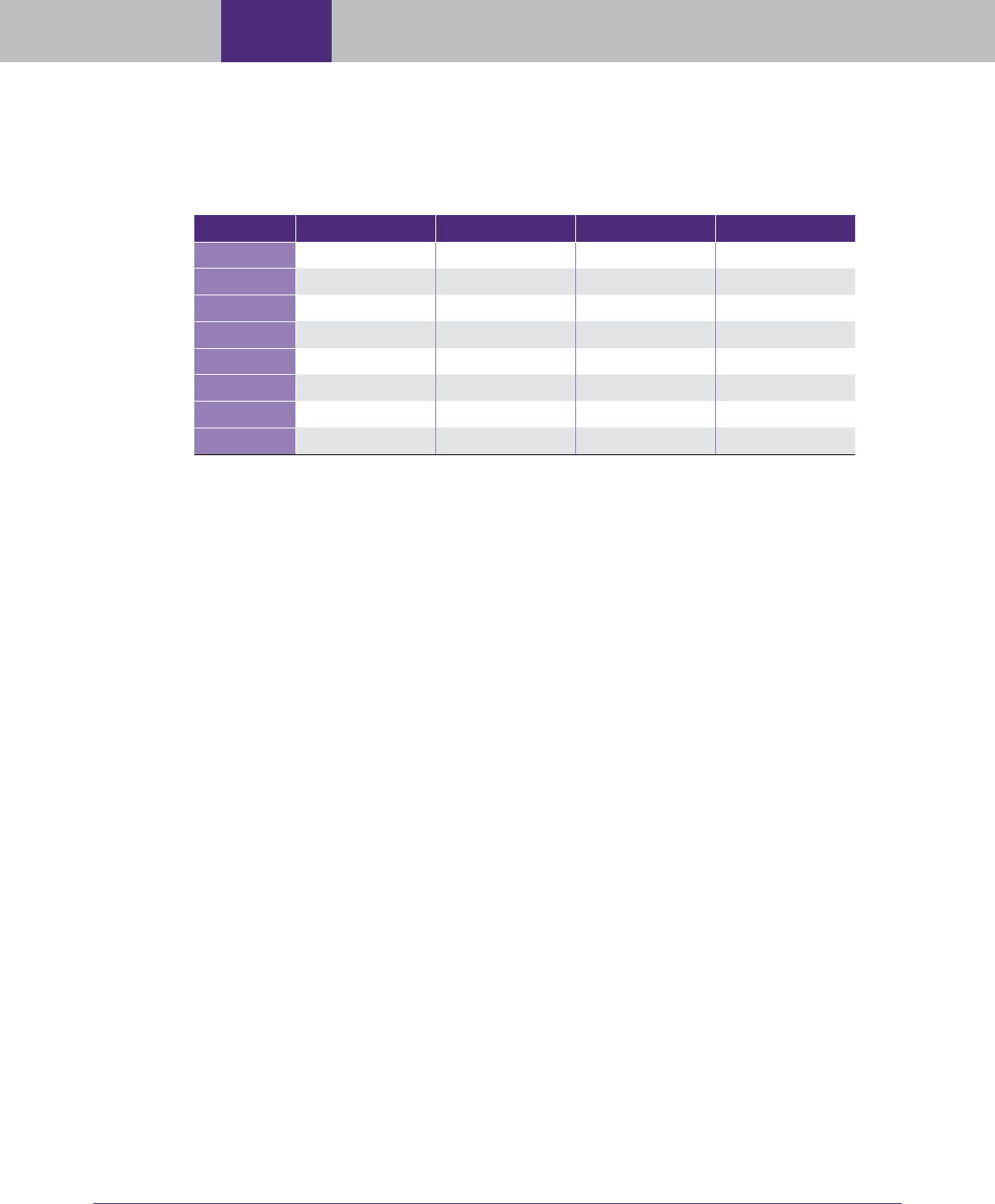

Figure 1 depicts the OIC receipts, dispositions, and acceptances since FY 2010. As shown, the IRS

began accepting a larger percentage of OICs in FY 2011, and reached its high-water mark of OIC

acceptances at 43.7 percent in 2013. The current rate of OIC acceptances remains about 40 percent.

37

31

IRM 5.8.1.2.3, Policy (May 5, 2017).

32

IRM 5.8.5.2, Ability to Pay (Sept. 30, 2013).

33

IRM 5.8.1.2.3, Policy (May 5, 2017).

34

IRC § 7122(c). Periodic payment agreements are limited to a maximum of two years. IRM 5.8.1.13.4, Payments (May 5,

2017).

35

National Taxpayer Advocate 2007 Annual Report to Congress 374-87, 374 (Most Serious Problem: Offer in Compromise); IRS

Collection Activity Report, NO-5000-108 (FY 2001 – FY 2007).

36

IRS Offers in Compromise, An Analysis of Various Aspects of the OIC Program 2004.

37

The acceptance rate is the numbers of accepted OICs in a fiscal year divided by the total number of OIC investigations

closed by the IRS during that same fiscal year.

Taxpayer Advocate Service — 2017 Annual Report to Congress — Volume Two 49

EITC

Letters

Collection

Agencies

OIC

Program

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

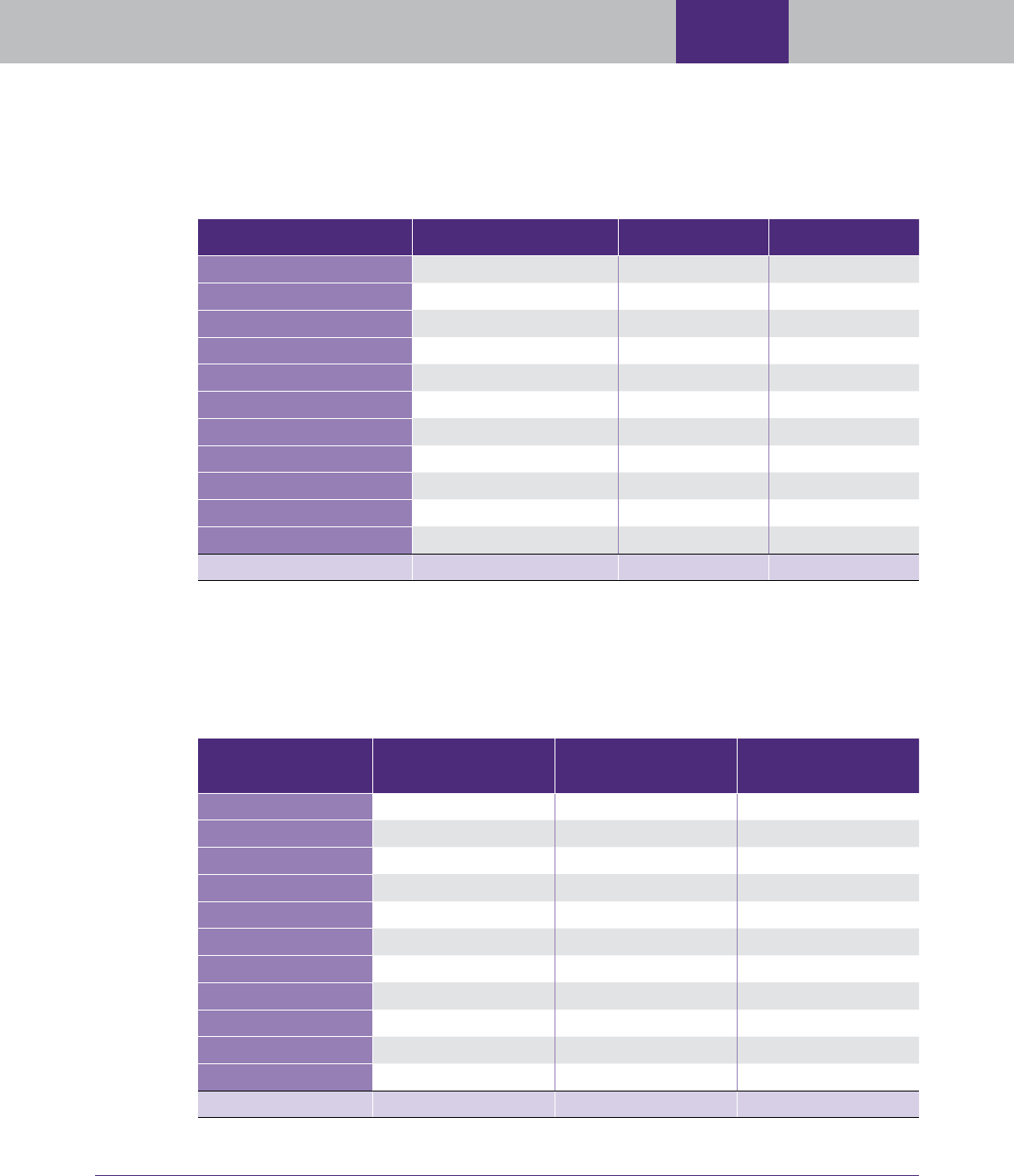

FIGURE 1, OIC Receipts, Dispositions and Acceptances since 2010

38

FY Receipts Acceptances Dispositions Acceptance Rate

2010

56,539 13,886 52,104 26.7%

2011

59,411 19,562 57,836 33.8%

2012

63,801 23,628 62,597 37.7%

2013

74,217 30,840 70,622 43.7%

2014

67,935 26,924 64,332 41.9%

2015

66,600 27,417 64,479 42.5%

2016

62,937 26,663 65,858 40.5%

2017

62,243 25,326 66,549 38.1%

While the IRS has accepted more OICs in recent years, the National Taxpayer Advocate is concerned

that IRS continues to reject a sizeable percent of offers even though the amount ultimately collected

is less than the amount offered and far less than what the IRS determined as RCP.

39

In this situation,

not only does the IRS collect less than what many individual taxpayers with rejected or returned OICs

offered to satisfy their tax liabilities, but the IRS must continue to devote additional resources to

collecting these liabilities, while missing a significant opportunity to change taxpayer behavior toward

future voluntary filing and payment compliance.

OBJECTIVES

Since 2007, quantify the number of taxpayers who have submitted multiple OICs in a short

amount of time (churning);

Examine the subsequent filing and payment compliance for the five years after the IRS accepts a

taxpayer’s OIC;

Determine if subsequent compliance continues beyond the five years required as part of the

accepted OIC agreement;

Compare the amount the IRS could have collected on a rejected or returned OIC to the amount

actually collected subsequent to the offer; and

Determine if the IRS realizes its estimation of the reasonable collection potential when it rejects

an offer.

38

IRS Collection Activity Report, NO-5000-108 (Fiscal Year (FY) 2010 – FY 2017).

39

This study includes an examination of all rejected or returned OICs submitted by individual taxpayers, whether the OIC was

submitted based on doubt as to collectability, doubt as to liability, or effective tax administration.

TAS RESEARCH AND RELATED STUDIES — OIC Program 50

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

METHODOLOGY

To request approval to compromise tax liabilities for less than the total amount due, the taxpayer

submits Form 656, Offer in Compromise, with the additional required financial documentation and user

fee. For the first three objectives, TAS Research analyzed the accounts of individual taxpayers who

submitted an offer from 2007 through 2017 to the IRS to compromise their tax liability for less than the

full amount due.

40

To determine if the taxpayer was churning, TAS research selected all OICs closed as rejected,

41

withdrawn/terminated,

42

or returned as not processable.

43

The 2004 OPERA report defined churning

taxpayers as those who submitted a new OIC within 180 days after one of the previously indicated OIC

disposition types.

44

TAS Research identified the taxpayers that had an OIC accepted

45

to distinguish

them from taxpayers whose OIC was returned or rejected.

For the second and third objectives regarding filing and payment compliance, TAS Research analyzed

the collection status codes of the modules for income tax returns due after the offer was submitted.

46

For accepted offers, we examined the status of income tax returns due within the five years after the

OIC acceptance and for unaccepted offers, we examined the five years subsequent to the OIC return,

rejection, or withdrawal. Where sufficient time had elapsed, we also examined the filing and payment

compliance of taxpayers’ individual income tax liabilities for the years beyond five years.

47

For both our

filing and payment compliance analysis, we compared the account statuses of individual taxpayers with

an accepted OIC to taxpayers where the IRS did not accept their OIC.

In our analysis of filing compliance, we analyzed the IMF to determine if the subsequent returns were

timely filed, late filed, or not filed.

48

In order to determine if the subsequent returns were filed timely,

TAS Research compared the filing date with the expected filing date of the return (considering any

extensions). In our analysis of payment compliance, we compared taxpayers with accepted OICs to

those taxpayers whose OIC was not accepted by the IRS by examining the collection status of these

taxpayer’s income tax returns subsequent to the offer. We detected if any payment delinquency was

present and if a payment delinquency reached Taxpayer Delinquent Account (TDA) status.

49

Finally, for the fourth and fifth objectives, TAS Research requested and obtained from the IRS a list

of individual taxpayers whose OICs were returned or rejected by the IRS from 2009 through 2013,

the amount of these OICs, and, in the case of rejected OICs, the amount of RCP determined by the

40

TAS Research used the Individual Master File (IMF) table on the Compliance Data Warehouse (CDW) to select cases with a

Transaction Code (TC) 480 after 2007; the latest Transaction Code date of the data was April 24, 2017.

41

TC 481.

42

TC 482.

43

TC 483.

44

IRS Offers in Compromise, An Analysis of Various Aspects of the OIC Program 2004 2.

45

TC 780.

46

Data is from the IMF on the IRS CDW.

47

The terms of an OIC require the taxpayer to remain in filing and payment compliance for the income tax returns due five

years after the year in which the IRS accepts the OIC. IRS, Form 656-B, Offer In Compromise 5 (Mar. 2017).

48

The taxpayers that filed their returns generally have a collection status code of 12 or greater, while unfiled returns show a

collection status code of less than 10; those that file an extension have a status of 4.

49

Any tax return with a status greater than 12 indicates that the return has been in balance due status. In addition, a status

of 22, 24, or 26 indicates a Taxpayer Delinquent Account (TDA).

Taxpayer Advocate Service — 2017 Annual Report to Congress — Volume Two 51

EITC

Letters

Collection

Agencies

OIC

Program

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

IRS.

50

The IRS defines RCP as the amount that can be collected from all available means, including

administrative and judicial collection remedies. RCP is generally the sum of taxpayers’ assets, future

income, amounts collectible from third parties (e.g., assets involved in a fraudulent conveyance from

the taxpayer), and taxpayer assets which are beyond the reach of the government (e.g., taxpayer assets in

foreign countries).

51

We compared the amount actually collected from subsequent payments by these

taxpayers to the amount that was submitted on the rejected OIC and to the IRS determined RCP.

52

FINDINGS

Quantify the number of taxpayers who have “churned” since 2007.

Churned OICs are ones in which the taxpayer makes multiple offer submissions within a 180-day

period. In other words, churning occurs when a taxpayer submits another OIC soon after the IRS

rejects their prior OIC or returns it as unprocessable. The IRS returns a taxpayer’s OIC as unprocessable

when the taxpayer submits an OIC of zero dollars, does not submit the required user fee or TIPRA

payment (unless they qualify for the low income waiver), when the taxpayer has unfiled returns

from tax years ending prior to the OIC submission, or when the taxpayer is involved in a bankruptcy

proceeding.

53

Unless special circumstances are present, the IRS will reject an OIC if it determines

that the amount offered is not sufficient based on an analysis of the amount the IRS believes it could

reasonably collect from the taxpayer, known as the RCP.

54

The IRS may have concerns that taxpayers

engage in churning as a way to forestall collection actions.

55

Therefore, a taxpayer may want to cure the

problem (for example, file his or her tax return) before attempting the OIC process again.

TAS Research identified about 450,000 unique individual taxpayers who submitted an OIC since 2007.

Of these, approximately 44,000, or less than 10 percent, churned, meaning they submitted a second

OIC within six months of having the first one withdrawn, rejected, or returned. The following figure

depicts the percentage of churned OICs since 2007 by year of first submitted OIC:

50

This study includes an examination of all rejected or returned OICs, whether the OIC was submitted based on doubt as to

collectability, doubt as to liability, or effective tax administration. However, the IRS generally only computes reasonable

collection potential for rejected OICs.

51

IRM 5.8.4.3.1, Components of Collectibility (Apr. 30, 2015).

52

The amount offered was obtained from an extract provided by the IRS from its Automated OIC System. Subsequent

payments are captured by the IRS as TC 670. For rejected OICs, the Transaction Code 670 date was used only if it was

after the date of the first TC 480.

53

IRM 5.8.2.3.1, Determining Processability (July 28, 2015), contains a complete list of reasons causing the IRS to deem an

OIC as unprocessable. The change in processability for OICs submitted by taxpayers who are not in filing compliance is

a relatively new change in procedure. IRS, Memorandum for Director, Specialty Collection Offers, Liens & Advisory, Offer in

Compromise Filing Compliance and Case Perfection, SBSE-05-0416-0015 (Apr. 13, 2016).

54

IRM Exhibit 5.8.1-1, Common Abbreviations Used in the IRM (May 5, 2017).

55

Per IRM 5.11.1.4.11, Offers in Compromise (Aug. 1, 2014), the IRS normally suspends collection activity during the time

in which it considers an OIC. IRM 5.8.4.20 describes IRS procedures when the IRS believes an OIC is submitted solely to

delay collection. See also, IRS Offers in Compromise, An Analysis of Various Aspects of the OIC Program 2004.

TAS RESEARCH AND RELATED STUDIES — OIC Program 52

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

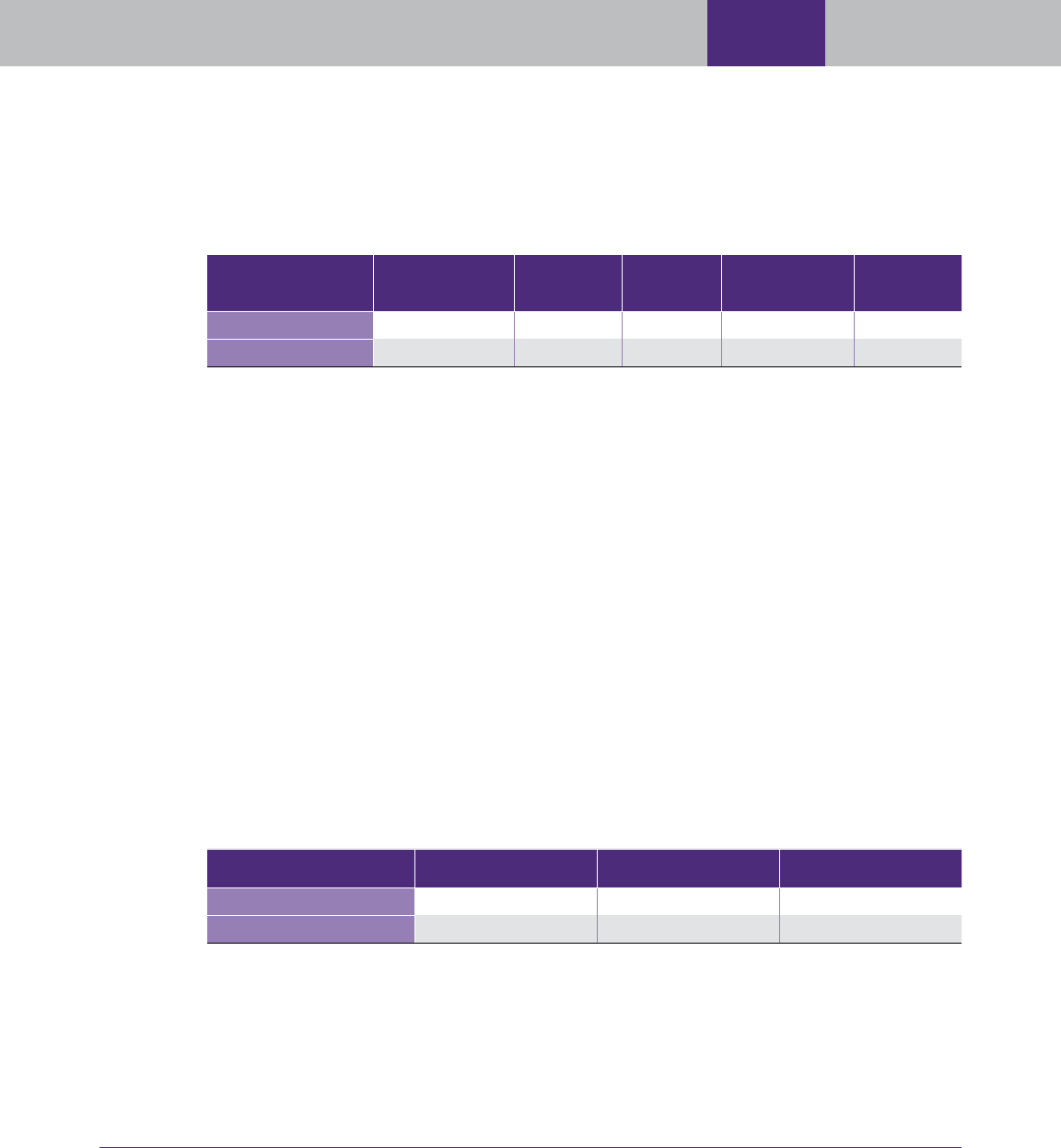

FIGURE 2, Churning Cases Broken Out by Year of First TC 480

56

Year of First Submitted OIC Count Of OICs Submitted Churning Count Percent Churning

2007

34,820 4,285 12.3%

2008

33,810 4,169 12.3%

2009

40,649 4,643 11.4%

2010

42,906 4,355 10.2%

2011

44,751 5,031 11.2%

2012

50,083 5,191 10.4%

2013

53,755 5,025 9.3%

2014

49,539 4,550 9.2%

2015

47,870 3,877 8.1%

2016

42,198 2,597 6.2%

2017

11,783 93 0.8%

Total 452,164 43,816 9.7%

While the figure above shows the percentage of taxpayers who churned, the following figure shows the

IRS ultimately accepted the OICs of nearly half of those taxpayers who churned:

FIGURE 3, Churning Cases Accepted vs. Not Accepted

57

Year of First

Submitted OIC Churning Count With an Accepted OIC

Percent churning with

an Accepted OIC

2007

4,285 1,823 42.5%

2008

4,169 1,816 43.6%

2009

4,643 2,242 48.3%

2010

4,355 2,296 52.7%

2011

5,031 2,709 53.9%

2012

5,191 2,871 55.3%

2013

5,025 2,672 53.2%

2014

4,550 2,235 49.1%

2015

3,877 1,479 38.2%

2016

2,597 633 24.4%

2017

93 4 4.3%

Total 43,816 20,780 47.4%

56

At the time, data was extracted for analysis, sufficient time had not elapsed to determine the churning rate of OICs

submitted in 2017; however, even excluding this year still results in a churn rate under ten percent. Taxpayers with

accepted OICs have a TC 780 on their compromised accounts. The data is extracted from the IMF.

57

At the time, data was extracted for analysis, sufficient time had not elapsed to determine the churning rate of OICs

submitted in 2017; however, even excluding this year, still results in a churn rate of under ten percent. The table is

produced from data contained in the IMF.

Taxpayer Advocate Service — 2017 Annual Report to Congress — Volume Two 53

EITC

Letters

Collection

Agencies

OIC

Program

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

While the IRS may be concerned that taxpayers churn OICs to avoid or delay collection action, Figure 3

shows that nearly half of the taxpayers who churn ultimately receive an accepted OIC, suggesting that

taxpayers are not trying to game the system, but are legitimately seeking an acceptable OIC. While the

IRS certainly has reason to reject or return some OICs, the data indicates that many taxpayers are really

trying to resolve their tax delinquencies. When the IRS returns or rejects an OIC and the taxpayer

subsequently submits a new OIC, the IRS expends additional resources by reworking the OIC.

58

Examine the subsequent filing and payment compliance for the five years required by the

terms of the accepted OIC.

The conditions associated with the acceptance of an OIC include the agreement of the taxpayer to

remain fully compliant with filing and paying all of their tax liabilities for the five years after the OIC is

accepted. Therefore, although the IRS agrees to settle a tax debt for less than the full amount due, the

IRS secures future filing and payment compliance for the next five years.

59

As a result, the IRS benefits

by obtaining an extensive period of compliance, hopefully developing good taxpayer habits, which

extend the compliance into the foreseeable future, while also collecting an amount on the previously

accrued liability that it determines to be at least the reasonable collection potential and is unlikely to be

otherwise collected. On the other hand, the taxpayer is no longer saddled with a debt that cannot be

satisfied.

TAS Research analyzed the filing compliance data for OICs submitted from 2006 through 2016

60

to

determine the percentage of taxpayers that filed, filed timely, or had an unfiled return reach Taxpayer

Delinquency Investigation (TDI) status. Figure 4 compares the filing compliance of those taxpayers

where the IRS accepted their OIC and those taxpayers where the IRS did not accept their OIC.

58

In 2016, the IRS announced that OICs submitted by a taxpayer who had not filed all necessary tax returns (based on

internal research) would be returned to the taxpayer as not processable. IRS, Memorandum for Director, Specialty Collection

Offers, Liens & Advisory, Offer in Compromise Filing Compliance and Case Perfection, SBSE-05-0416-0015 (Apr. 13, 2016).

Prior to this change, if the IRS determined that a taxpayer was not in filing compliance, the IRS would process the OIC

and give the taxpayer time to file his or her late tax returns. IRM 5.8.3.6.1, Field Cases - Case Building (May 14, 2013);

IRM 5.8.3.7.1, Case Building for COIC Offers (May 14, 2013). In February 2017, the IRS announced another change in

practice, whereby the IRS will keep the payments sent with OICs that are not processed and returned for lack of filing

compliance. IRS, Memorandum for Director, Collection Policy, Offer in Compromise Filing Compliance and Case Perfection

(Feb. 23, 2017).

59

The IRS will default an OIC and reinstate the original liability for failure to file or pay taxes due for five years subsequent to

the acceptance of the offer. The taxpayer is given a grace period to rectify the noncompliance. IRM 5.19.7.2.19.4, Failure

to Adhere to Compliance Terms (Aug. 25, 2017).

60

If less than five years has elapsed, we consider the number of years elapsed since the IRC closed the OIC when determining

the taxpayer’s filing compliance.

TAS RESEARCH AND RELATED STUDIES — OIC Program 54

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

FIGURE 4, Filing Compliance for Taxpayers for the First Five Years After the OIC

Disposition

Filing Compliance for Taxpayers for the First Five Years

After the Offer in Compromise Disposition

Taxpayers With

Accepted Offers

Since 2007

Percent Filing

Income Tax Returns

After the OIC

Percent With No

Late Filed Returns

After the OIC

Percent With

No TDI

Taxpayers With

Unaccepted Offers

Since 2007

70%

66%

42%

58%

90%

97%

As Figure 4 indicates, taxpayers with accepted OICs were somewhat more likely (four percent) to file

their income tax returns for the next five years than taxpayers whose OICs over the same time period

were not accepted by the IRS. However, taxpayers with accepted OICs were significantly more likely

(16 percent) to timely file their subsequent income tax returns for the next five years than taxpayers

whose OICs were not accepted.

61

Thus, OIC acceptance appears to promote filing compliance. Timely

filed tax returns reduce IRS resources, which it must expend to pursue collection of these returns.

Taxpayers with accepted OICs are also seven percent more likely to not have a return delinquency reach

TDI status.

62

We see a similar difference between rates of payment compliance for the first five years after the OIC,

depending on whether the IRS accepted the taxpayer’s OIC. The following figure chronicles the

payment compliance for these two groups:

61

TAS Research also determined that only 52 percent of taxpayers whose unfiled return reached Taxpayer Delinquency

Investigation (TDI) status in 2012 did not have an account reach TDI or Taxpayer Delinquent Account (TDA) status for the

next five years. IMF data on the IRS CDW.

62

When a taxpayer’s unfiled return reaches TDI status, the IRS has assigned the delinquent return for active research by

Collection personnel to determine if the return has tax due and, if so, to secure the return from the taxpayer.

Taxpayer Advocate Service — 2017 Annual Report to Congress — Volume Two 55

EITC

Letters

Collection

Agencies

OIC

Program

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

FIGURE 5, Payment Compliance for Taxpayers for the Five Years Required by the OIC

63

Payment Compliance for Taxpayers for the Five Years

Required by the Offer in Compromise

All Accepted Offers

Percent With No Balance Due Percent With No TDA

All Non-Accepted Offers

72%

52%

71%

89%

Figure 5 shows that for the first five years after the OIC, taxpayers with accepted OICs are much more

likely to pay their subsequent income taxes than taxpayers whose OICs were not accepted (72 percent

compared to 52 percent). Taxpayers who continue to have unresolved liabilities (or unfiled returns)

risk the IRS reinstating the full amount of the compromised liability, so there is a strong incentive to

remain in compliance.

64

The IRS must expend additional resources on taxpayers who accrue additional

liabilities including sending additional payment notices, and in the case of liabilities that reach TDA

status, assigning the delinquency to collection personnel for resolution.

65

As with filing compliance,

OIC acceptance also appears to promote payment compliance.

Examine the subsequent filing and payment for the years beyond the five required by the

terms of the accepted OIC

Ideally, the taxpayer not only will remain in filing and payment compliance for the five years required

under the terms of the accepted OIC, but will remain compliant long after the terms of the OIC are

completed. The following figure shows the subsequent taxpayer payment compliance after the five years

required by the OIC:

66

63

We derived the presence of unfiled returns and balances due by examining the collection status of the module from the IMF.

64

The IRS will default an OIC and reinstate the original liability for failure to file or pay taxes due for five years subsequent to

the acceptance of the OIC. The tax period is given a grace period to rectify the noncompliance. IRM 5.19.7.2.19.4, Failure

to Adhere to Compliance Terms (Aug. 25, 2017).

65

When a taxpayer’s unfiled return reaches TDA status, the IRS has assigned the delinquent account for active collection

action by Collection personnel.

66

The length of time elapsed after the five years of filing and payment compliance depends on the year in which the OIC was

accepted. For example, for OICs accepted in 2007, individual Income Tax returns will be due for Tax Years 2007 (due in

2008) through 2011 pursuant to the terms of the accepted OIC, and five more Individual Income Tax returns will have been

due subsequent to those first five years (Tax Years 2012, 2013, 2014, 2015, and 2016). Accordingly, for OICs accepted

in 2008, four years of Individual Income Tax returns (Tax Years 2013–2016) will be due after the five years required by the

terms of the accepted OIC.

TAS RESEARCH AND RELATED STUDIES — OIC Program 56

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

FIGURE 6, Filing and Payment Compliance for Taxpayers for the Beyond Five Years After

the Accepted OIC

Percent with Filing

Compliance

Percent with

no Late files

Percent with

no TDI

67

Percent with no

Balance Due

Percent with

no TDA

68

All Accepted Offers

53% 39% 94% 60% 83%

All Non-Accepted Offers

49% 28% 82% 40% 62%

In those instances where sufficient time has elapsed to examine taxpayers’ filing and payment

compliance beyond five years after the initial offer, Figure 6 indicates that the better compliance of

taxpayers with accepted offers continues beyond the five years required by the terms of the accepted

OIC. Although the percent of taxpayers remaining in filing and payment compliance declines after the

five years required by the terms of the accepted OIC, taxpayers with accepted offers are still 12 percent

less likely to have an unfiled return reach TDI status. Similarly, taxpayers who had an accepted OIC are

20 percent less likely to file a balance due return and 21 percent less likely to have an account reach TDA

status, when compared to those taxpayers whose OIC the IRS did not accept.

Compare the amount the IRS could have collected on a rejected OIC to the amount

actually collected subsequently

From 2009 through 2013, the IRS has rejected or returned nearly 100,000 offers from individual

taxpayers who were ultimately not able to compromise their tax liabilities.

69

As indicated by Figure 7

below, overall, the IRS has collected about 800 million more than the amount offered.

FIGURE 7, Dollars Offered and Dollars Collected on Rejected or Returned OICs From 2009

Through 2013

70

Mean Median Total

Collected Amounts

$18,600 $4,500 $1.8 billion

Offered Amounts

$10,500 $2,700 $1 billion

While the IRS collected overall significantly more on these rejected or returned OICs, about 40 percent

of the offered amounts exceeded what the IRS has actually collected. Although in many cases, the statutory

period for collecting taxes has not expired, it is also true that, on average, the IRS collects less than ten

percent of the total amount collected beyond three years after the inception of the liability.

71

67

When a taxpayer’s unfiled return reaches TDI status, the IRS has assigned the delinquent return for active research by

Collection personnel to determine if the return has tax due and, if so, to secure the return from the taxpayer.

68

When a taxpayer’s balance due account reaches TDA status, the IRS has assigned the delinquent account for active

collection action by Collection personnel (or the account is queued awaiting assignment to Collection personnel).

69

As we saw earlier, many taxpayers churn, and the IRS eventually accepts the OICs of almost half of these taxpayers. This

study only examines the liabilities of individual taxpayers. The IRS also compromises the liabilities of taxpayers with

business tax liabilities (e.g., employment taxes). TAS will conduct a study of Business Master File (BMF) offers for the 2018

Annual Report to Congress. TAS only requested to receive returned or rejected OICs from 2009 through 2013.

70

IRS IMF and Automated OIC System.

71

National Taxpayer Advocate 2015 Annual Report to Congress vol. 2, 39 (Research Study: IRS Collectibility Curve Study).

Taxpayer Advocate Service — 2017 Annual Report to Congress — Volume Two 57

EITC

Letters

Collection

Agencies

OIC

Program

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

The following figure displays the mean, median and total amounts offered and the amounts collected

for the approximately 40,000 taxpayers that offered amounts in their OICs exceeding what the IRS has

been able to collect.

FIGURE 8, Offer Amounts vs. Collected Amounts for Rejected Offers Where Offered

Amount Is More Than Collected Amount

72

Mean Median Total

Collected Amounts

$4,400 $480 $177 million

Offered Amounts

$13,000 $3,500 $530 million

As the prior figure indicates, the IRS has only collected slightly over a third of the amount offered.

73

Of course, not all offers should be accepted, and some of the offers may have been returned or rejected

because of the taxpayer’s failure to become filing compliant or provide requested documentation.

However, taxpayers with accepted OICs have significantly better subsequent filing and payment

compliance. Therefore, it may be prudent for the IRS to invest additional resources into perfecting an

offer and considering documentation alternatives, instead of spending even more resources attempting

to resolve subsequent filing and payment delinquencies. Doing so could not only save on overall IRS

resources, but the taxpayers could also achieve a final resolution of their tax debt.

As shown in the following figure, 30 percent of the taxpayers with returned or rejected OICs satisfied

their liabilities. However, 40 percent of taxpayers whose OICs were returned or rejected from 2009

through 2013 rejected have been deemed by the IRS to be CNC.

FIGURE 9, Current Collection Status of Taxpayers Whose OICs Were Returned or Rejected

Current Collection Status of Taxpayers Whose

Offers in Compromise Were Returned or Rejected

Full Paid

12,239

(30.0%)

Installment

Agreement

Notice Taxpayer

Delinquency

Account

Currently

Not

Collectible

Other

273

(0.7%)

2,459

(6.0%)

3,732

(9.1%)

17,275

(42.3%)

4,837

(11.9%)

72

IRS IMF and Automated OIC System.

73

The IRS also collected slightly over 193 million in refund offsets on returned and rejected OICs; however, the IRS still

collected $160 million less than the OIC it returned or rejected. Refund offsets generally account for the fact that 30

percent of the OICs where the amount offered exceeded the amount of subsequent payments ultimately resulted in full

paid liabilities. However, it is also true that the terms of an accepted OIC result in the IRS offset of refunds for tax periods

extending through the calendar year in which the IRS accepted the OIC.

TAS RESEARCH AND RELATED STUDIES — OIC Program 58

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

We further analyzed those taxpayers where the delinquent liability was reported as CNC even though

the offer was returned or rejected. The following figure shows that the amount collected from these

taxpayers is about one-fourth of the amount offered.

FIGURE 10, Dollars Offered and Dollars Collected on Rejected or Returned OICs from

2009 through 2013 Where the IRS has Reported the Delinquent Accounts as Currently

not Collectible

74

Mean Median Total

Offer Amount

$10,378 $2,744 $179,277,958

Payment Amount

$2,659 $210 $45,930,465

We also stratified the collections between returned and rejected offers. The following figure depicts

these results:

FIGURE 11, Comparison of Dollars Offered and Dollars Collected Depending on Whether

the Offer Was Returned or Rejected From 2009 Through 2013

Rejected Offers

Count

Amount Offered Amount Collected

Total Mean Median Total Mean Median

17,017 $267,111,002 $15,697 $4,800 $98,100,113 $5,765 $900

Returned Offers

Count

Amount Offered Amount Collected

Total Mean Median Total Mean Median

25,213 $301,090,864 $11,942 $3,000 $94,734,934 $3,757 $319

We see that when considering the many instances where the offered amount exceeded the dollars

actually collected, the IRS collects, on average, over 50 percent more from taxpayers with rejected OICs

as compared to taxpayers with returned OICs and shows a median amount collected of nearly three

times as much as is collected from taxpayers with returned offers. These statistics are not surprising, as

most IRS rejections of OICs are because it determines the offered amount does not equal or exceed what

it could expect to collect through its normal procedures. In the next objective, we will briefly explore

how the amount actually collected compares to the RCP determined by the IRS.

74

IRS IMF and Automated OIC System.

Taxpayer Advocate Service — 2017 Annual Report to Congress — Volume Two 59

EITC

Letters

Collection

Agencies

OIC

Program

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

Determine if the IRS realizes its estimation of the reasonable collection potential when

it rejects an offer.

The 2004 OPERA study on the IRS OIC program determined that the IRS is often overly optimistic

when determining RCP.

75

Our analysis of rejected offers from taxpayers who submitted their offers

from 2009 to 2013 also shows that the IRS frequently overestimated reasonable collection potential.

Figure 11 compares the IRS determined RCP, the amounts offered, and the amounts actually collected

from rejected OICs when the offered amount exceeds the dollars actually collected through subsequent

payments.

FIGURE 12, Comparison of Dollars Offered and Dollars Collected Depending on Whether

the OIC Was Returned or Rejected From 2009 Through 2013

Rejected OICs Where OIC Amount Exceeded Amount Actually Collected Through Subsequent Payments

Reasonable Collection Potential

Total Mean Median

$4,079,813,262 $272,169 $68,841

Amount Offered

Total Mean Median

$267,111,002 $15,697 $4,800

Amount Collected

Total Mean Median

$98,100,113 $5,765 $900

As the figure above demonstrates, the IRS determined reasonable collection potential was over 15 times

the amount offered, but over 40 times the amount actually collected. While the rejection of the OIC

is sometimes appropriate, in many instances, the IRS often has an exaggerated view of the RCP, with

the dollars collected being less than the amount offered and significantly less than the amount the IRS

determined as the taxpayer’s RCP.

CONCLUSIONS

Overall, since 2007, the percentage of taxpayers who have a submitted an OIC and subsequently

churn is approximately 10 percent. Furthermore, the churn rate has generally been declining over

the past 10 years. The IRS accepted the OICs of nearly half of those taxpayers who churned,

suggesting that taxpayers are often trying to submit good OICs and the IRS could save resources

by working with these taxpayers to perfect offers rather than return them.

Taxpayers with accepted OICs remain in filing and payment compliance at a much higher rate for

the five years after the IRS accepts the OIC than other individual taxpayers whose OICs were not

accepted.

Taxpayers with accepted OICs continue to remain in filing and payment compliance beyond the

required five years from the year of offer acceptance.

75

IRS Offers in Compromise, An Analysis of Various Aspects of the OIC Program 2004 11.

TAS RESEARCH AND RELATED STUDIES — OIC Program 60

Taxpayer

Attitudes

Penalty

Study

Settlement

Initiatives

Telephone

Service

Taxpayer

Engagement

Use of IRS

Services

OIC

Program

EITC

Letters

Collection

Agencies

The IRS has only collected subsequent payments of less than a third of the amount offered in

about 40 percent of the returned and rejected OICs.

The IRS often overestimates taxpayer’s reasonable collection potential. The IRS has subsequently

determined that the tax delinquencies of over 40 percent of the taxpayers with returned or

rejected OICs are currently not collectible. For those taxpayers with rejected OICs whose

amounts offered exceed the amount actually collected, the IRS determined the reasonable

collection potential was over 40 times the amount offered, but the IRS has only actually collected

36.7 percent of the amount offered.

RECOMMENDATIONS

Congress intended for the IRS to take a flexible approach in utilizing the OIC as a collection tool.

While the IRS accepts many OICs, the percentage of accepted OICs has declined since FY 2013. The

IRS also returns or rejects many taxpayer OICs even though it fails to collect as much as the taxpayer

offered to satisfy the liability. Yet, as a whole, taxpayers with accepted OICs have better subsequent

filing and payment compliance. With these facts in mind, the National Taxpayer Advocate makes the

following recommendations:

The IRS should consider devoting more resources to obtaining acceptable OICs from taxpayers

who seek to compromise their liabilities. Securing acceptable OICs could actually save IRS

money by preventing resources from being spent collecting the uncompromised delinquency and

by obtaining the increased filing and payment compliance that generally accompanies accepted

OICs. Such an approach could also decrease the resources wasted as a result of taxpayers

submitting multiple OICs within a short period of time.

The IRS should study a sample of returned and rejected OICs to determine factors which indicate

that the IRS is likely to actually collect an amount less that what has been offered to compromise

the liability. Given the huge differential between RCP and the amount offered for rejected OICs,

taxpayers may become discouraged, distrustful, and unwilling to amend their OICs upward. As

part of this study, the IRS should also determine what factors lead to an inflated RCP, so that in

future situations with similar circumstances, the IRS could determine a more realistic amount of

RCP, which may result in more accepted OICs.