Business Studies (UGC - CARE Listed Journal Group I, ISSN 0970-9657)

Volume – XLV, No. 1, January, 2024

108

Fintech Adoption in Banking Sector: An Empirical Study

Dr. Jinti Sharma

Assistant Professor

School of Commerce and Business Management,

Pragjyotishpur University

Email: jintisharma21@gmail.com

Bipasha Sharma

Assistant Professor

Faculty of Commerce and Management

Assam Down Town University

Email: bipashasharma007@gmail.com

Abstract

India has evolved as one of the fastest growing economies of the world, especially after the prolonged macro-economic

factor of Covid-19 which stimulated India to take up the Umbrella scheme of Aatma-Nirbhar Bharat i.e. Self-Reliant

India. This gave a boost to India’s quest to pave more towards technologies and become a Tech advanced country

turning it into a global fin-tech superpower. Furthermore, India has launched varied schemes and initiatives, particularly

in North-eastern India.

Guwahati, a city of Assam has been able to attract modalities from many parts of India and the world in its place by

being an epitome of emerging India. This paper throws a light on the trends of the technologies inculcated in the city

and the awareness and experiences relating to the adoption of such fintech services. The paper examines the stages of

fintech development and instillation in the city and the pace of fintech adoption by the consumers in the banking sector.

The methodology includes preparation of structured questionnaires for data collection from 130 SBI customers in an

attempt to study their experiences of fintech solutions offered by banks. The findings include the quality of fintech

services offered, preferences, experiences and challenges faced in usage of services from consumers’ point of view.

Keywords: Fintech, Fintech Unicorns, Fintech Adoption, Banking Sector.

1. Introduction

intech mostly refers to start-up businesses that combine technology with finance and offer specialised

versions of the existing products and services of established financial institutions like banks, asset

management firms, and insurance companies. (Karthika, 2022).

Fintech can be generally explained as

digitization of financial services within the finance industry or it can be stated as a technology that is designed

to provide financial services in an easy manner. According to the Financial Stability Board (FSB), of the

BIS, “Fintech is technologically enabled financial innovation that could result in new business models,

applications, processes or products with an associated material effect on financial markets and institutions

and the provision of financial services”. This definition aims at encompassing the wide variety of innovations

in financial services enabled by technologies, regardless the type, size and regulatory status of the innovative

firm. (Goyal, 2022).

F

Jinti Sharma and Bipasha Sharma

109

Evolution of Fintech

The use of technology in finance is not new to the industry. Fintech development started in between 1865-

1966 when transatlantic cable was set up. In 1918, Fedwire invented Electronic Fund Transfers using

telegraph and Morse code which marked the beginning of the money's conversion to digital form. In 1950,

the first universal credit card was introduced by the Diners’ Club to make cashless payments followed by the

introduction of Barclay’s first ATM in 1967. In 1970, computers became an integral part in the back offices

which gradually shifted to middle and front offices of the financial institutions. Later to modernise the

bidding procedure, NASDAQ was established as the first electronic stock market in 1971. In 1973, Society

for Worldwide Interbank Financial Telecommunications (SWIFT) was used by financial organisations to

transfer instructions and information securely using a set of codes (Fayen, 2023). During 1980s, digital

technology companies emerged to serve financial institutions that included core banking system providers

like Fidelity National Information Services (FIS) and Fiserv as well as payments networks like Mastercard.

The fintech sector witnessed a major shift after the financial crisis of 2008, when new technologies like

Bitcoin and P2P were introduced followed by the blockchain model. (Ramakrsihnan, 2022).

Why Fintech?

Digital technology has been reshaping financial services by eliminating many barriers in delivery of services.

The internet and mobile technology have connected the consumers with the financial service providers with

reduced the cost of information transfer and remote interactions. Minimum access to the services at least

with a smartphone is available to billions of individuals across the globe. This has encouraged the financial

service providers like banks to engage in digital technology making them more approachable and accessible

online than through traditional methods. In comparison to traditional services, fintech generates fast revenue,

delivers quality service and reduces expenses that reconfigure the financial industry. (Huparikar, 2022)

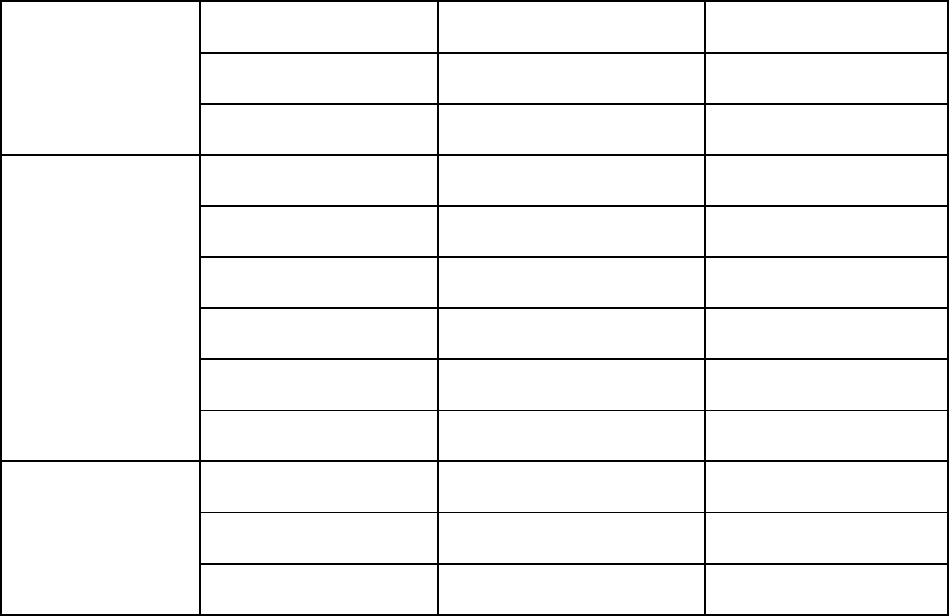

Fintech – SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

▪ Innovation in the

banking sector with

dynamic and pervasive

banking models

▪ Resistance to

shift to modern

banking practices

▪ De-risking solutions

▪ Lack of customer

loyalty

▪ Contribution to the

growing Research and

Development

▪ Lack of

awareness among

consumers

▪ More penetration

▪ Lack of effective

regulations

▪ Increased flexibility and

decreased cost

▪ Lack of

infrastructure

▪ New partnerships

between traditional

and fintech sector

▪ Fast changing

and obsolete

technologies

▪ Effective risk

management with

provision of customer-

friendly solutions

▪ Lack of

consumers’ trust

▪ Financial inclusion

▪ Data Breach

▪ Penetration and serving

of under-served

customers

▪ Financial risk

▪ Sustainability

▪ Cyber frauds

Source: Researcher’s analysis

Business Studies (UGC - CARE Listed Journal Group I, ISSN 0970-9657)

Volume – XLV, No. 1, January, 2024

110

Fintech Start-ups in India

India is a hub of fintech markets in the world. The drive of financial inclusion and Digital India by the

Government has paved the way for fintech companies to grow and become top fintech unicorns. Turning the

entire economy completely cashless is yet a challenge but with the rapid use of smartphones, people have

resorted to cashless transactions through digital wallets marking the first step in fintech adoption.

There are around 9000 fintech startups in India with 21 fintech unicorns. Some of the major fintech

companies of India are discussed below:

BharatPe: BharatPe headquartered in Delhi was established in the year 2018. It provides QR code-based

payment solutions for consumers and businesses. Users can use it to pay for groceries, restaurants, cabs,

salons, mobile businesses and energy bills, among other things. It is an app-based platform that allows

merchants to take payments from customers.

CAMS: Computer Age Management Services (CAMS) established in 1988 in Chennai, is an online platform

focused on mutual fund investments that allows users to invest in multiple public market securities through

app-based platforms. It provides tools for managing portfolios, alerts & news updates to assist in developing

investment strategies. App can be accessed on iOS and Android devices.

CRED: CRED was established in 2018 in Bangaluru and serves in the B2C space in the FinTech market

segments. It supports managing different credit cards, real-time monitoring of credit scores, and the use of

calculators for home loans, EMIs, PPFs and other financial products.

Lendingkart: Lendingkart, established in the year 2014, Ahmedabad, is an online lending platform providing

business loans that offers loans such as working capital loans, SME loans and business loans for women.

Niyo: Niyo Key Metrics, established in 2015 in Bangaluru is an online platform for wealth management and

offers a savings and investments platform. It allows users to make investments in the financial market, offers

in-built Robo-advisory, mutual fund management, goal-based advisory and a banking platform for business.

Paytm: Established in 2009, Noida, Paytm is an app-based wallet for individuals and businesses. It provides

a web-based and mobile-based platform for mobile recharge, money transfer, bill payments, travel bookings,

hotel and ticket booking, booking cylinders, gold purchases and donations. It offers banking services, credit

cards, loans, and investment platforms for insurance, mutual funds, and more.

PhonePe: PhonePe, established in 2012 with headquarters in Bangaluru, serves as a card-linked wallet

solution for consumers and businesses and offers UPI-based options for bill splitting, online shopping, paying

postpaid and utility bills, mobile and DTH recharging, money transfers, online payments at retail shops,

paying mobile and DTH bills, checking account balances and other allied services.

Pine Labs: Pine labs is a fintech unicorn established in the year 1998, headquartered in Noida and serves in

the B2B, SaaS space in the Retail, Fintech market segments. Pine Labs provides payment solutions for

businesses and merchants, offers hardware and software-based payment terminals, point-of-sale financing

and working capital loans.

Policybazaar: Policybazaar, found in the year 2008 in Gurgaon, is an app-based comparison platform for

life and non-life insurances. It offers quotes for life insurance, health insurance, auto insurance, health

insurance, retirement plans, travel insurance, provides claims processing and policy renewal services and

also offers quotes for different investment plans.

Razorpay: Razorpay, located in Bangaluru was set up in 2013 and serves in the B2B, SaaS space in the

Retail, Fintech market segments as a Developer of payment processing solutions for businesses. It offers

Jinti Sharma and Bipasha Sharma

111

solutions such as payment gateways and link-based payment solutions for accelerating and automating

banking operations, working capital loans and corporate credit cards.

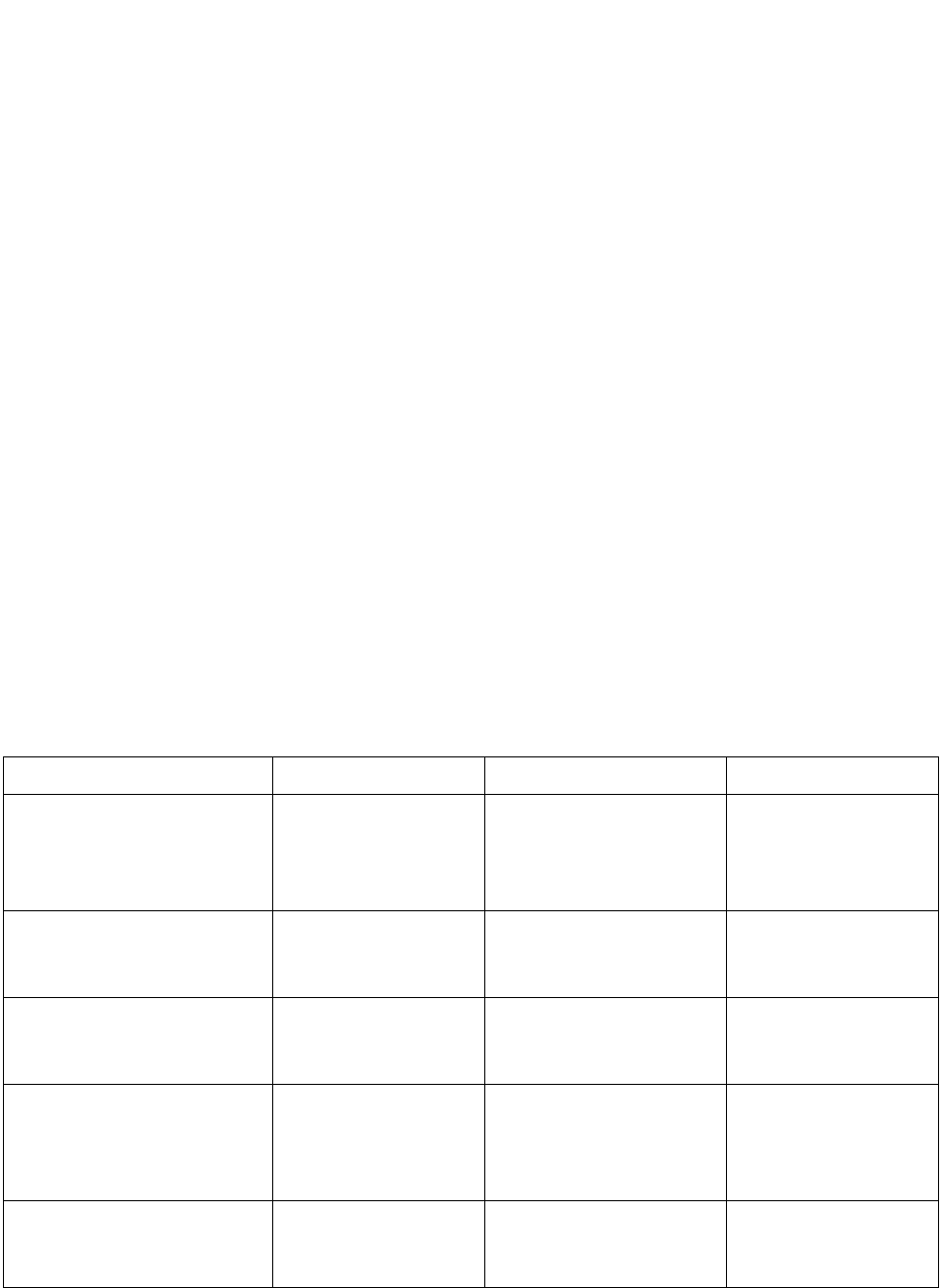

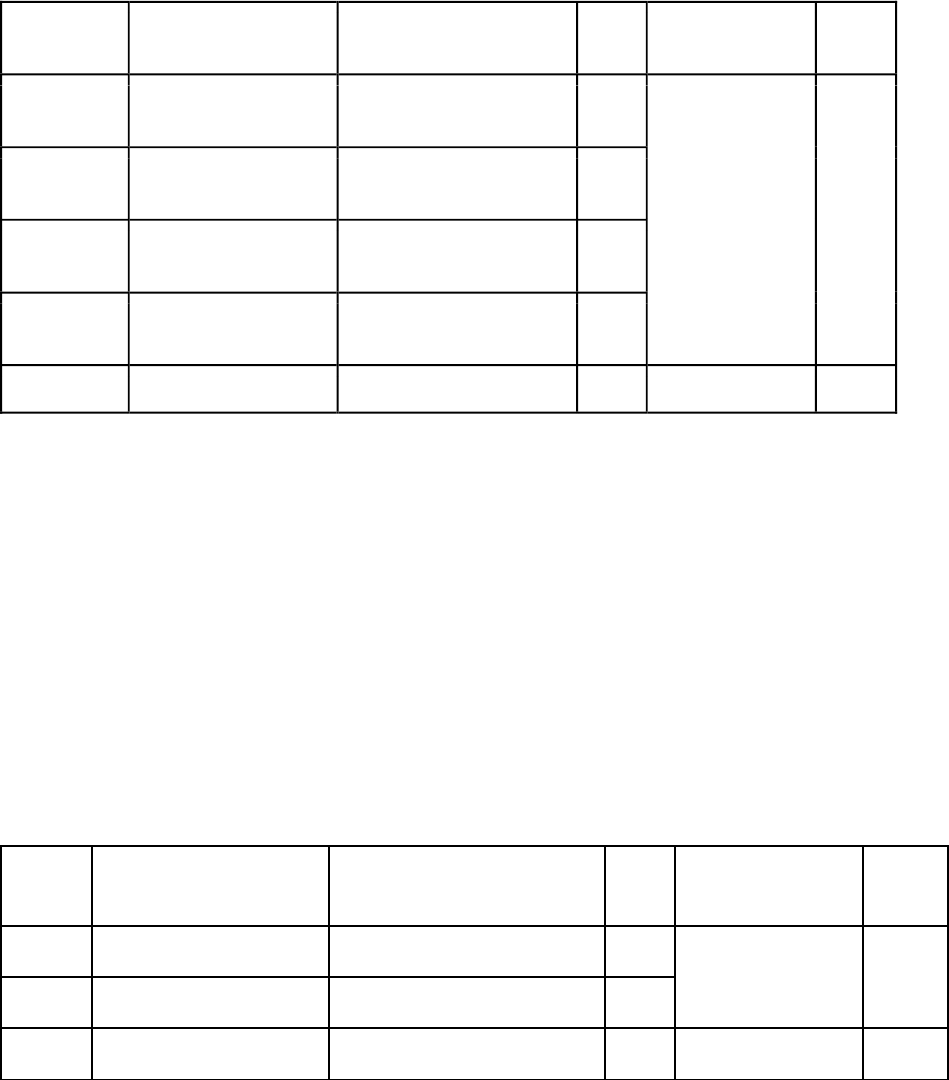

Some of the top fintech companies of India in various fields are-

Areas of Fintech

Fintech Companies

Investment Tech

Zerodha

Groww

Smallcase

Dezerv

Scripbox

Upstox

Insurance Tech

Policybazaar

Paytm

insurance

Insurity

Acko

Digit

Nova

Benefits

Neobanking

Jupiter

Fi

Open

Zolve

Chqbook.com

Akudo

Lending Tech

Capital

Float

Leap

Finance

Zest

Cred

Avenue

Kredit Bee

Uni

Fintech Saas

(Software apps)

Khata Book

Unbound

Charge

Bee

Pay

Mate

Zeni

Safexpay

Cryptocurrencies

CoinDCX

Zeb Pay

Unocoin

Bitbns

Coinswitch

Kuber

Wazirx

Source: https://digest.myhq.in/fintech-startups-in-india/

Fintech in Banking Sector

Fintech solutions in banking sector are offered through various channels. The SBI is a pioneer in offering

different customer tailored fintech services to its customers. Some common fintech services offered by SBI

are YONO SBI, YONO LITE, BHIM SBI Pay, SBI Quick, SBI Secure OTP, SBI e-Pay, YONO Business

and SBI Anywhere. The SBI offers these services through various channels like Internet banking (website),

ATMs, Mobile banking (apps), telebanking and POS (point of sales).

Some of the new fintech products offered by SBI are discussed below-

• State Bank Buddy: The mobile wallet for smartphones from State Bank of India is called State Bank

Buddy. It is a prepaid, semi-closed wallet that enables anytime, anywhere money transfers to bank

accounts and wallet users. The State Bank of India (SBI) launched an e-wallet called SBI Buddy in

August 2016 to encourage citizens to use cashless transactions. SBI Buddy does not require an SBI

account.

• State Bank Scribe: SBI offers this service to assist clients who are blind or visually impaired with

accessing financial services by providing them with scribes which help them complete different

banking activities. It helps in completing forms, reviewing papers, performing transactions and other

crucial duties.

• SBI Digi Voucher: The State Bank of India has developed a new green programme that makes it

simple to fill out coupons on smartphones. Access to numerous challans, transactions slips, and forms

is made possible via SBI Digi Voucher. People can save money by pre-completing transaction

paperwork online so they can have immediate access to the bank teller counter. One may check the

history of their digital coupons using the SBI Digi Voucher app.

• SBI Mingle: The bank's effort to integrate social media with banking is called SBI Mingle. Customers

of SBI may use this special software to access a variety of financial services through the bank's

Facebook page and Twitter account. The SBI Mingle app for smartphones is available to all SBI

Business Studies (UGC - CARE Listed Journal Group I, ISSN 0970-9657)

Volume – XLV, No. 1, January, 2024

112

customers. Once they have enrolled, they may use of a variety of services, including balance inquiries,

money transfers, mini statements, etc., especially with their Facebook and Twitter connections.

Fintech Adoption by Consumers

One of the key factors influencing fintech adoption behaviour is information quality. (Aggarwal, 2023). It is

important to consider how demographic aspects like gender, age, education, and income affect the decision

to use fintech. (Dhanalaxmi, 2022). The people's perceptions about digital payment methods have a big

influence on how they decide to pay. There are several situations when digital payments might not be

accepted, leaving only cash payments as an alternative. To identify the steps involved in the use of financial

technology in the financial services sector, a key component of users' intentions to adopt Fintech is customer

trust. Customers feel that an online company with a high reputation might adopt safe encryption technology

and assurances whenever there is a disagreement, which decreases the sense of danger while utilising Fintech.

(Peong, 2021). Also, the connections between various demographic characteristics, the acceptance of fintech

services, and the perception, usage patterns and barriers that bank customers must be considered in order to

use fintech services. (Roy, 2021). Everyone who lives in the country now has access to a national digital

biometric identification, which effectively gives them full access to the financial system. Retail consumers

and small-scale transactions now operate more efficient with the establishment of a real-time payment system

platform. The structure of the Indian payment system undermines the economic case for separate commercial

payment systems by offering affordable and immediate payment services to regular individuals. (D’Silva,

2019).

2. Background of the Study

Banks have undergone several reforms in the past years to overcome various challenges in the sector.

Evolution of fintech has posed another threat to the traditional banking services which compelled a lot of

banks to adopt fintech services to retain customers. However, the customers of the banks are not yet familiar

with the concept of fintech and the services available under it. Here the study aims to bridge the gap between

adoption of fintech by banks and its acceptance by the customers. (Savitha, 2022).

3. Significance of the Study

Indian Banks have undergone numerous reforms over the years comprising nationalisation, liberalisation,

globalisation, privatisation and digitalization. With the changing market dynamics and preference of

customers, banks have had a challenging phase to meet the expectations of customers and retain them.

(Aggarwal, 2023) In the continuous efforts of banks to include the unbankable masses in its ambit, tap the

potential segments, mitigating risks and countering various challenges, technology has been playing a

catalytic role. In this context, fintech has gained momentum in recent years in expanding the banking services

beyond physical barriers. The present study explores the role of fintech in the banking sector and also

examines factors behind the adoption of fintech services of SBI by its customers.

4. Objectives of the Study

• To examine the factors behind adoption of Fintech services by customers of SBI.

• To study the awareness and user experience of Fintech services offered by SBI.

• To find out the challenges that arise for SBI customers in using Fintech Services.

Jinti Sharma and Bipasha Sharma

113

5. Limitation of the Study

• Due to time constraint non probabilistic convenience sampling has been adopted for the study which

would not cover all the areas of Guwahati.

• Only SBI has been taken for the study which would not reflect the rate of adoption of Fintech services

by all commercial banks.

6. Methodology

Sample Size- In order to know the experience of customers of banks as users of Fintech services, a total of

130 customers of SBI from Guwahati have been selected for the study.

Sampling technique- To determine the sample size, the convenience sampling technique has been adopted

for the study.

Source of data- The primary data have been collected through structured questionnaires distributed among

the customers of SBI. The secondary data sources include research papers, articles from newspapers and

journals and official websites.

Technique of data analysis- Data is analysed using chi-square test and percentage method. To calculate p-

value in the chi square test, Chi Square calculator has been used.

Social Implications- The study focuses on examining the awareness and experience of the citizens of

Guwahati towards adoption of Fintech services by banks. The outcome of the study shall help to know the

pace of Fintech adoption by the customers of banks and fill the gap between the services offered by banks

and those received by customers.

7. Data Analysis

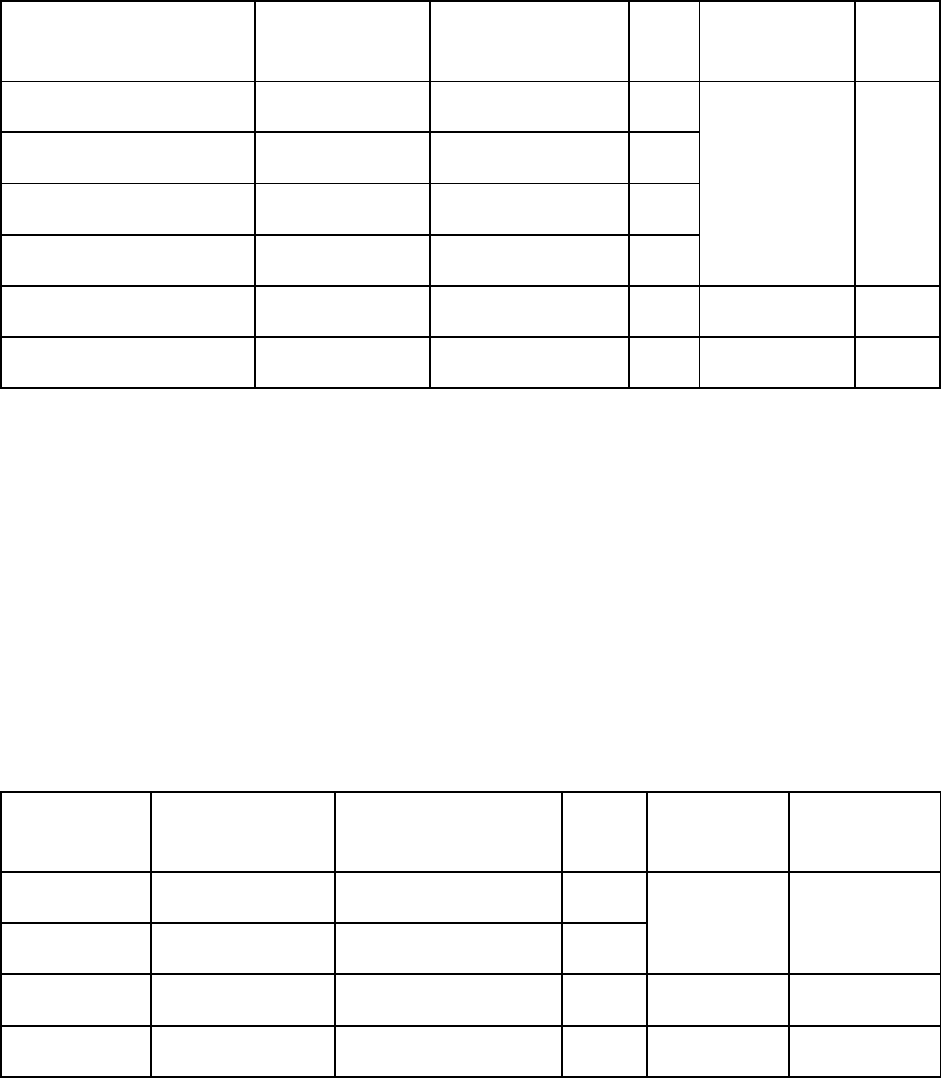

Profile of Respondents

A total of 130 respondents have been interviewed for the study through a structured questionnaire and data

have been collected from customers of SBI. A brief description about the profile of respondents is given

below-

Around 60% of the respondents are male users of fintech services in comparison to female users of 40%. The

young generation belonging to the age group of 18 to 28 years have shown interest in using fintech services

with approximately 42%, compared to other age groups. In-service employees are seen to be the highest

users of SBI fintech services followed by students with 37.2%. The respondents who are post graduates i.e.

50% are seen to use fintech services followed by 42% graduates.

Generally, the age, occupation and education of respondents play an important role in determining the

adaptability towards new technology. In this context, the relationships between age, gender, occupation and

education of respondents and adoption of such services can be traced and the following hypotheses have

been formed (Table 1).

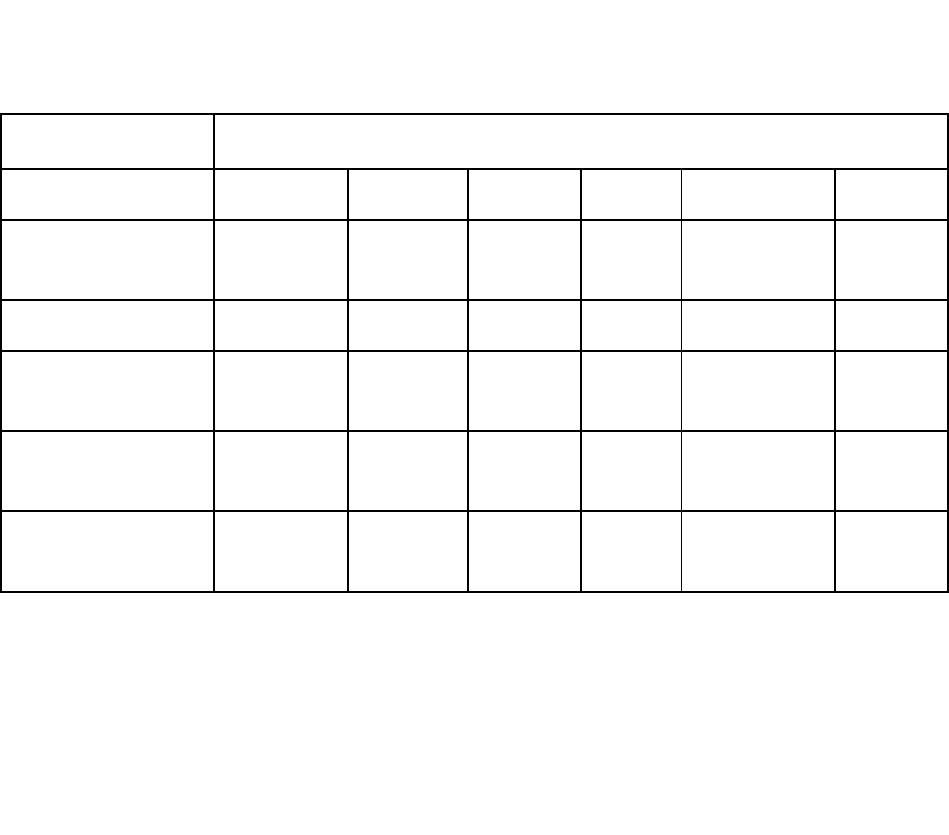

Table 1: Profile of Respondents

GENDER

Male

77

59.7%

Female

53

40.3%

AGE GROUP

18 to 28 years

75

57.4%

Business Studies (UGC - CARE Listed Journal Group I, ISSN 0970-9657)

Volume – XLV, No. 1, January, 2024

114

29 to 39 years

37

28.7%

40 to 59 years

11

8.5%

60 and above

7

5.4%

OCCUPATION

Student

49

37.2%

Salaried

54

41.9%

Start up/ business owner

04

3.1%

Professional

13

10.1%

Unemployed

05

3.9%

Retired

05

3.9%

QUALIFICATION

HS

10

7.6%

Graduate

55

42.3%

Post Graduate

65

50%

Source: Field survey

Age and Adoption of Fintech Services

H

0

: There is no association between age and adoption of fintech services.

H

1

: There is an association between age and adoption of fintech services.

While examining the association between age and adoption of Fintech services, it is found that the age group

of 18 to 28 years are the highest users followed by 29 to 39 years. However, the other age groups are of the

opinion that they prefer to use the services with precautions, rather than using without knowing the

consequences of cyber fraud. Therefore, the higher age groups have shown reluctance towards abrupt usage

of fintech services. While trying to test the hypothesis, to determine the association between age and fintech

service usage, p= 0.6 which is greater than 0.05 which shows age and adoption of fintech services are

independent of each other, i. e. there is no association between them. Hence, null hypothesis is accepted at

the 5% level of significance (Table 2).

Jinti Sharma and Bipasha Sharma

115

Gender and Adoption of Fintech Services

H

0

: There is no association between gender of respondents and adoption of fintech services.

H

1

: There is an association between gender of respondents and adoption of fintech services.

While examining the association between gender and adoption of Fintech services, it is found that out of 57

male respondents, 20 of them are non-users of fintech services. However, out of 44 female respondents only

9 of them are non-users. This shows gender does not play any significance in adoption of fintech

services. This is also evident from the chi square test, where p value is 0.22 which is greater than 0.05 which

shows that gender and adoption of fintech services are independent of each other, i. e. there is no association

between them. Hence, null hypothesis is accepted at the 5% level of significance (Table 3).

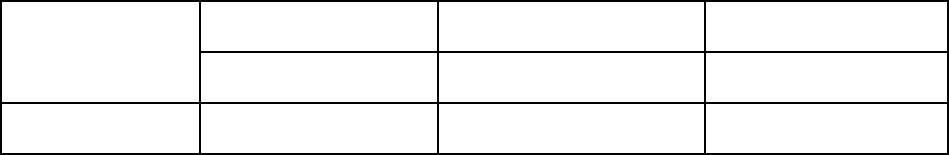

Table 3: Gender and Adoption of Fintech Services

Gender

Users of Fintech

Services

Non-users of Fintech

Services

Total

Chi square

statistic

p

value

Male

57

20

77

1.46

0.2261

Female

44

09

53

Total

100

30

130

—--

—--

Source: Field Survey

Occupation and Adoption of Fintech Services

H

0

: There is no association between occupation and adoption of fintech services.

H

1

: There is an association between occupation and adoption of fintech services.

While testing the hypothesis to see if there is any association between occupation of respondents and fintech

service usage, p value is 0.51 i.e. greater than 0.05 which shows occupation and adoption of fintech services

Table 2: Age and Adoption of Fintech services

Age group

Users of Fintech

Services

Non-users of Fintech

Services

Total

Chi square

statistic

p

value

18 to 28

years

60

15

75

1.6529

0.647

29 to 39

years

29

08

37

40 to 59

years

07

04

11

60 and

above

05

02

07

Total

101

29

130

—--

—--

Source: Field Survey

Business Studies (UGC - CARE Listed Journal Group I, ISSN 0970-9657)

Volume – XLV, No. 1, January, 2024

116

are independent of each other, i.e. there is no association between them. Hence, null hypothesis is accepted

at the 5% level of significance (Table 4).

Table 4: Occupation and Adoption of Fintech Services

Occupation

Users of Fintech

Services

Non-users of

Fintech Services

Total

Chi square

statistic

p

value

Students

35

14

49

3.243

0.518

Salaried

44

10

54

Start up/ Business owner

03

01

04

Professional

12

01

13

Retired

08

02

10

Total

102

28

130

—--

—--

Source: Field Survey

Education and Adoption of Fintech Services

H

0

: There is no association between education and adoption of fintech services.

H

1

: There is an association between education and adoption of fintech services.

Education here is significant as lack of technical knowledge and redressal measures have led to limited use

of services for the HS passed respondents. This is evident from the hypothesis tested where p value is 0.00

i.e. less than 0.05, which implies that education and adoption of fintech services are dependent on each other,

i.e. there is association between them. Thus, null hypothesis is rejected at the 5% level of significance (Table

5).

Table 5: Education and Adoption of Fintech Services

Education

Users of Fintech

Services

Non-users of Fintech

Services

Total

Chi square

statistic

p value

HS passed

06

04

10

20.343

0.000038

Graduate

58

02

55

Post graduate

41

24

65

Total

100

30

130

—--

—--

Source: Field Survey

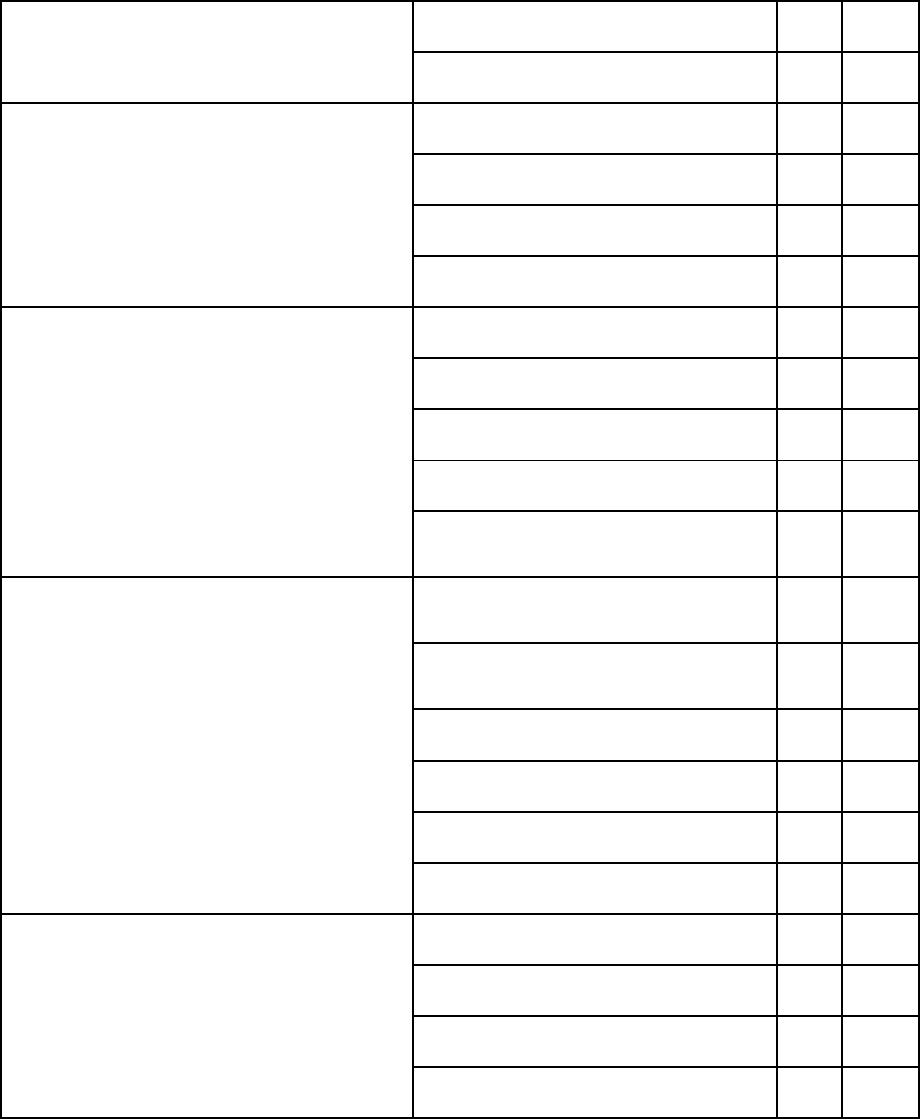

Awareness, Factors behind Fintech Adoption, Preferences and Challenges

76% of the respondents have come to know about the fintech services in the recent past and their source

about fintech services is mainly from ads and promotions by SBI. In order to determine the factors that

influenced the respondents to use/ adopt fintech services, it is revealed that time management, prompt

Jinti Sharma and Bipasha Sharma

117

services and automation of services are the major reasons while technical failure is the major reason for not

using fintech services. Cyber and data privacy risk associated with fintech services followed by lack of

operational knowledge are the other reasons cited by respondents for non-adoption of fintech services. 80%

of the respondents have used ATMs as channels of fintech services followed by mobile banking apps (69%)

and internet banking (56%). Majority of respondents have availed fintech services in the form of money/

fund transfer/ payment services. Regarding use of new digital services of SBI, most of the respondents have

not yet availed any of it, only approximately 11% have used SBI Buddy till date (Table 6).

Table 6: Awareness, Factors behind Fintech Adoption, Preferences and Challenges

Awareness

about Fintech services of SBI

Recently came to know

100

76.3%

Known since a long time

30

23.7%

Source of information about fintech

services

SBI official website

35

26.7%

Ads and Promotions

39

29.8%

Peers

21

16%

Others

36

27.5%

Factors behind adoption of fintech

services

Automation of services

57

48%

Hassle free and prompt services

67

56.3%

Saves time without visiting branches

86

72.3%

Chatbot and AI assisted information

19

16%

Others

20

17.4%

Factors behind non-adoption of fintech

services

Technological risk (technical failure)

30

46.9%

Data Privacy Risk

22

34.4%

Cyber Risk

23

35.9%

Operational Risk

12

18.8%

Lack of knowledge

15

23.4%

Others

14

21.9%

Channels of fintech services experienced

Internet banking

73

55.7%

ATM

105

80.2%

Mobile banking (apps)

90

68.7%

Telebanking

13

9.9%

Business Studies (UGC - CARE Listed Journal Group I, ISSN 0970-9657)

Volume – XLV, No. 1, January, 2024

118

POS (point of sale)

25

19.1%

Fintech services of SBI availed

Money/fund transfer/ payment

101

77.1%

Crypto and stock market

09

6.9%

Other Investment

14

10.7%

Credit and loan

12

9.2%

Other banking and related services

47

35.9%

Digital Banking Platforms used

YONO SBI

99

75.6%

YONO LITE SBI

33

25.2%

BHIM SBI Pay

32

24.4%

YONO Business

05

3.8%

SBI Quick

09

6.9%

SBI Secure

05

3.8%

SBI ePay

04

3.1%

SBI Anywhere

06

4.6%

SBI Net banking

43

32.8%

None

15

11.5%

SBI Digital Products used

State Bank Buddy

14

10.7%

State Bank Scribe

02

1.5%

SBI Digi Voucher

05

3.8%

SBI Video Statement

02

1.5%

SBI Smart Watch

04

3.1%

SBI Mingle

02

1.5%

None

104

79.4%

Preference of fintech services over

traditional services

Yes

114

87%

No

17

13%

Lack of awareness

66

50.4%

Jinti Sharma and Bipasha Sharma

119

Challenges associated with fintech

services

Operating cost (storage and

infrastructure issues)

20

15.3%

Lack of skill to use

36

27.5%

Risk of hacking/ security issues

50

38.2%

Resistance to shift to online banking

21

16%

Low personal contact

32

24.4%

Source: Field Survey

87% of the respondents prefer fintech services of SBI over the traditional services of SBI due to ease of

operation and time saving feature. Only 13% have shown reluctance in using such services. While examining

the challenges faced by the respondents, 50.4% are unaware about the new SBI fintech services and 38%

fear cyber fraud issues like hacking. Approximately 27% of the respondents lack the knowledge to use online

services of SBI.

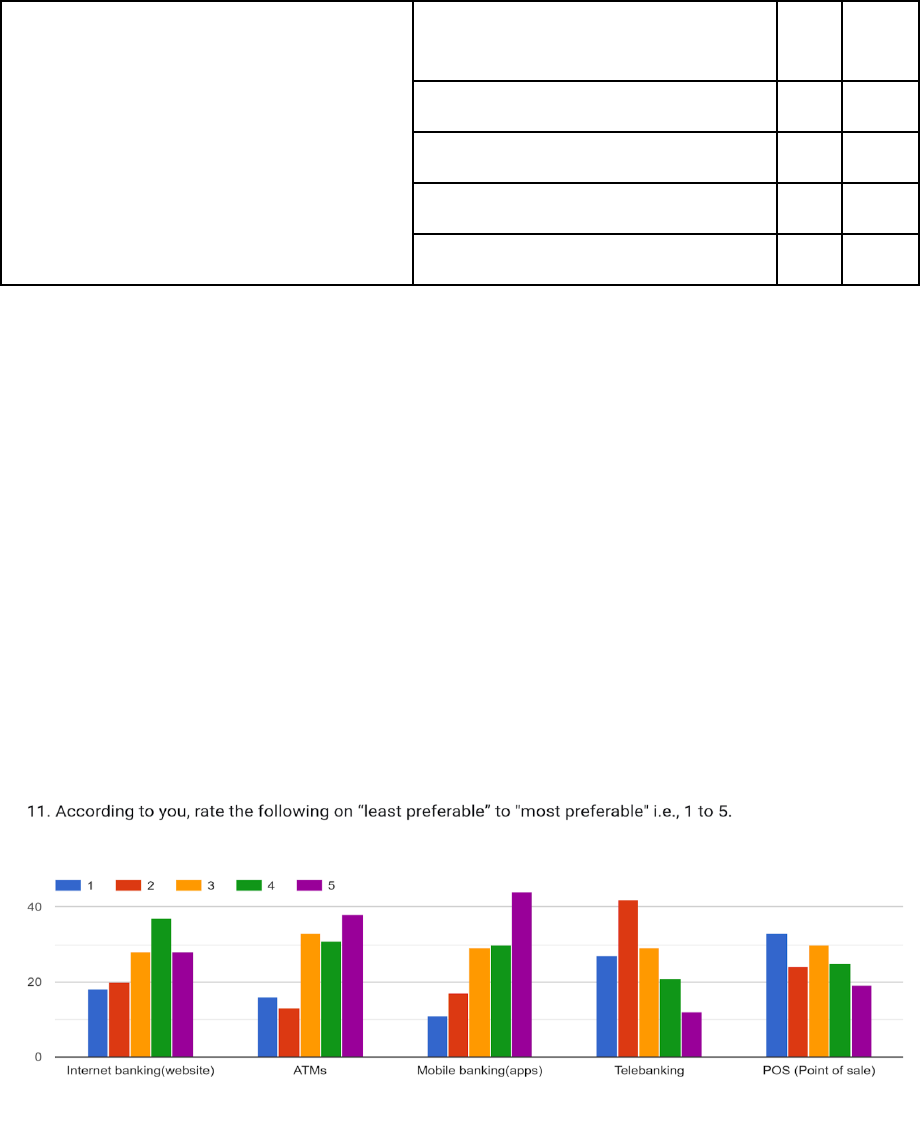

Preference of Fintech Services of SBI

Out of the different fintech services offered by SBI, Mobile Banking apps are most preferable followed by

ATMs and internet banking. Mobile banking apps are hassle free with easy access to everyone which makes

it a favourable service to use. ATMs act as lifesavers for people in urgent need of money and it is one of the

oldest practices in India to opt for ATMs in emergency. Internet banking is considered as one of the safe

platforms of fintech service in comparison to other payment gateways and online wallets thus making it the

third preferable fintech service (Chart 1).

Chart 1: Preference of Fintech Services of SBI

Source: Field Survey

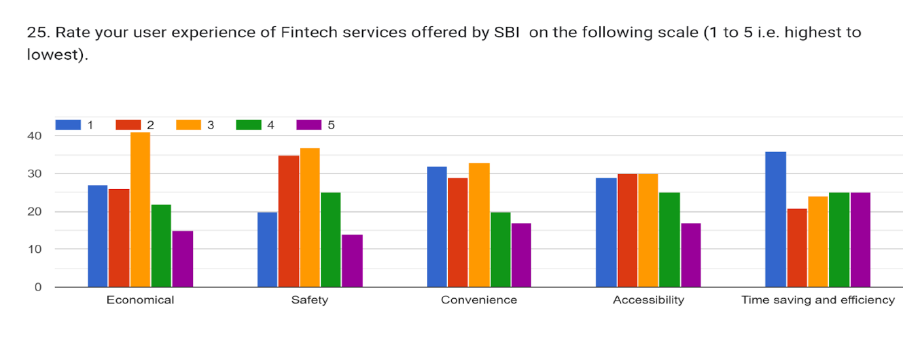

User Experience of Fintech Services

The respondents prefer fintech services of SBI for its ability to offer branchless services thereby saving ample

time. Also, they are of the opinion that the services offered are convenient to use and have greater

accessibility. The respondents are however concerned with the risks associated with fintech services which

have turned few of them hesitant to use these services (Chart 2).

Business Studies (UGC - CARE Listed Journal Group I, ISSN 0970-9657)

Volume – XLV, No. 1, January, 2024

120

Chart 2: User Experience of Fintech Services

Source: Field Survey

8. Findings and Discussions

• The young generation belonging to the age group of 18 to 28 years have shown interest in using fintech

services with approximately 42%, compared to other age groups. Rest of the age groups are of the opinion

that they prefer to use the services with precautions, rather than using without knowing the consequences

of cyber fraud. Therefore, the higher age groups have shown reluctance towards abrupt usage of fintech

services

• However, gender does not play any significance in adoption of fintech services. This is evident from the

chi square test, where p>0.05 which shows that gender and adoption of fintech services are independent

of each other, i. e. there is no association between them.

• In-service employees are seen to be the highest users of SBI fintech services followed by students with

37.2%.

• The respondents who are post graduates i.e., 50% are seen to use fintech services followed by 42%

graduates. Education here is significant as lack of technical knowledge and redressal measures have led

to limited use of services for the HS passed respondents.

• It is to note that the majority i.e 76% of the respondents have come to know about the fintech services in

the recent past and their source about fintech services is mainly from ads and promotions by SBI.

• The factors that majorly influenced the respondents to use/ adopt fintech services are time management,

prompt services and automation of services.

• On the other hand, technical failure, cyber and data privacy risk associated with fintech services followed

by lack of operational knowledge are the other reasons cited by respondents for non-adoption of fintech

services.

• 80% of the respondents have used ATMs as channels of fintech services followed by mobile banking

apps (69%) and internet banking (56%).

• Majority i.e. 76% of respondents have availed fintech services in the form of money/ fund transfer/

payment services.

• Regarding use of new digital services of SBI, most of the respondents have not yet availed any of it, only

approximately 11% have used SBI Buddy till date.

• 87% of the respondents prefer fintech services of SBI over the traditional services of SBI as it is

automated, easy to operate and saves time.

• Being a major factor in fintech adoption, 13% have shown reluctance in using such services due to lack

of operational knowledge and unawareness.

Jinti Sharma and Bipasha Sharma

121

• While examining the challenges faced by the respondents, 50.4% are unaware about the new SBI fintech

services and 38% fear cyber fraud issues like hacking. Approximately 27% of the respondents lack the

knowledge to use online services of SBI.

• Following the above, the different fintech services offered by SBI, Mobile Banking apps are most

preferable followed by ATMs and internet banking. Mobile banking apps are hassle free with easy access

to everyone which makes it a favourable service to use.

• Finally, it can be observed that respondents prefer fintech services of SBI for its ability to offer

branchless services thereby saving ample time. Also the respondents are of the opinion that the services

offered are convenient to use and have greater accessibility. The respondents are however concerned

with the risk associated with fintech services which have turned few of them hesitant to use these

services.

9. Suggestions

• One of the common challenges faced by the respondents while availing fintech services of SBI was the

inability to use the services due to lack of technical knowledge along with lack of awareness about

recent fintech products. Organising awareness campaigns by the bank would help the existing customers

to know about the new services as well attract potential customers who would be interested in using the

fintech services offered by SBI. Circulation of videos via emails and WhatsApp platforms demonstrating

the method of using digital services would help the technically challenged customers to learn the

mechanism, thereby, filling the gap between services offered and targeted customers.

• Fear of breach of data privacy and cyber fraud is another reason for not adopting fintech services. To

combat this challenge and instil confidence in the customers, communicating to them the potential

risks/threats associated with transactions and improving the background infrastructure i.e. SBI’s security

system is important. Also the customers should be communicated about the grievance redressal

mechanism of SBI in case of any fraud so that the customers could act promptly.

• To retain the position of SBI among other competing banks, SBI needs to upgrade the services according

to the needs of the customers which include being user friendly, better server management system,

efficient and easy user interfaces, faster activation process of contactless payments and prompt response.

• For improved operational efficiency, the SBI could optimise operations and cut costs by encouraging

the use of fintech services for tasks like payment processing, risk assessment and client onboarding.

• Regular monitoring and updating of SBI website shall not only provide timely information to clients but

also address several issues or services which are otherwise excluded in normal course of business.

• There is a need for an app or internet banking website in local or regional language where the population

which finds it inconvenient to interact in English/Hindi or any other language provided find it feasible

to interact, get informed and most importantly access the digital banking services.

• Reluctancy is a major reason among the older demographic population for not adopting fintech services

provided by the banks. Factor of reluctance comes under the culture of a population which is formed by

attitudes, beliefs and behaviours of a particular group which greatly influence the willingness regarding

the use of digital technologies and services. Thus, SBI should make an attempt to promote a culture that

values innovation and openness to change. This will not only promote digital literacy but also help in

the contribution of SBI in the field of sustainability.

• Reliability with regards to chatbot interaction is a decisive factor when it comes to adoption of fintech

services. Transparency needs to be maintained in this regard so that users or clients are able to get

informed whether the chatbot is working effectively and solving his problem or not.

• For an effectively working module, SBI should build a comprehensive unified single-button platform

which enables the specially-abled segment to access the digital financial services with ease and

convenience.

Business Studies (UGC - CARE Listed Journal Group I, ISSN 0970-9657)

Volume – XLV, No. 1, January, 2024

122

10. Conclusions

Banks have included fintech services within their ambit as traditional banking services failed to reach the

unbankable due to geographical constraints. Technology in the form of smartphones and internet connectivity

boosted the penetration of digital banking among the customers as they have unlimited access to banking

services. It is evident from the findings of the study that most of the people of Guwahati are aware about the

fintech services provided by SBI and majority of them prefer online fintech services over traditional banking

services which require frequent visits. Automated services, cashless transactions, ease of availing loans with

prompt services at a click are some of the reasons as to why SBI customers of Guwahati have adopted fintech

services. However, technical failure, privacy risks, cyber-attacks and lack of technical knowledge to utilise

the services are the few reasons behind non adoption of fintech services by customers. In addition, the

existing customers of SBI are unaware about the new fintech products due to which the majority of them

have not yet used them. To ensure optimum penetration of fintech services among common masses, it is

important to educate about the operational mechanism, redressal measures in case of cyber frauds and

conduct awareness drives about introduction of new fintech products.

References

Aggarwal, M. et al (2023). Examining the Factors Influencing Fintech Adoption Behaviour of Gen Y in

India. Cogent Economics & Finance, 11(1), 2197699, DOI: 10.1080/23322039.2023.2197699.

Das, A & Das, D (2020). Perception, Adoption, and Pattern of Usage of FinTech Services by Bank

Customers: Evidences from Hojai District of Assam. Emerging Economy Studies. 6(1).

https://doi.org/10.1177/2394901520907728

Dhanalakshmi, A. (2022). An Empirical Study on the Adoption Intention of Financial Technology (FinTech)

Services among Bank Users. AMBER – ABBS Management Business and Entrepreneurship Review.

https://www.researchgate.net/publication/361890269

D’Silva, D. (2019). The Design of Digital Financial Infrastructure: Lessons from India. BIS Papers.

Fayen E., et al. (2023). Fintech and the Future of Finance; Market and Policy Implications. Study Report of

World Bank Group.

Goyal M. (2022). Fintech in Indian Banking Sector: Overview and Challenges. International Journal of

Advanced Research in Commerce, Management and Social Science, 5(4). 197-200.

Huparikar A., Shinde N. (2022). A Study on Influence of Fintech on Customer Satisfaction of Banks in Pune.

Journal of Positive School of Psychology, 6(5). 989-995.

Karthika. M. (2022). Impact of Fintech on the Banking Sector. Integrated Journal for Research in Arts and

Humanities. 2(4), 109-112.

Nawayseh, M. (2020). FinTech in COVID-19 and Beyond: What Factors Are Affecting Customers’ Choice

of FinTech Applications? Journal of Open Innovation: Technology, Market and Complexity, 6(4), 153.

https://doi.org/10.3390/joitmc6040153

Pejkovska, M. (2018) Potential Negative Effects of Fintech on the Financial Services Sector, Thesis of

Helsinki Metropolia University of Applied Sciences.

Jinti Sharma and Bipasha Sharma

123

Peong, K.K et al (2021). Behavioural Intention of Commercial Banks’ Customers towards Financial

Technology Services. Journal of Finance and Banking Review, 5(4). 10-27.

https://doi.org/10.35609/jfbr.2021.5.4(2).

Ramakrsihnan S. et.al. (2022). Fintech Innovations in the Financial Service Industry. Journal of Risk and

Financial Management, 15, 287. https://doi.org/10.3390/jrfm15070287

Report of the Working Group on Fintech and Digital Banking of Reserve Bank of India. dated 8th February

2018. https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=892

Roy, D. et al. (2021) Digital Financial Inclusion: Policies and Business Models National Institute of Bank

Management Working Paper.

Savitha, B. et al. (2022) Continuance Intentions to Use Fintech Peer-to-Peer Payments Apps in India,

Heliyon. https://doi.org/10.1016/j.heliyon.2022.e11654.

Vijai, Dr. C. (2019). Fintech in India – Opportunities and Challenges, South Asian Academic Research

Journals, 8(1) DOI NUMBER: 10.5958/2319-1422.2019. 00002. https://digest.myhq.in/fintech-startups-in-

india/ assessed on 3

rd

October 2023.